ONDO Price Stalls as Whales Reach All-Time Highs

The Ondo Finance (ONDO) prize has shown little movement in the past 24 hours. However, its long -term growth remains impressive, with an increase of 519% in the past year. As one of the largest actors in the real world (RWA) on the market, Ondo has aroused a strong interest from retail and institutional investors.

While RSI has recovered levels of occurrence and whale titles have reached peaks of all time, Ondo remains in the consolidation phase with its closely positioned EMA lines. Whether it forms a golden cross for a bullish break or that the downward pressure will depend on the momentum of the market and the activity of future investors.

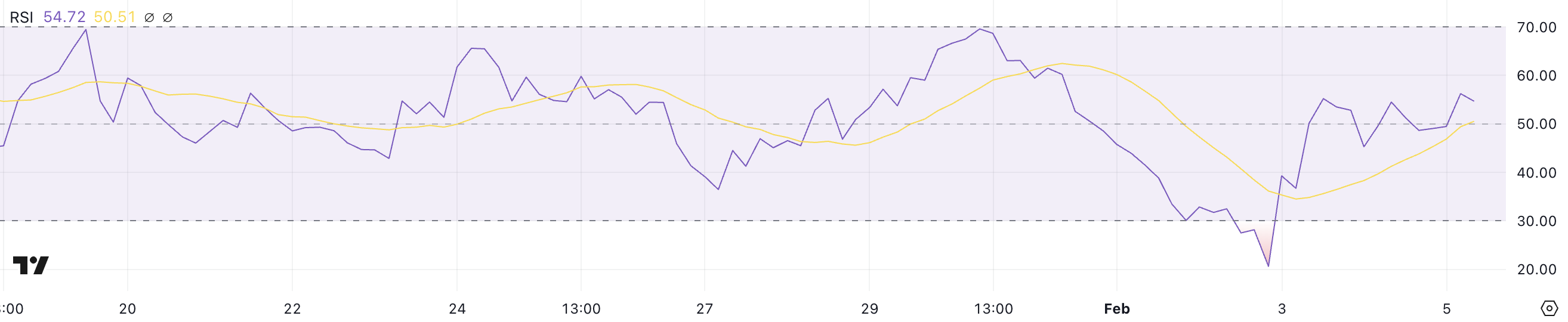

Ondo RSI is currently neutral, recovering levels of occurrence

The relative force index of Ondo (RSI) is currently 54.7, a net recovery of 20.6 only two days ago. This significant rebound indicates that the purchase pressure returned after the Ondo was previously under deeply occurred conditions.

An RSI less than 30 generally suggests that an asset is occurred and may be due to a rebound, which aligns the recent increase in Ondo.

Now that RSI has exceeded 50 years, the momentum seems to be moving in favor of buyers, although it remains in a neutral area rather than highly raised.

RSI is a momentum indicator which measures the speed and extent of price movements on a scale of 0 to 100. Readings greater than 70 suggest conditions of basket and a maintenance potential, while readings less than 30 indicate The conditions of occurrence and the recovery of possible prices.

With Ondo RSI now at 54.7, the asset is in a neutral area in Bullins, which suggests that it still has room to climb if the purchase of the momentum continues.

If RSI grows above 60, it could indicate a stronger bullish momentum, but if it stalls or decreases, the price of Ondo can consolidate before making its next movement.

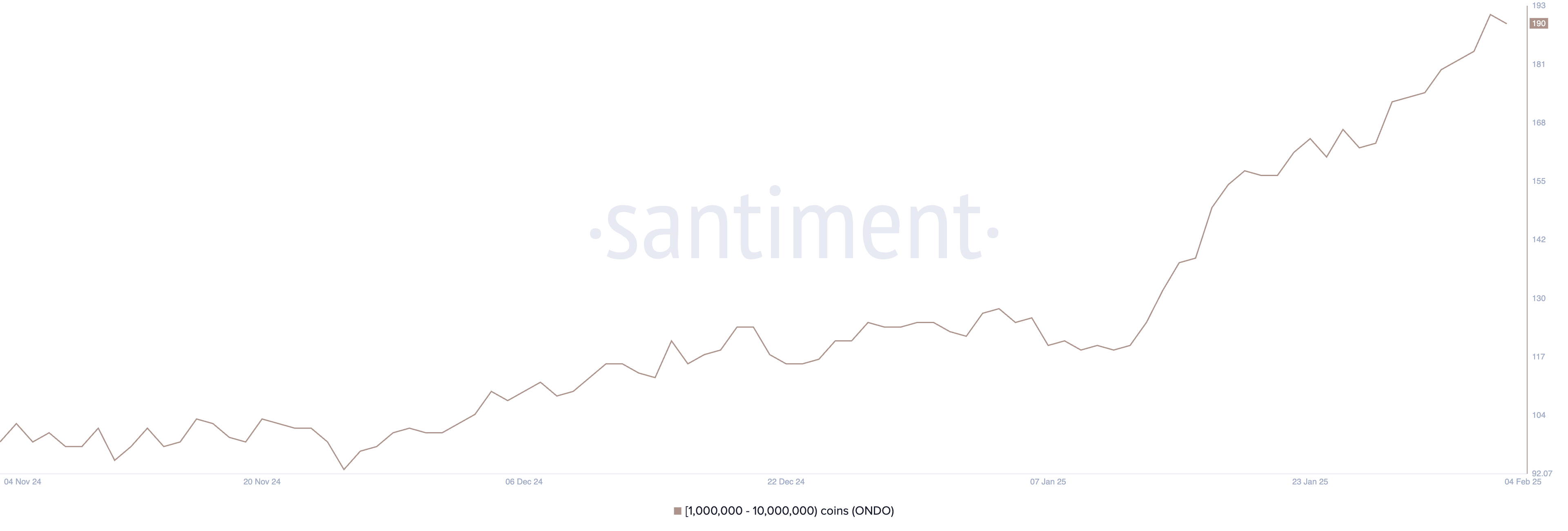

Ondo whales are reaching heights of all time

The number of whales holding between 1,000,000 and 10,000,000 Ondo fell slightly from 193 to 190 on the last day. However, despite this minor drop, the overall number of Ondo whales has increased regularly since January 12, when there were only 120.

This long -term growth suggests that whales have accumulated Ondo, reflecting growing confidence in the asset. Even with the recent decrease, these whale assets remain at their highest levels, which indicates a strong interest in RWA of the main investors.

Monitoring the activity of whales is crucial because major holders can influence prices movements by accumulation or distribution. An increasing number of whales generally signals strong institutional confidence or high shuttle, which can ensure price stability or bull fuel momentum.

While the slight decrease from 193 to 190 suggested a certain short -term distribution, the overall trend remains positive. If the number of whales continues to grow, the price of Ondo could see more, but if more whales are starting to sell, this could increase the volatility or price corrections.

Ondo price prediction: Will a golden cross-form be?

Ondo is currently one of the largest RWA coins on the market, with a market capitalization of around $ 4.5 billion. Its EMA lines are very close to each other, indicating a period of consolidation since yesterday.

If the short-term EMAs cross the EMAs above the long term, it would form a golden cross, a bullish signal which could push Ondo to the resistance of $ 1.53. An escape above this level could further fuel the momentum, with the following objective at $ 1.66.

On the other hand, if Ondo fails to establish an upward trend, it can face downward pressure. A drop in assistance of $ 1.25 could be the first sign of weakness, and if this level breaks, Ondo could decrease more to $ 1.00.

Given the current consolidation, the market is at a critical point and the next major movement will determine if Ondo resumes its upward trend or between a deeper correction.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.