PancakeSwap (CAKE) Surges 40%, Is the Buying Phase Over?

Pancakeswap (Cake) has increased by 40% in the last 24 hours, and its income has climbed $ 19 million in the last seven days, behind Tether, Circle and Jupiter.

The recent price wave comes as the bruising technical signals continue to build. The Cake RSI has reached its highest level since 2023, while the Ichimoku Cloud and EMA indicators indicate that the upward potential. Here is what is behind the cake rally and the key levels to look at then.

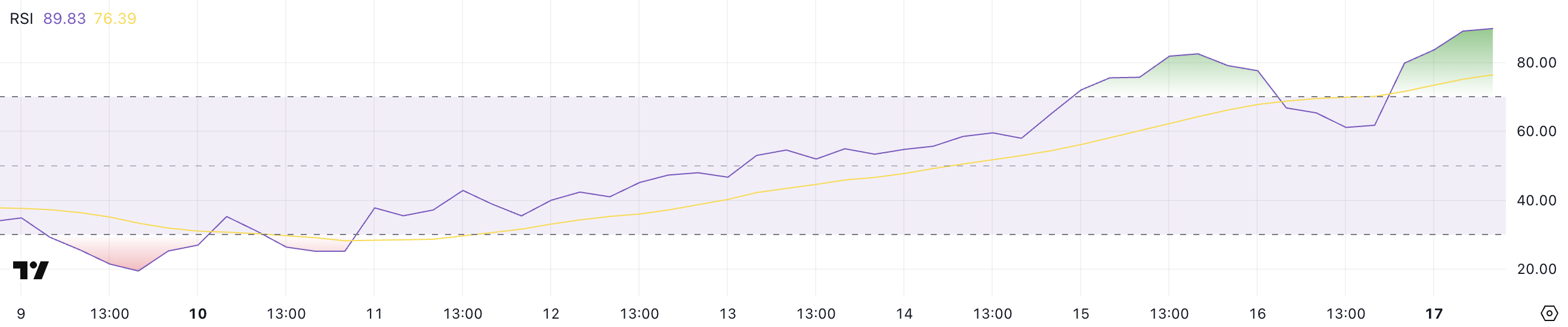

Pancakeswap RSI has reached its highest levels since 2023

The Cake RSI is currently 89.6, up 25.1 only a week ago, marking its highest level since November 2023.

This significant increase suggests a high recent purchase pressure, pushing the momentum to an extreme territory.

The relative resistance index (RSI) is a widely used momentum oscillator which measures the speed and extent of recent price changes.

It varies from 0 to 100, with readings greater than 70, generally considered to be overchat and readings less than 30 views as an occurrence.

The 89.6 cake RSI indicates that the token is deeply in the exaggerated territory. This might suggest that the price is likely for short -term correction because traders could start locking profits.

However, during strong optimistic trends, assets can remain exaggerated for long periods before reversing.

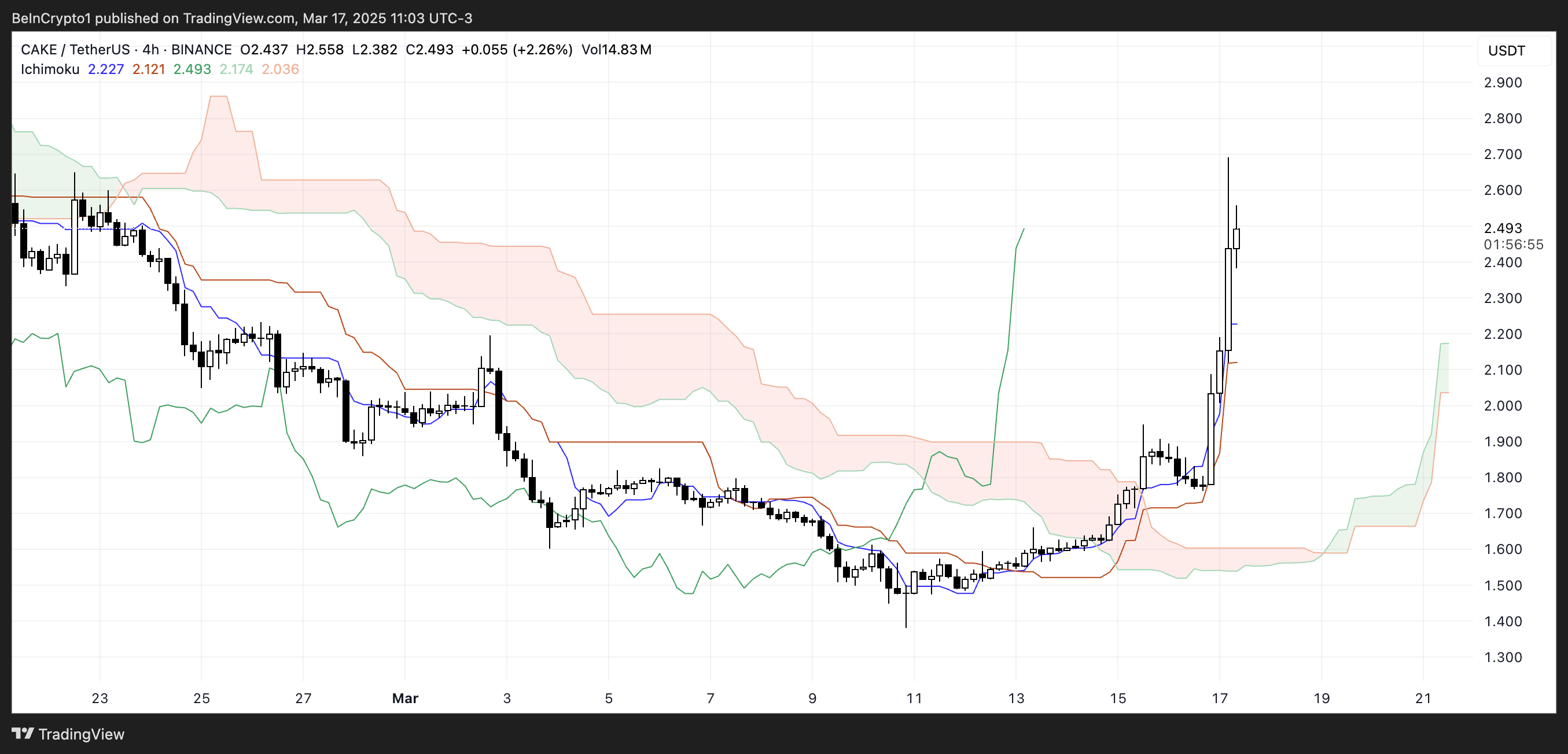

The Ichimoku cloud shows a strong bullish configuration

The cake has broken decisively above the Ichimoku cloud on the graph, marking a strong passage to a bullish trend.

Tenkan-sen (Blue Line) crossed above the Kijun-Sen (red line), a classic bullish signal, while the price remains well above the two lines, confirming a strong momentum.

The future cloud has become green, indicating that the bullish feeling could extend during the sessions to come.

However, with the price now considerably distant from the Cloud and the support of Tenkan-Sen, a short-term correction or consolidation could occur before the increase.

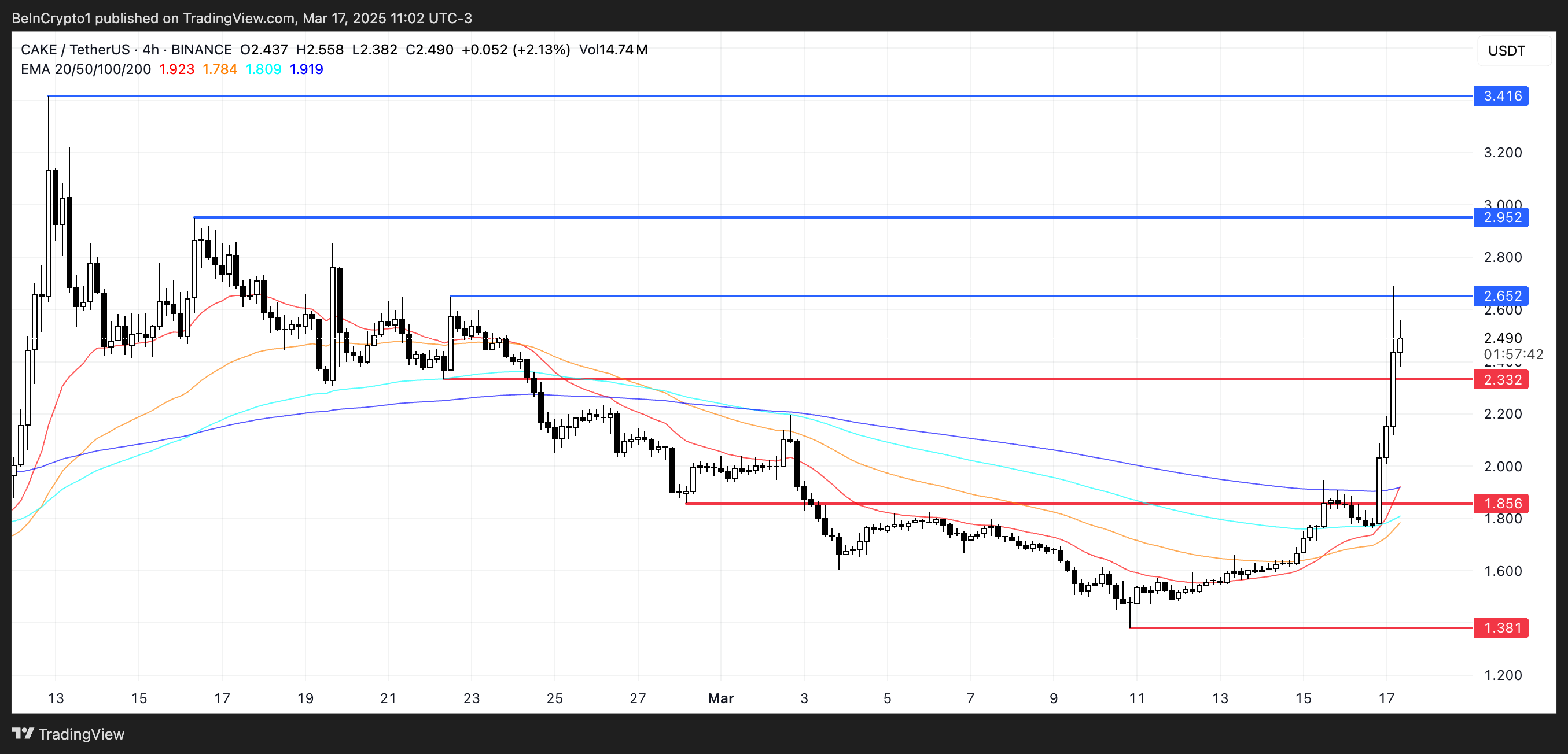

The cake could exceed $ 3 soon

The EMA lines of Cake show signs that a golden cross could form soon, indicating a potential passage to a sustained upward trend while the BNB ecosystem continues to draw attention.

If this crossing takes place, it could provide the necessary momentum for the cake to test the resistance at $ 2.65. An escape above this level could open the door to additional gains, with the following key targets at $ 2.95 and $ 3.41.

However, if the upward trend does not hold and the momentum fades, although Pancakeswap is still the most dominant DEX in the BNB channel, Cake could withdraw to support at $ 2.33.

A break below this level can speed up the correction, with a risk of additional decline to $ 1.85 and potentially $ 1.38.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.