PENGU Surges 10% Amid Market Lull — But Here’s Why a Pullback Could Be Looming

Even Coin Pengu has become the best winner on today’s cryptographic market with an increase of almost 10% in the last 24 hours. This rally intervenes in the middle of a broader lull on the cryptography market, where the main active workers had trouble gaining ground.

However, despite the bullish momentum, the technical indicators suggest that the buyer’s fatigue can be established, increasing the risk of short -term correction of the price of the pingou.

The Pingou faces resistance and lowers

Between May 14 and June 26, Pengu exchanged in a descending parallel channel, fighting to take a momentum up. An escape followed, leading to a price rally which now pushes the Altcoin to its summit on May 14.

However, technical and on -chain readings suggest that buying pressure can lose steam and pingou risk a short -term decline. For example, the relative force force of the token (RSI) is 72.16 at the time of the press, which indicates that the pingou is too hidden and could witness a reversal.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100. The values greater than 70 suggest that the asset is overflowed and due for a drop in prices, while the values less than 30 indicate that the assets are occurring and can attend a rebound.

At 72.16, the RSI of Penguin shows Altcoin on the Surbouillé territory. This suggests that the purchase pressure can be unbearable in the short term, increasing the probability of withdrawal or consolidation of prices as the momentum cools.

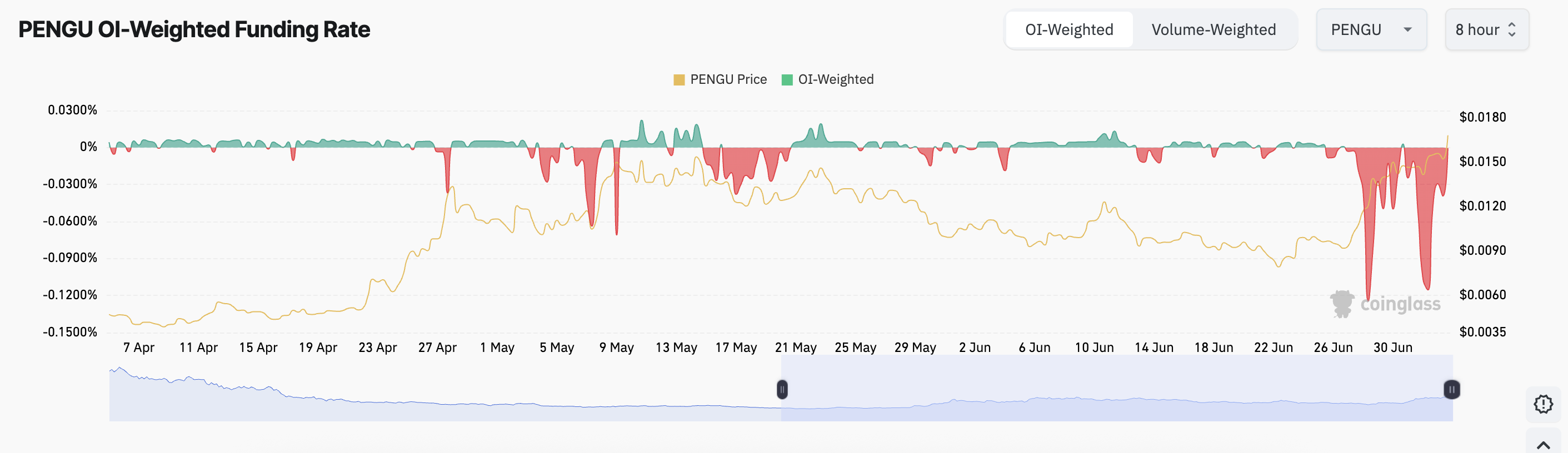

In addition, the aggregate financing rate of the token on the derivative market has remained significantly negative in recent days. It is a sign that the lowering feeling develops among leverage traders. At the time of the press, the pengue financing rate is -0,0005%.

The funding rate is a periodic cost exchanged between long and short traders in perpetual term markets to maintain prices aligned on the cash market.

PEGGU’s constantly negative funding rate indicates that short positions dominate, signaling a potential withdrawal while traders are preparing for a slowdown.

This, combined with the fatigue of gradual buyers gradually, underlines a possible correction of pingou prices in the coming days.

Escape of the pingu eyes but the risk of correction increases

At the time of the press, Pengu is negotiated at $ 0,0,0160, just below the resistance at $ 0.0170. If the profit taking begins, the same part could witness a downward pressure to $ 0.0137.

If this support floor does not hold, Pengu’s price could slip more at $ 0.0128.

Conversely, if the request is strengthened, the pingou could break over the resistance of $ 0.0170. A successful escape could open the door to $ 0.0175, a level given for the last time before the start of its downward trend on May 14.

The Pingu Post -Ungu increases 10% in the middle of the lull on the market – but this is why a decline could appear first on Beincrypto.