BitMine’s $60,000 Ethereum Value Forecast: What It Means

In their latest presentation, Bitmin Immersion Technologies suggested an implicit value of $ 60,000 for Ethereum (ETH), citing consultations with nameless research companies.

The evaluation comes in the middle of the notable optimistic rally of ETH. The price jumped 57% in the last month, even exceeding the monthly gains of 10% Bitcoin (BTC).

Ethereum evaluation of $ 60,000 Bitmine of $ 60,000

On Monday, Bitmine, the largest public holder in ETH, launched “the president’s message”. This series of monthly videos describes the company’s strategic vision for cryptocurrency investments.

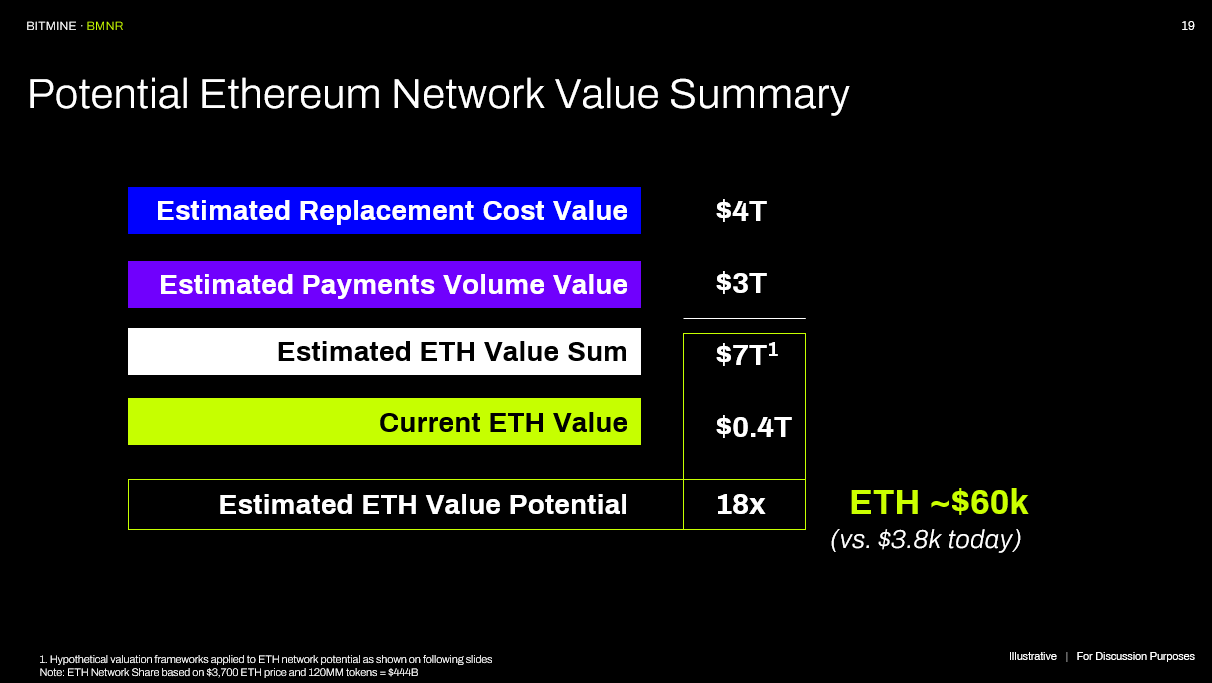

Supporting the presentation on X (formerly Twitter) was a slide entitled “Potential summary of the value of the Ethereum network”, highlighting the potential implicit value of Ethereum.

“We have asked several research companies to give us a” replacement “value (of Wall Street) to assess the ETH. The implicit value for ETH is $ 60,000. ETH currently ~ $ 3,800,” said post.

The $ 60,000 assessment represents an increase of 18 times compared to the current ETH market value. However, the company’s post has formulated this as an illustrative projection.

Although this projection is hypothetical, it always highlights the significant potential of ETH. This confidence in ETH coincides with the second largest cryptocurrency that recently experienced impressive gains.

Beincryptto data has shown that yesterday, ETH has exceeded $ 3,900 for the first time since December 2024, still supplying its continuous recovery. At the time of the press, Ethereum was negotiated at $ 3,871, marking a slight drop of 0.50% in the last 24 hours.

Ethereum price prediction: what analysts expect

Meanwhile, many market analysts are planning more and more higher assessments for the price of Ethereum. In a final article on X, Bitcoinsensus suggested that Ethereum is ready for a significant increase movement, similar to what Bitcoin knew in 2020.

The analyst has observed that Ethereum could suffer an escape above a multi-year trend line. This, in turn, could lead to an increase in prices.

“ETH shows a relative force for a break, after an accumulation of multi -year pressure below this trend. With enough momentum, the break could lead to much higher prices for Ethereum in the coming phase of this cycle,” said post.

In addition, the pillows of the Ethereum Ted promoter have mentioned that Altcoin is currently undervalued. He argued that, on the basis of the growth of the money supply of M2, the value of Ethereum should already be more than $ 8,000.

“This shows how undervalued ETH is at the moment, and is probably one of the best trades here,” said Pillows.

Meanwhile, analyst Mark stressed that more investors accumulate Ethereum. This is often considered a sign of growing confidence in the future price potential of assets.

“The Ethereum accumulation report is increasing again. After reaching a weakness in April 2025, the ratio began to climb, indicating a potential increase in ETH demand,” he noted.

This paints an upward image for ETH. In addition, projections may not be too eccentric, in particular given a number of factors working in favor of Ethereum.

Beincryptto said that institutional interest in Altcoin continues to increase, many companies committing millions of dollars to buy Ethereum as part of their cash strategy.

“Ethereum slowly moves at the same time. When the institutions run, it will not be subtle,” said an observer in the market.

Bitcoin’s domination is declining and many experts predict that Ethereum could be an important beneficiary. Finally, Ethereum’s 10th anniversary has aroused increased interest, putting the token more under investor spotlights.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.