Over $10 Billion in Crypto Options Expiring Today: What It Means for Bitcoin and Ethereum

The cryptography market will attend $ 10.31 billion in Bitcoin and Ethereum Options contracts today. This massive expiration could have an impact on short -term prices action, especially since the two assets have recently decreased.

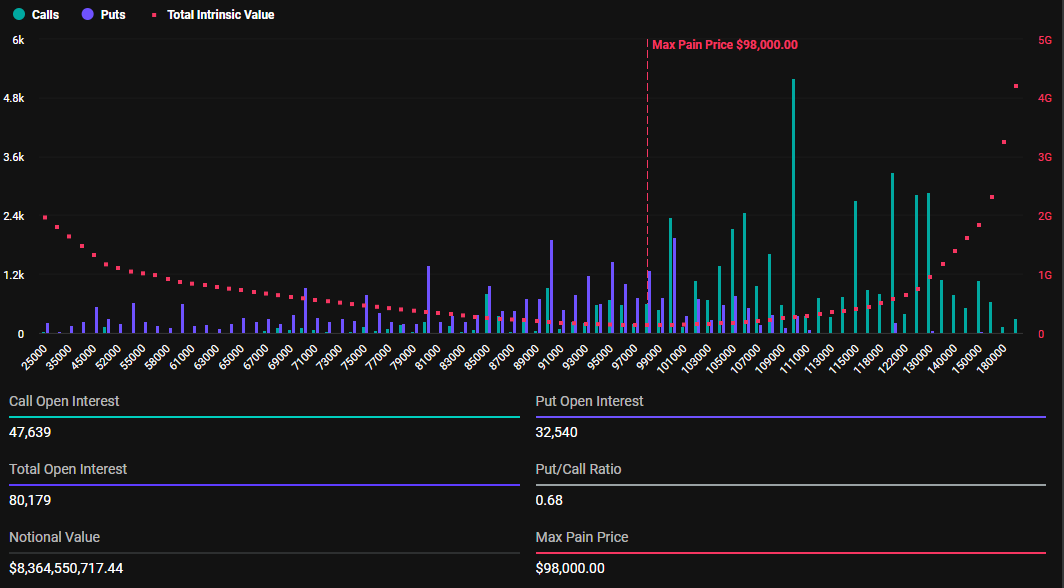

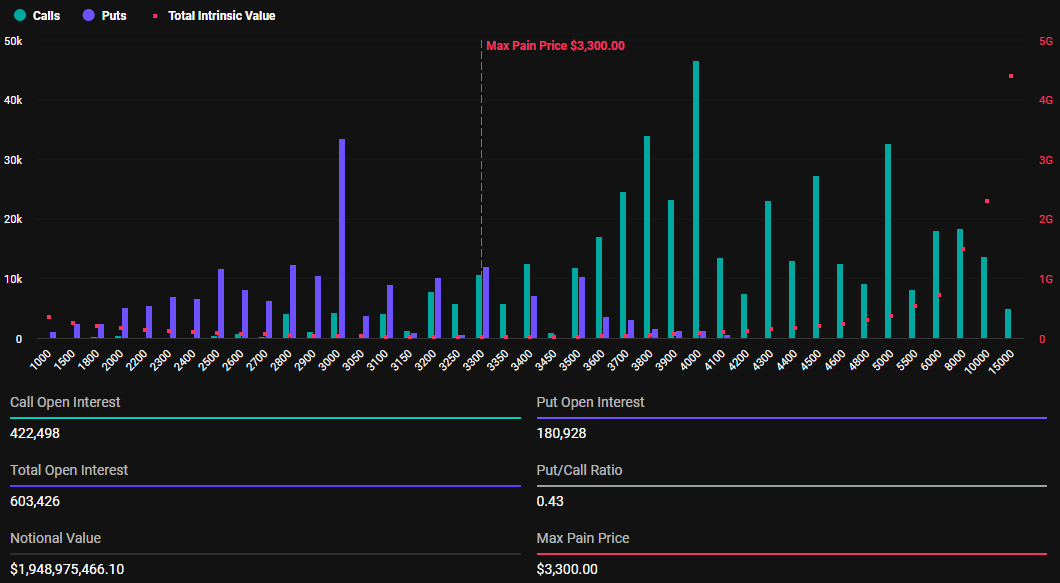

With Bitcoin options worth $ 8.36 billion and Ethereum at $ 1.94 billion, traders are preparing for potential volatility.

Expirations of crypto options with high issues: what traders should look at today

Today’s expired options mark a significant increase compared to last week because it expires at the end of the month. According to deribit data, the expiration of Bitcoin options involves 80,179 contracts, against 30,645 contracts last week. Likewise, the expired options of Ethereum total 603,426 contracts, against 173,830 contracts the previous week.

These expired bitcoin options have a maximum price of pain of $ 98,000 and a space / call ratio 0.68. This indicates a generally optimistic feeling despite the recent decline in assets. In comparison, their Ethereum counterparts have a maximum price of pain of $ 3,300 and a 0.43 ratio, reflecting similar market prospects.

Put-appeal ratios below 1 for Bitcoin and Ethereum suggest optimism on the market, with more traders betting on price increases. Nevertheless, analysts call caution due to the tendency of the expiration of options to cause market volatility.

“This could bring significant volatility of the market as traders reposition themselves before expiration, expect net price movements and potential liquidations,” warned Crypto Dad, a popular user on X,.

The warning comes as expirations of options often cause short -term price fluctuations, creating market uncertainty. Meanwhile, Beincryptto data show that the Bitcoin trading value dropped 0.64% to $ 104,299. On the other hand, the price of Ethereum is up 1.04% modest, now negotiating at $ 3,226.

Implications for Options Expire on BTC and Eth

With their current prices, Bitcoin is much higher than its maximum level of pain of $ 98,000, while Ethereum is lower than the exercise price of $ 3,300. The maximum pain point or the exercise price is a crucial metric that guides market behavior. It represents the price level at which most options expire without value.

Based on the maximum pain theory, the prices of the BTC and the ETH will probably tackle their respective exercise prices, therefore the expected volatility. Here, the greatest number of options (both calls and put) would expire without value as these options contract near the expiration.

Buyers of options that lose all the value of their options would feel “pain”. On the other hand, the sellers of options would benefit as the contracts expire out of money, and they prevent the credit received from the sale of options.

This happens because the maximum pain theory works by assuming that option editors are generally large institutions or professional traders, otherwise called intelligent currency. Consequently, they have the resources and the influence of the market to generate the price of closing the action towards the maximum pain point on the day of expiration.

“Traders often monitor this level because it can influence price movements as expiration approaches,” wrote an analyst on X.

Based on this hypothesis, these market manufacturers will cover their positions to maintain a neutral portfolio of Delta. As their positions near the expiration, they compensate for their positions of short options by selling or buying the contract, influencing the price towards the maximum pain point.

It should be noted that the markets generally stabilize shortly after, traders adapt to the new price environment. With the expiration of the high volume of today, traders and investors can expect a similar result, potentially influencing the trends in the cryptographs in the weekend.

The message of more than $ 10 billion in crypto options expires today: what it means for Bitcoin and Ethereum appeared first on Beincrypto.