PancakeSwap (CAKE) Leads Market Gains as Trading Volume Soars 88%

Cake, the Pancakeswap native token of decentralized exchange (DEX), is the best winner of today, defying wider market trends.

The token recorded a modest gain of 3% in the last 24 hours, surpassing the main assets like Bitcoin (BTC) and Ethereum (ETH), which are both decreasing by about 1% each during the same period. The technical indicators suggest that the rally could continue because it is supported by a significant demand from market players.

The climbing of cakes as the trading volume rises in currency 88%

In the midst of the wider market in last week, Cake managed to record gains. By currently negotiating at $ 2.48, the token has climbed 9% since May 31.

This upward trend continues today, as evidenced by the overvoltage of the commercial volume accompanying the growth in cake prices. The token trading volume increased by 88% in the last day, highlighting the interests of increased investors and the growing demand for the DEFI assets.

When the volume of trading of an asset increases alongside its price, it indicates a strong interest in purchase and confirms the strength of the price movement upwards. This combination suggests increasing confidence in investors in the cake and advice that the upward trend can continue in the short term.

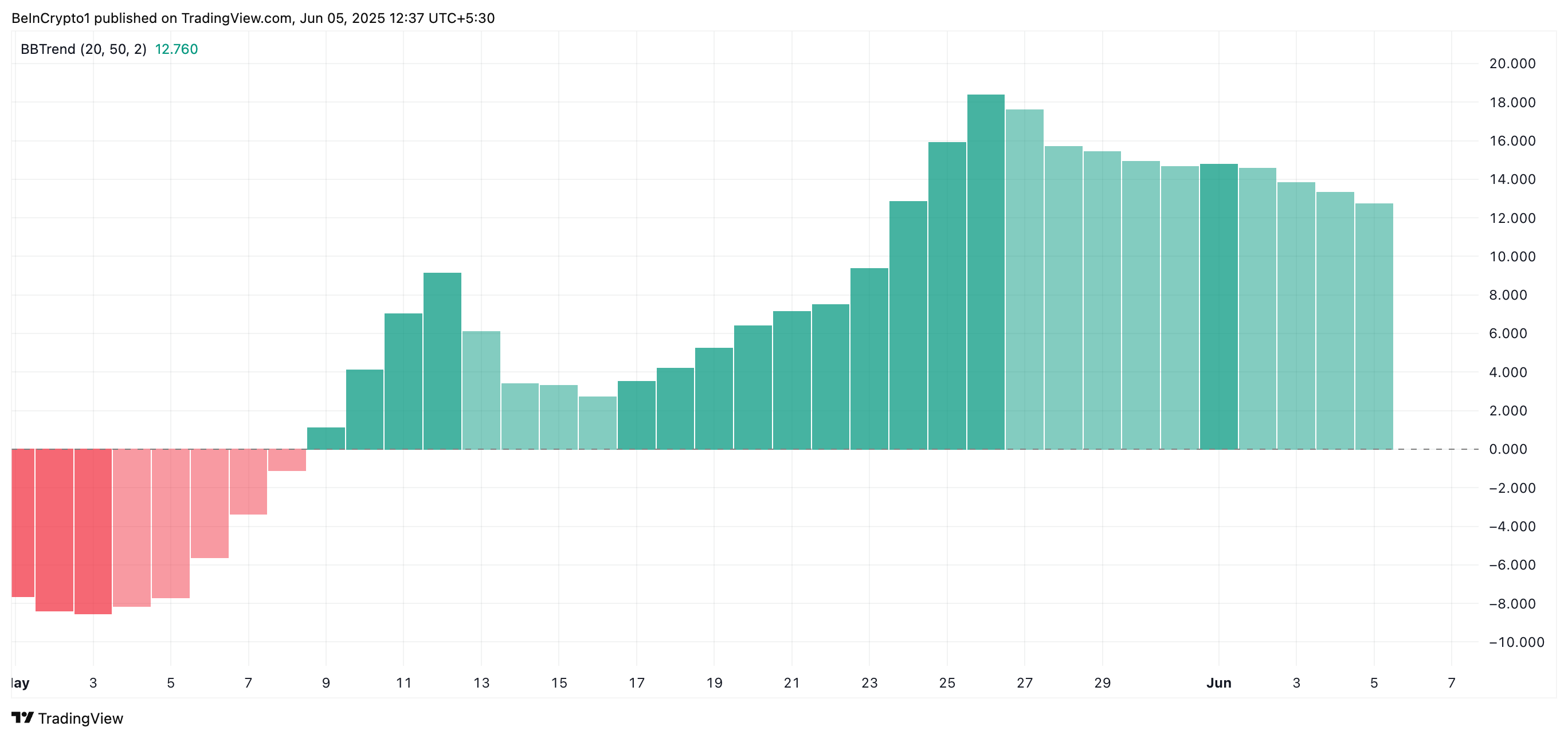

In addition, the readings of the Bbtrend indicator of Altcoin support this upward perspective. Observed on a one -day graph, the indicator is currently at 12.76, publishing only green histogram bars since May 9.

The Bbtrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger bands. When it returns the red bars (negative values), the price of the assets systematically closes near the lower Bollinger strip, reflecting a sustained sales pressure and referring to the potential of the decline.

Conversely, as for the cake, when Bbtrend’s values are positive, this generally signals a strong upward trend. At 12:76 pm, the momentum indicator confirms the increase in upward pressure among the chips, which suggests that the current rally can have more room to run.

Haussier indicators emerge for the cake, but will $ 2.81 hold?

The index of relative force increased cake (RSI) gives credit to this hassled perspective. To date, the indicator is 54.75 and in an upward trend.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100. The values greater than 70 suggest that the asset is overflowed and due for a drop in prices, while the values less than 30 indicate that the assets are occurring and can attend a rebound.

The current Cake RSI configuration shows a constant increase in the accumulation of tokens, a model that could cause additional prices.

If the current feeling and the volume levels persist, the cake could extend its earnings to $ 2.81 in the short term.

On the other hand, if the request falls, the cake could fall below the support floor at $ 2.41 and drop to $ 2.25.

The Post Pancakeswap (Cake) directs the gains on the market while the volume of trading soars 88% on Beincrypto.