ONDO Whales Retreat as Price Risks Dropping Below $0.70

Ondo faces a significant drop pressure. It has dropped by more than 5% in the last 24 hours and has corrected more than 19% in the last 30 days. With its market capitalization which is now around 2.5 billion dollars, the medal is much lower than competitors like ChainLink and Mantra in terms of market capitalization.

Recent technical indicators and whale behavior suggest that current weakness may not be finished, despite a slight recovery of the momentum.

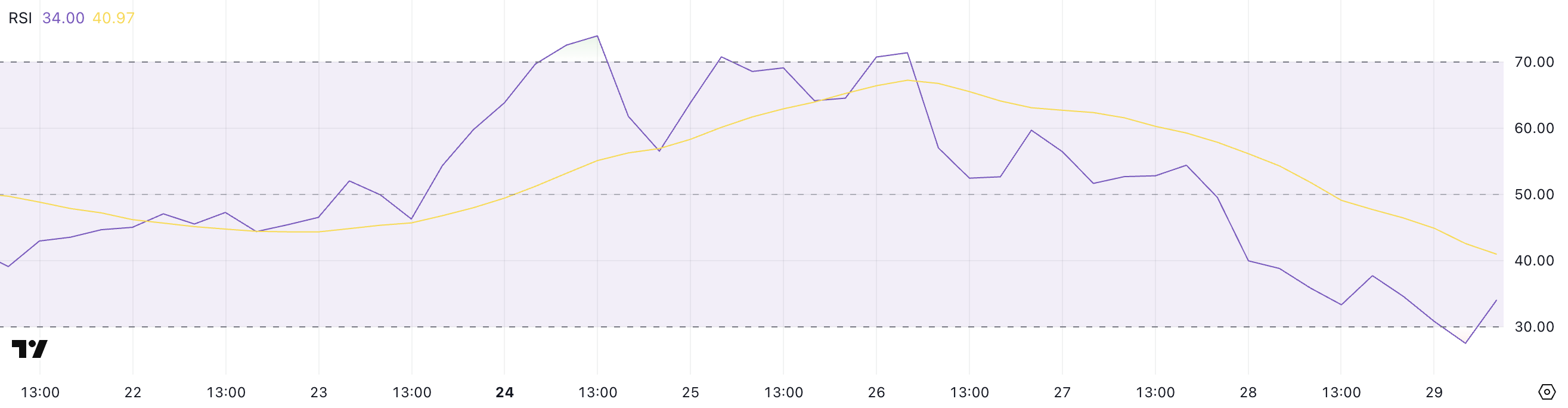

Ondo RSI recovers levels of occurrence

The relative force index of Ondo (RSI) is currently seated at 34 years after having slightly bounced with a drop prior to 27.5. Barely two days ago, the RSI was at 54.39, indicating how fast the momentum changed.

The RSI is a Momentum oscillator which measures the speed and extent of recent price changes. It varies from 0 to 100.

Readings less than 30 are generally considered to be occurring, which suggests that the asset can be undervalued and due for a rebound, while readings above 70 are considered exaggerated, indicating a withdrawal potential.

With Ondo RSI now at 34, he has technically released the territory of occurrence but remains near the lower end of the scale. This suggests that if the strongest sales pressure may have been relaxed, the market is still fragile and the feeling remains cautious.

If the RSI continues to recover and climb over 40 or 50, it could point out a change to a more bullish momentum.

However, if the sale of curriculum vitae and RSI turns out to be below 30, this would indicate a risk renewed downward and a potential for lowering additional prices.

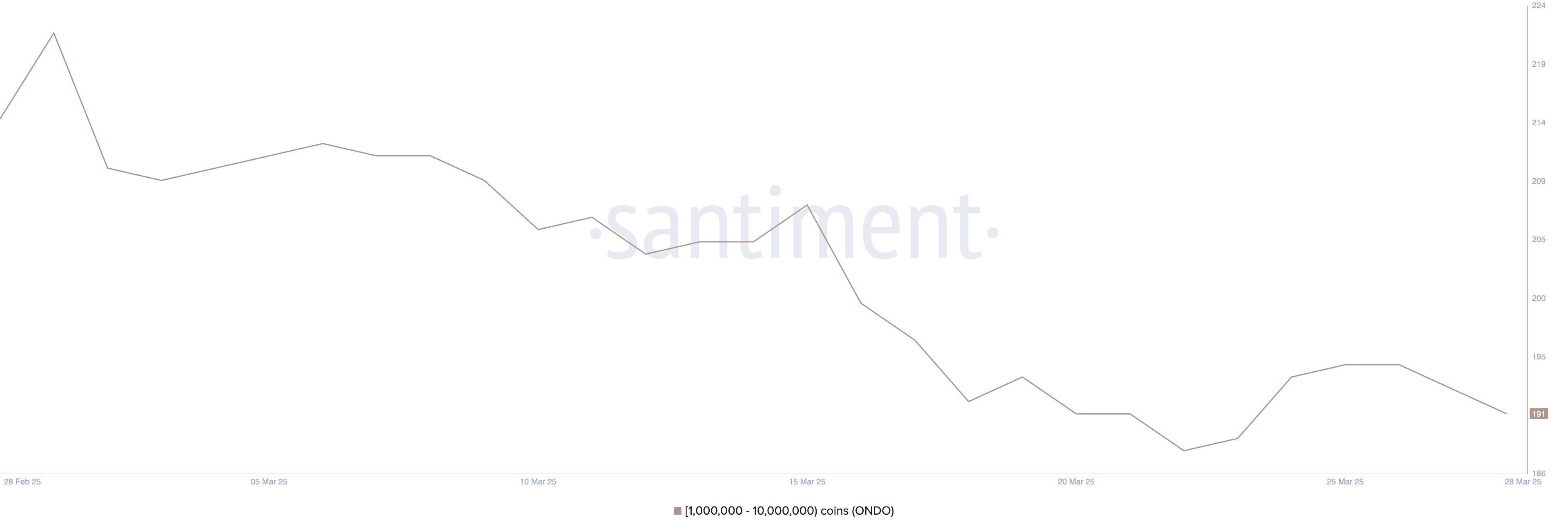

Whales recently stopped their accumulation

The number of Ondo – member whales holding between 1 million and 10 million Ondo – fluctuated at the end of March, initially from 188 to 195 between March 22 and 26 before spending 191 in recent days.

This model of whale activity is significant because these major holders often influence the feeling of the market and price movements, their accumulation or distribution phases potentially foreshadowing the market.

The follow-up of whale addresses provides valuable information on how influential investors are positioned themselves, which can help predict the action of potential prices.

The failure of the whale addresses to maintain the rupture greater than 195 and the yield subsequent to 191 could point out a lower feeling among the greatest investors.

This retirement could indicate that whales are making profits or reducing exposure, which could create downward price pressure on Ondo in the short term.

When large holders are starting to reduce their positions after a period of accumulation, it often precedes prices corrections, which suggests that the Ondo can feel resistance in the maintenance of the momentum up until the whale confidence returns and the accumulation resumes.

Will Ondo fall below $ 0.70 for the first time since November?

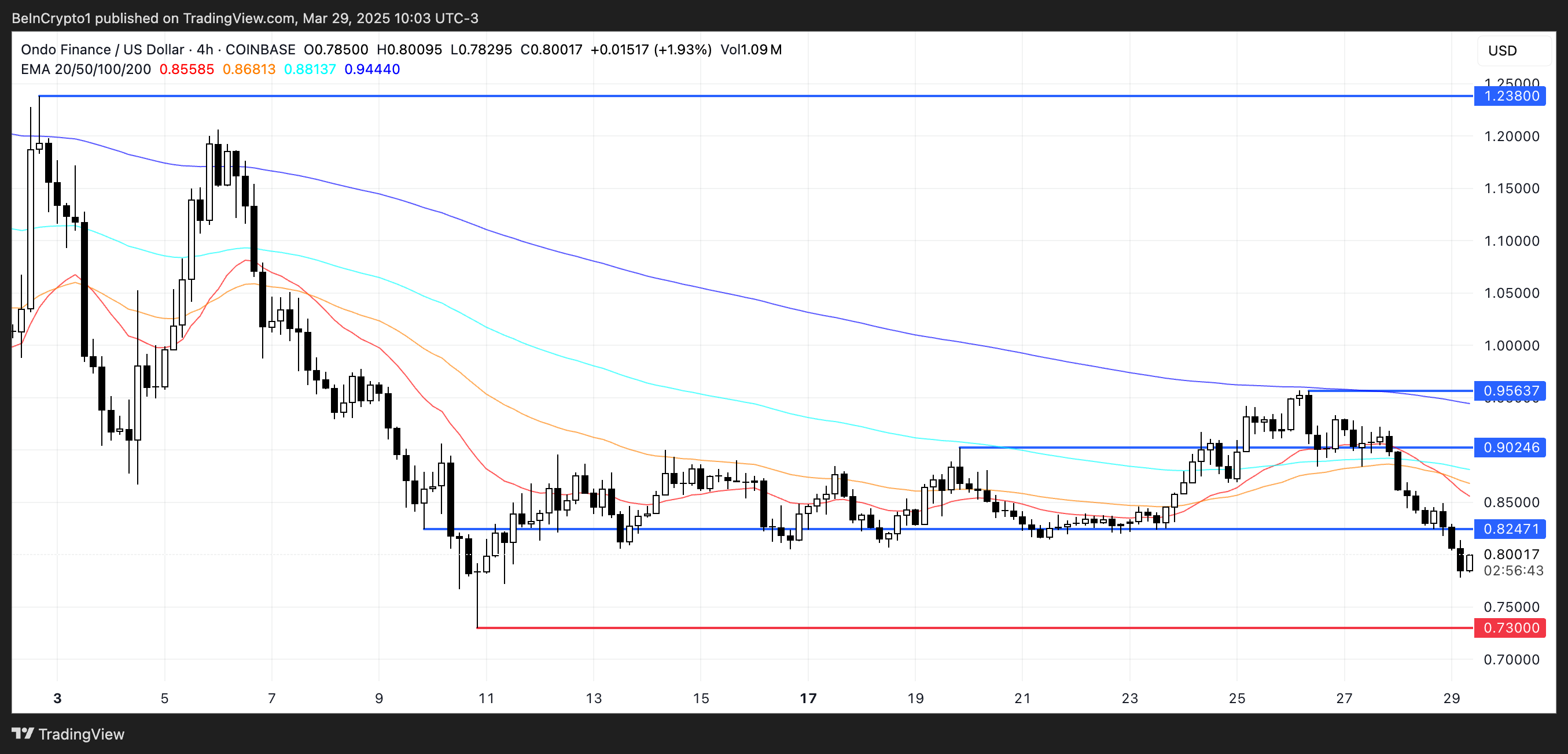

Ondo exponential mobile average lines (EMA) are currently aligned with a lower training, which suggests that the decreased trend may be persisting. If this weakness continues, Ondo could drop to test the level of key support at $ 0.73.

A break below would be significant, potentially sending the price of less than $ 0.70 for the first time since November 2024.

The token had a hard time keeping the pace of other active active ingredients (RWA) like the Mantra, and this underperformance adds additional pressure to the short-term ONDO prospects.

However, if the feeling changes and Ondo manages to reverse its trend, the first key level to watch is the resistance at $ 0.82.

An escape above this level could trigger a wider recovery, with price targets at $ 0.90 and $ 0.95.

If the RWA sector as a whole takes up the momentum, Ondo could even exceed the brand of $ 1 and aim for the next major resistance to $ 1.23.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.