Onyxcoin (XCN) Drops 23% After January Rally

Onyxcoin (XCN) was one of the most efficient altcoins in January, its market capitalization from $ 70 million on January 1 to 1 billion dollars before January 26. However, it is down 23% in the last 30 days.

The relative resistance index (RSI) fell to 42, and the average directional index (ADX) indicates a discolorating downward trend, signaling a potential consolidation phase. If XCN loses its key support at $ 0.0145, it could drop as low as $ 0.0075, but a bullish overthrow could see it test resistance to $ 0.0229, $ 0.033 and even $ 0.040.

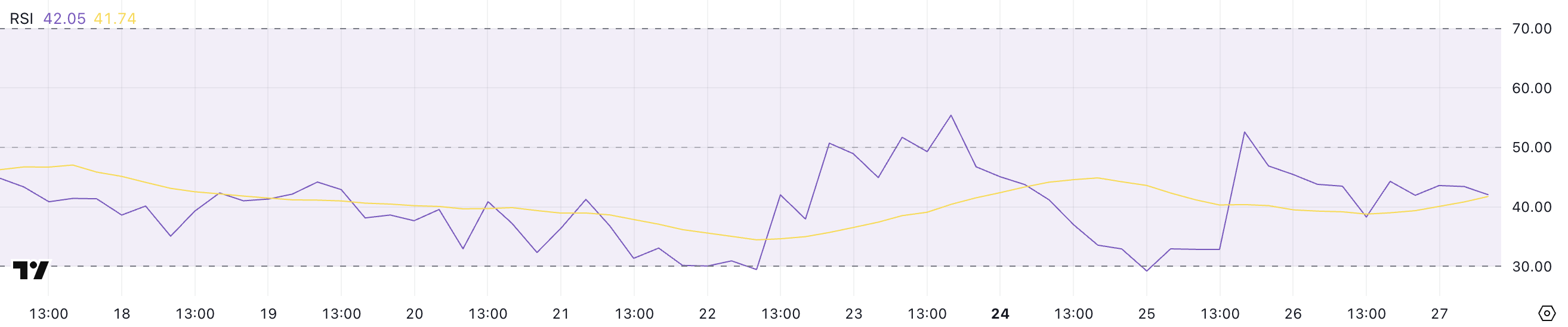

Onyxcoin RSI shows that the purchase pressure is not strong

The RSI of Onyxcoin is currently at 42, against 52.6 two days ago, after having previously spent 29.2.

The relative resistance index (RSI) is a momentum oscillator which measures the speed and variation of price movements. It varies from 0 to 100, with values greater than 70 indicating over -rascal conditions and potential for a prize print, while the values less than 30 suggest conditions of exceeding and the rebound potential.

An RSI between 30 and 70 generally indicates a neutral trend without solid directional bias.

RSI of XCN had trouble exceeding 60 since January 30, indicating a lack of strong bullish dynamics.

The recent decrease from 52.6 to 42 suggests that the purchase pressure is weakening, potentially pointing further if the RSI continues to drop. This decrease reflects the discoloration of bullish feeling, making altcoin vulnerable to continuous sales pressure.

If the RSI is not recovering soon above 50, it could confirm a downward trend, potentially resulting in new price reductions.

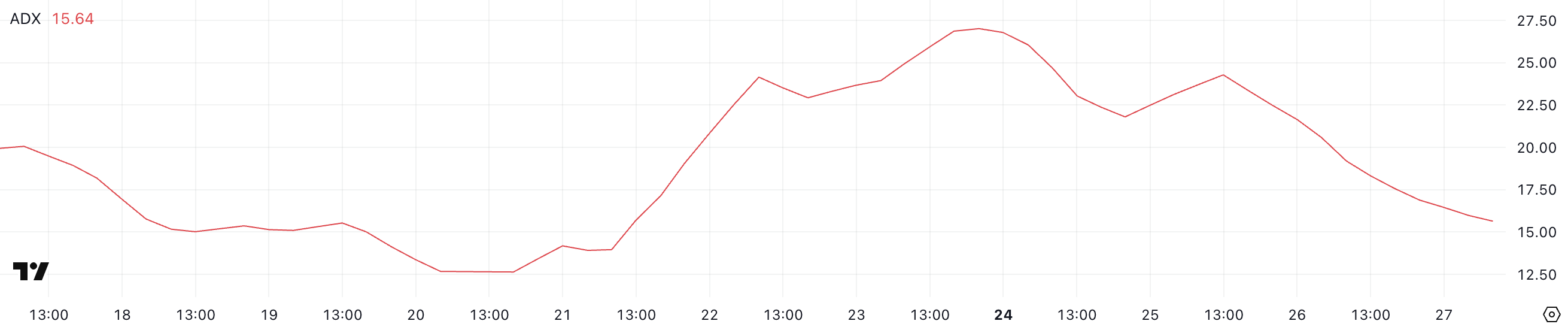

XCN ADX shows that the downward trend is disappearing

The ADX of Onyxcoin is currently at 15.6, against 24.2 two days ago. The average directional index (ADX) is an indicator of resistance to the trend that measures the intensity of a trend without indicating its direction.

It goes from 0 to 100, with values above 25 indicating a strong trend and values below 20 indicating a low or not trendy market.

An ADX less than 20 suggests that price movements are likely to be lateral or lacker.

Adx de XCN falling to 15.6 suggests a weakening trend, indicating that the current decrease trend loses momentum.

In a downward trend, an ADX declining reflects the reduction in sales pressure and market indecision, increasing the probability of consolidation of prices or lateral movement.

However, without increasing the ADX or a directional change, XCN is unlikely to see a significant price reversal soon. If the ADX remains less than 20, the price could continue to drift without a clear direction.

Onyxcoin could drop by 51% if the downward trend is recovered again

The combination of a downward trend and a drop in RSI suggests that Altcoin could enter a consolidation phase.

Currently, he has close support of about $ 0.0145, which, if he was tested and lost, could lead to a drop of $ 0.0075.

On the other hand, if an increased trend emerges, XCN could increase to test the resistance level by $ 0.0229. If this is broken and that we have the positive momentum observed in the previous months, it could continue to rally, testing $ 0.033 or even $ 0.040.

This would represent a potential at 154% of current levels. However, for this Haussier scenario to be played, XCN should resume a strong purchasing momentum and maintain it through zones of key resistance.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.