Can The SOL Coin Price Break $160 by Q2’s End?

Altcoin Solana Populaire is up 2% in the last 24 hours, as the wider market of cryptography shows signs of resilience.

However, beyond the general recovery of the market, the movement upwards is fired by an index of institutional interest renewed for the medal and its ecosystem.

Solana started for the rally? Nasdaq depositing the fuel momentum

According to a 40-F form of the form of June 18, the Canadian asset manager Sol Strategies, a company focused exclusively on the Solana ecosystem, has filed compliance documents with the Securities and Exchange Commission (SEC) of the United States, signaling its intention to list on the Nasdaq.

While waiting for approval, the deposit represents a daring step towards the supply of institutional investors, a direct exposure to assets based on Solana via traditional markets. This development triggered a renewed wave of cautious optimism among Hodlers soil, which increases its price today.

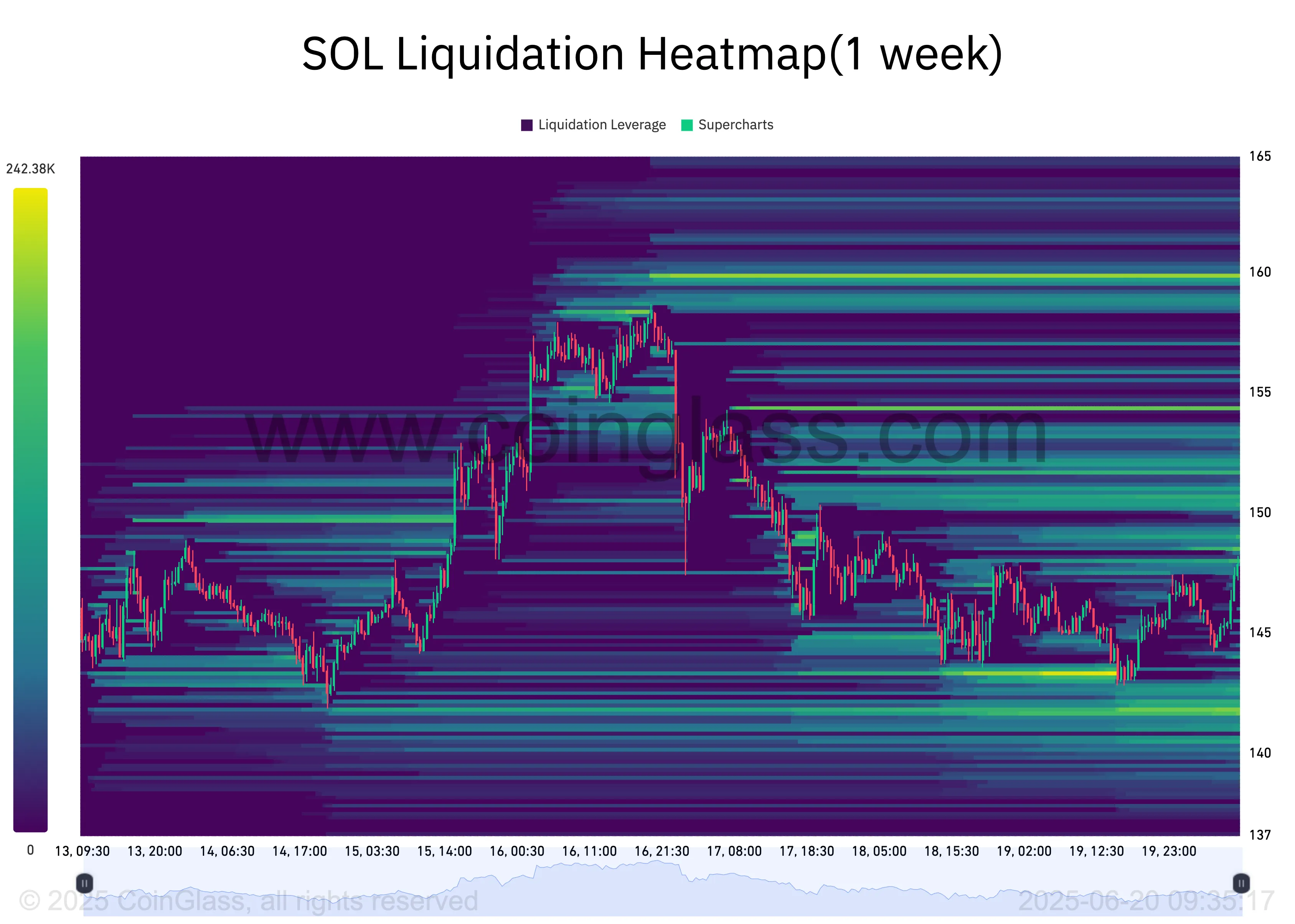

In addition, the time of this deposit aligns with signals on the increasingly bullied chain such as the thermal liquidation maps of the part, which show that a dense liquidity group formed around the level of $ 160.

Thermal liquidation cards are visual tools that traders use to identify the price levels where large clusters of leverage positions are likely to be liquidated. These cards highlight the high liquidity areas, often coded by color to show the intensity, with brighter areas representing a greater liquidation potential.

Usually, these price zones are magnets for prices, because the market moves to these areas to trigger liquidations and open new positions.

Consequently, for soil, the heap of dense liquidity around the level of $ 160 suggests a strong interest of trader to buy or cover short positions at this price. This opens the ground for a short -term rally to this area.

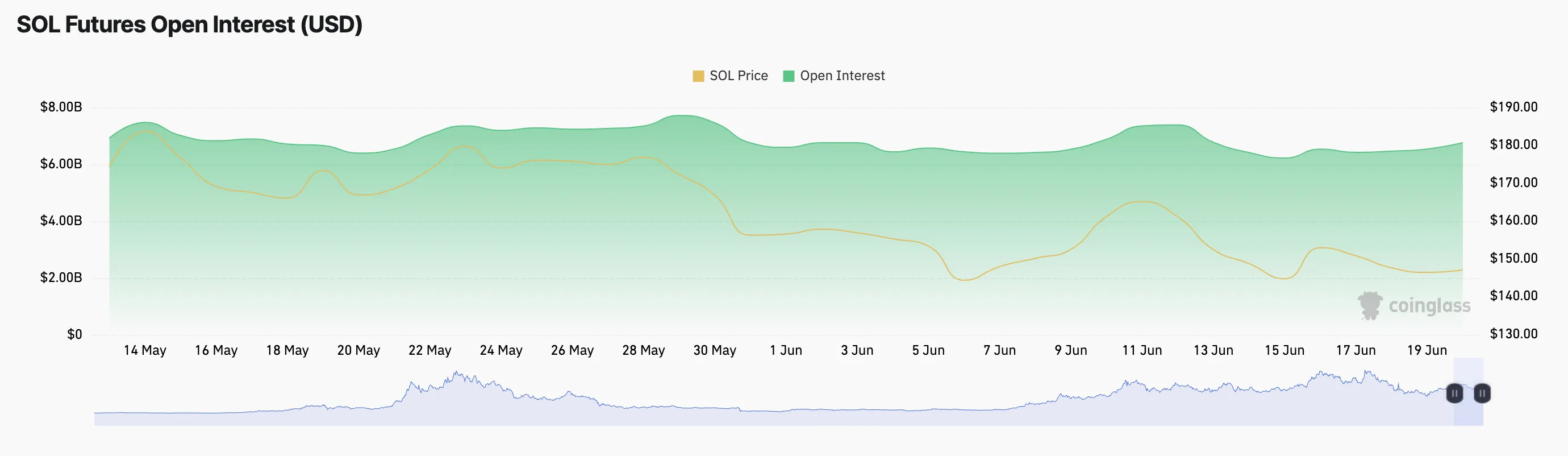

In addition, the open interest in soil (OI) has climbed 3% in the last day, indicating a lever effect increased in floor -term contracts.

An ancient OI suggests that more capital take place in the market derivative markets, reflecting an increasing conviction among traders concerning the potential movement of soil prices.

Can the new request trigger an escape greater than $ 160?

Since early June, Sol has exchanged in a tight range, facing the resistance at $ 153.59 and finding support at $ 142.59. A potential thrust around $ 160 would require a decisive escape above this resistance, which can only occur if the demand for new demand enters the market.

Without a renewed purchase pressure, the current momentum can stall. If buyers are starting to show signs of exhaustion, soil may reverse its recent earnings and retest support at $ 142.59.

Ventilation below this level could open the door to a deeper correction of the price of the floor room around $ 134.68 while the Q2 fired in its end.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.