Ethereum Faces Supply Shock as Shorts and Staking Hit Record

Ethereum (ETH) is on the edge of a spectacular supply shock as short -lever effects skyrocketing at unprecedented levels, the jolluture of historical summits and the liquidity of the falls fall.

Will this be optimistic for ETH, or will another “black Thursday” event be created?

ETH provides shock to grow

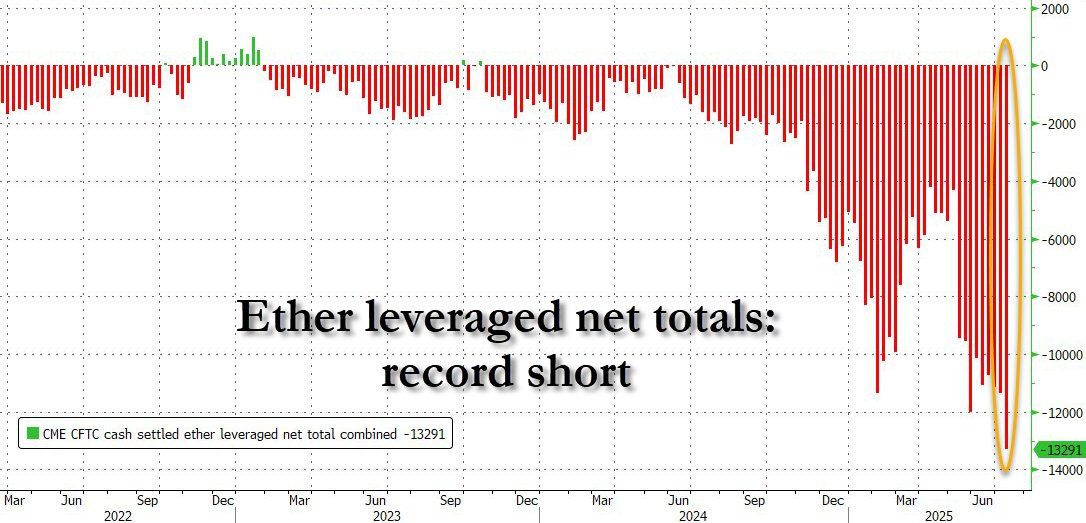

A graphic published by Zerohedge on X highlights Ethereum’s tender shock with short leveraging positions reaching a record of -13,291 in over -the -counter and cash contracts. This marks the strongest decline since the beginning of 2025, signaling an aggressive activity of hedge funds.

The expert in Crypto Fejau notes on X that this is not motivated by the lowering feeling but by a basic commercial strategy. The hedge funds exploit the price differences between the term contracts on the ETH on the CME markets and the punctual, guaranteeing coherent profits in the middle of Contango.

“The reason for the huge ETH shorts is the base of the base. Funds can capture an annualized base of 9.5% by interrupting CME’s term contracts and buying ETH spot with a stimulation yield of 3.5% (this is why this is mainly and not BTC) for a 13% neutral delta. ” Fejau explained.

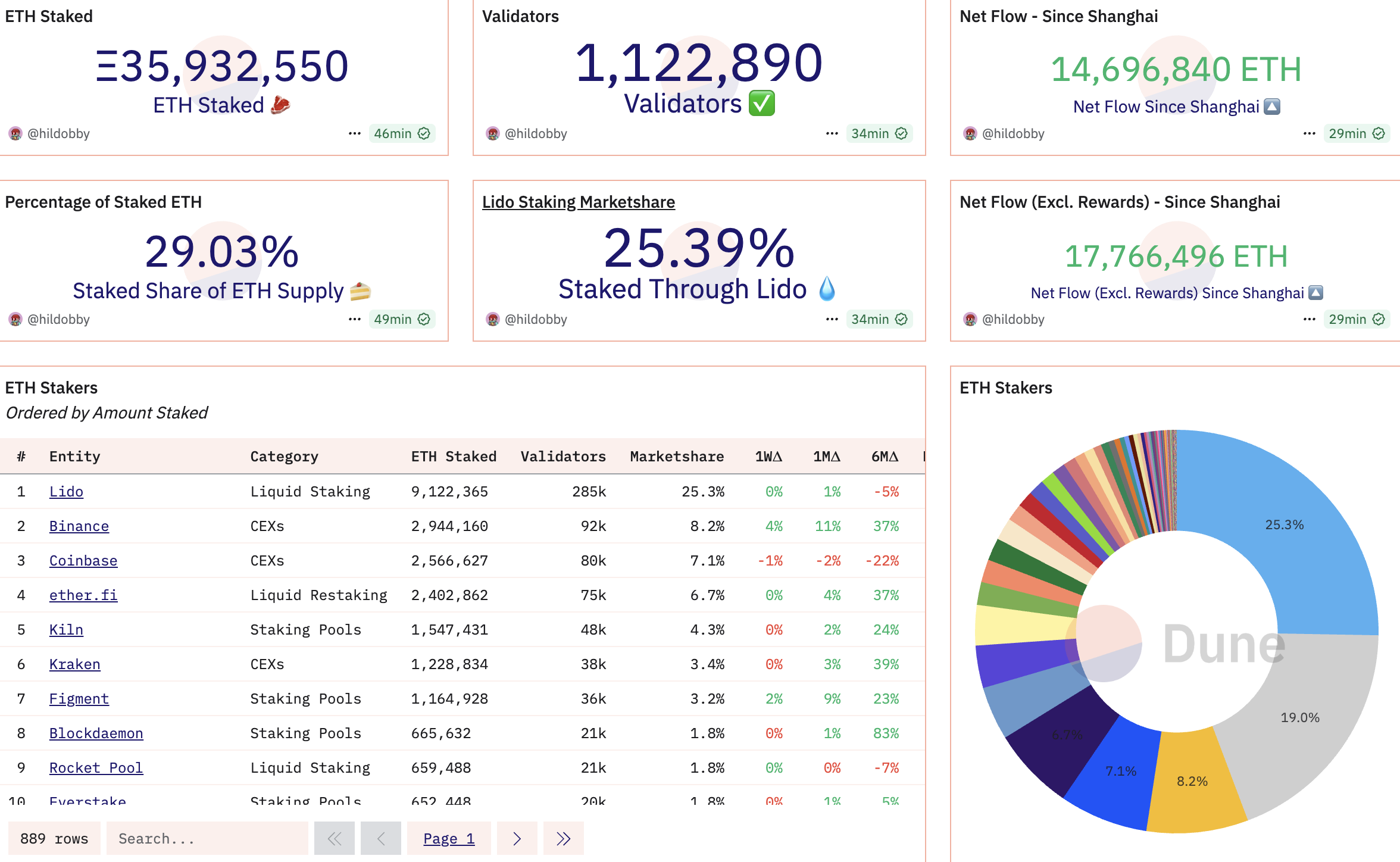

The shock of ETH’s offer is still intensified by stimulating the climb to a record level. According to Dune Analytics, more than 29.03% of the total offer is locked, leaving around 121 million ETH circulation.

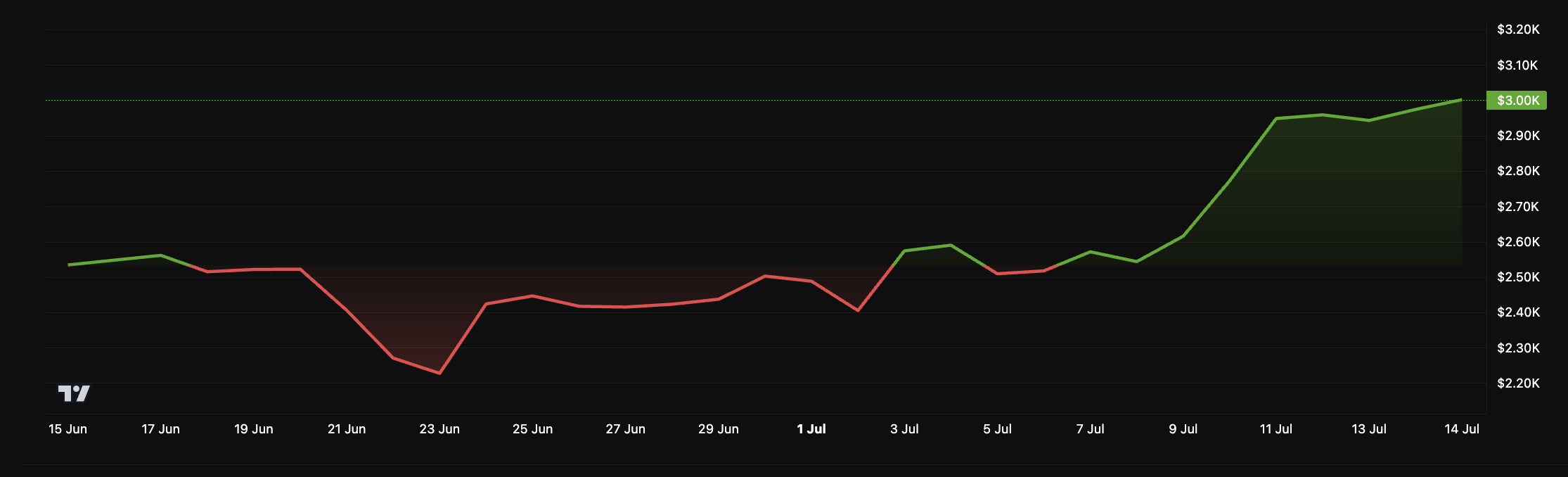

Chain data also shows that ETH has left the exchanges recently, coinciding with the price of the ETH which returns to its current $ 3,000 bar. This is due in part to the strategy of accumulation of whales or large companies like Sharplink.

Reduction of liquidity also contributes to the upward pressure of prices when demand exceeds supply. Last Friday, 140,120 ETH estimated at around $ 393 million were removed from crypto exchanges.

“More than 140,000 ETH, worth around 393 million dollars, have flowed exchanges, marking the largest withdrawal of a day in more than a month,” said Sentora.

Merlijntrader on X provides and strikes $ 10,000 in this cycle, propelled by short pressure and potential dynamics. The approvals of the staging of the ETFs are expected by the end of the year, strengthening the story of the shocks of the ETH offer.

However, the risks are looming. Base trade, although lucrative, is vulnerable to sudden volatility, as we can see in the “black Thursday” of the 2020s. If the shock of the Ethereum offer fails to stimulate overvoltage, the funds could undergo losses, shake the confidence of the market.

ETH broke up above the $ 3,000 mark when writing this article. However, the current price is still 38% below the top of all time it has reached in November 2021.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.