Pi Coin To Break Out Soon? Bullish Signals Traders Should Watch

Pi Coin (PI) frustrating the merchants for weeks, oscillating between the narrow ranges and having little momentum in both directions. Over the past seven days, Pi Price has only slipped 0.5%, trading at around $ 0.448.

On the monthly time, the price of the PI part is down 15%, while its three -month drop is 23% deeper. The action of slow prices has kept bulls and bears in an impasse. But while July is coming to an end, a change can be prepared below the surface.

Volume -based confirmation: OBV begins to move!

The balance sheet volume indicator (REBR) displays early signs of optimistic intention. Between July 13 and 22, the Pi Coin price had a decent increase. The REBR indicator reflected this movement with a higher top.

This synchronicity between the price and the volume suggests that the overvoltage of prices was not a stroke of luck; The real purchase volume supported the movement.

However, this force still requires validation. For the OBMO to confirm a trend continuation, it must exceed the previous peak of -1.57 billion. A higher on the OBV would signal a sustained accumulation, strengthening the case for a wider bullish overthrow.

As a volume -based cumulative indicator, REBD adds volume on green days and subtracts on red days. When it reaches the price with the price, this confirms a bullish conviction. When it flattens or diverges, the momentum is suspect. Currently, OBV is built, but has not yet broken out.

Pi Coin The RSI divergence aligned with the ROV momentum

The relative force index (RSI) also shows signs of life. While the PI price continued to print lower peaks, the RSI was on an ascending trajectory. This upward divergence suggests that the down pressure is discouraged; A divergence between the price and the underlying force.

That said, for this signal to solidify, the RSI must exceed level 52. The closure above 52 would imply that the bullish momentum is not only bubbling; It allowed. Until then, the divergence remains promising, but not confirmed. A movement above 52 would mean two highest highs, indicating a reversal reversal.

RSI follows the momentum by comparing the magnitude of recent gains with recent losses. The differences between the RSI and the price, in particular near the large support areas, often precede trend reversals.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

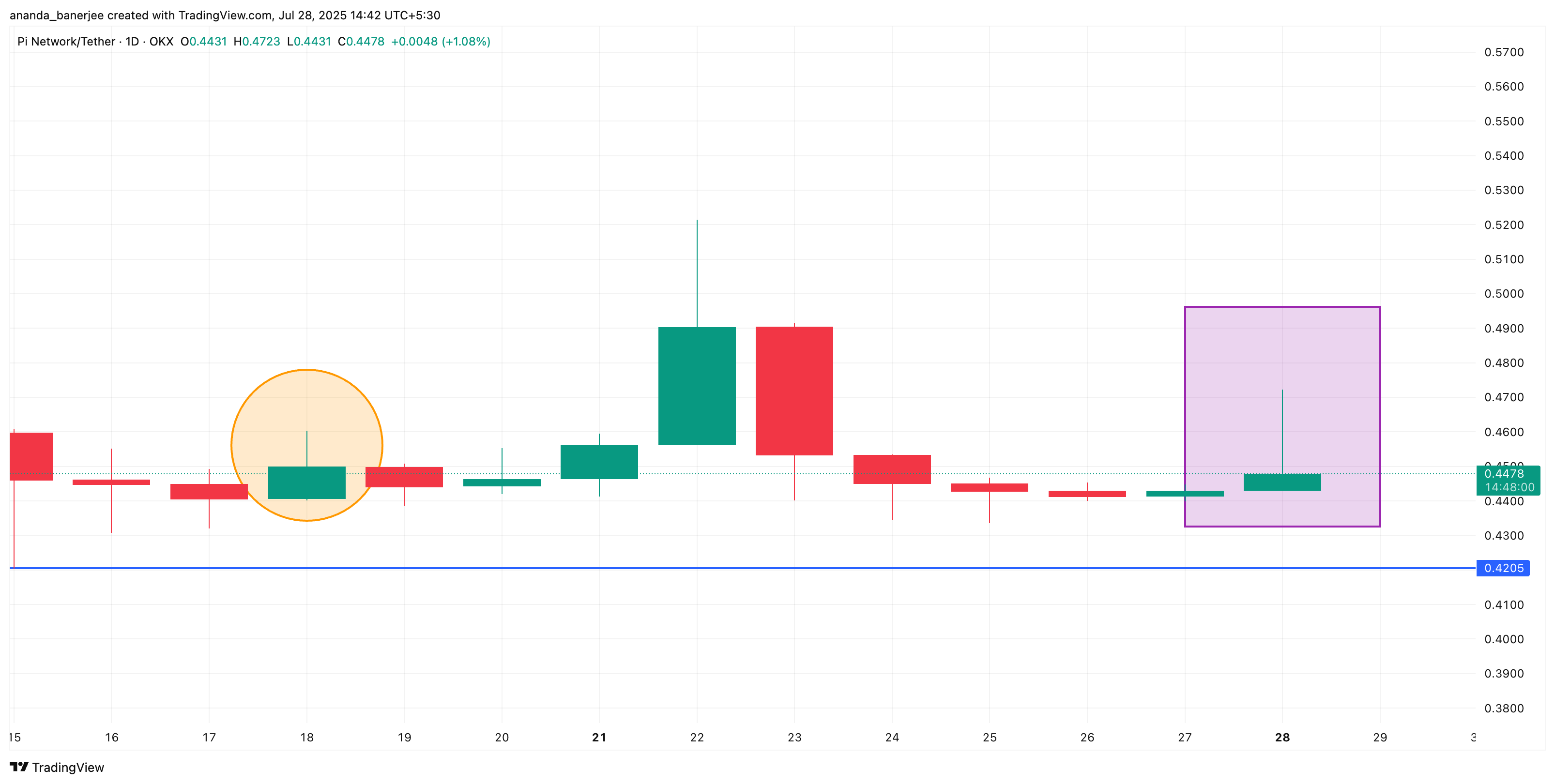

Candle confirmation: the inverted hammer adds weight To the inversion of Pi prices!

The latest Haussier signal comes from a candlestick model. On July 28, Pi Coin printed a green inverted hammer, a candlestick with a small real body near the upper low wick and a long upper wick, suggesting a stranded break or a resistance test. This model generally emerges after a downward trend, referring to a potential optimistic inversion, but only if it is confirmed by a strong follow -up candle.

While the buyers pushed the highly higher prices, they could not keep the gains. However, the closure above the opening (green body) shows a certain intra-day force. What matters now is confirmation: a solid green candle that breaks above the wick. Without that, there is just a potential reversal, not guaranteed.

This is not the first time that Pi has shown this behavior; A similar configuration on July 18 preceded a net rally from $ 0.439 to $ 0.521 in four sessions.

Where does the price of the PI room go from here?

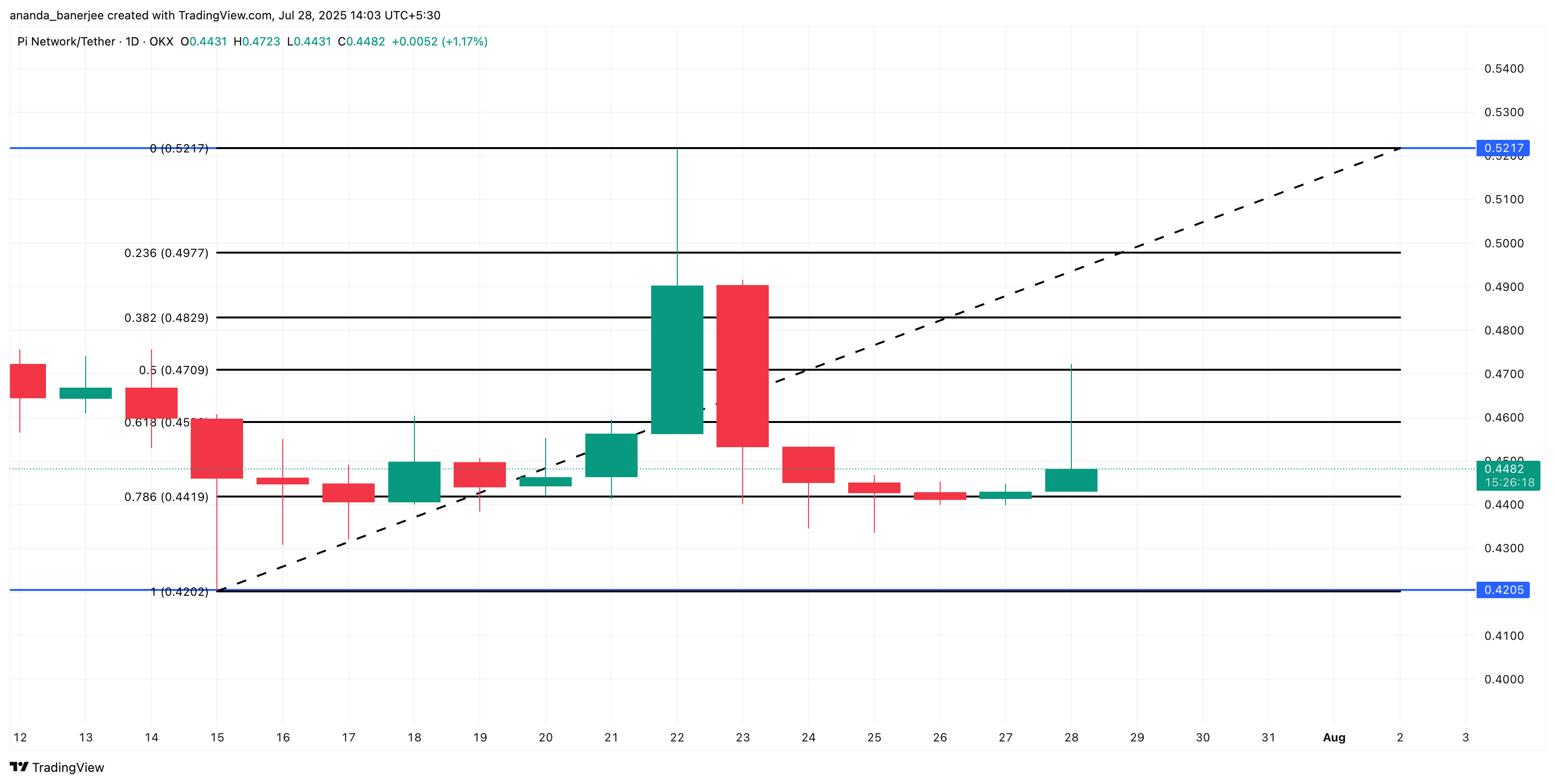

The Haussier trifecta, the upward Revs, the RSI divergence and the inverted hammer point to a potential reversal. But confirmation remains the key. If the price of the PI room exceeds the bar of $ 0.47 (0.5 Fibonacci removal), a retest of $ 0.52 seems plausible.

On the other hand, a fence less than $ 0.44, the FIB extension of 0.786, would invalidate this upward structure. Until then, traders might want to remain vigilant for confirmation before positioning too aggressively.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.