PI IoU Price Drops Before Official Mainnet Launch

PI Network (PI) Iou Price, which represents the pre-commercial evaluation of the IP before its official launch, was very volatile as the anticipation is built. As one of the most publicized crypto launches of all time, the open network of Pi Network should be posted on February 20, which lets users wonder what its actual launch price will be.

Recent technical indicators suggest that the pi iou is at a crucial point, both the strength of the trends and the momentum showing potential signs of weakness. Whether the price breaks down or Metra on stage a solid rebound remains the key question for merchants before the launch of Mainnet.

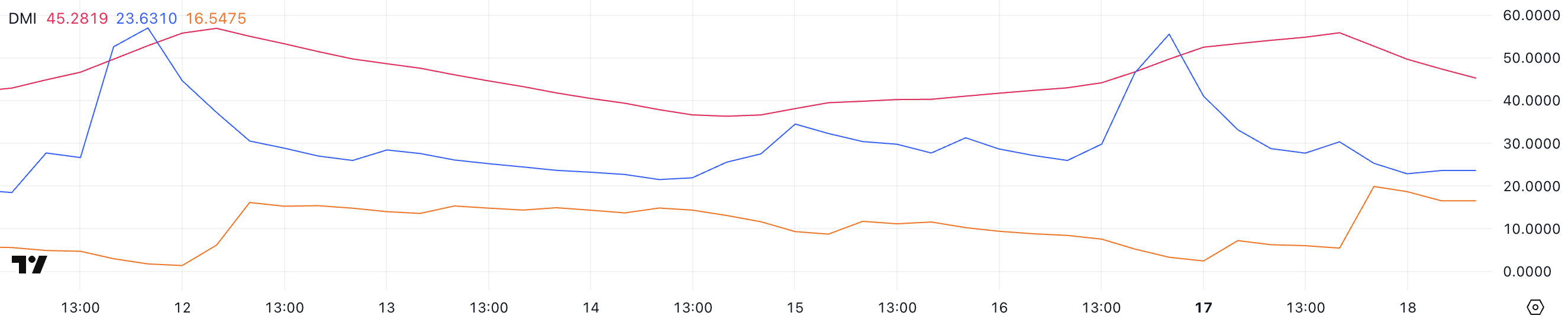

Pi DMI shows a strong downward trend could appear

Pi Network attracts a lot of overhaul before its official launch, its research interest reaching new heights. From a technical point of view, his Table DMI for PI shows his ADX at 45.2, down 55.8 yesterday. ADX (average directional index) measures resistance to trend, with values above 25 indicating a strong trend lower than 20 suggesting weakness.

Reading greater than 50 often points out an overheated trend that could slow down. While the ADX de Pi remains strong, its decline suggests that the trend loses a certain momentum but is still intact.

+ DI went strongly from 55.5 to 23.6, while -Di went from 3.3 to 16.5. This change indicates a weakening of the bullish pressure and a growing downward resistance, which could cause more corrections, although buyers always hold an edge.

The EMA of Pi lines remain in a bullish configuration, with short-term lines above those in the long term, strengthening the wider trend. However, if ADX continues to fall and -Di exceeds + DI, this could point out an inversion or a tendency consolidation to come.

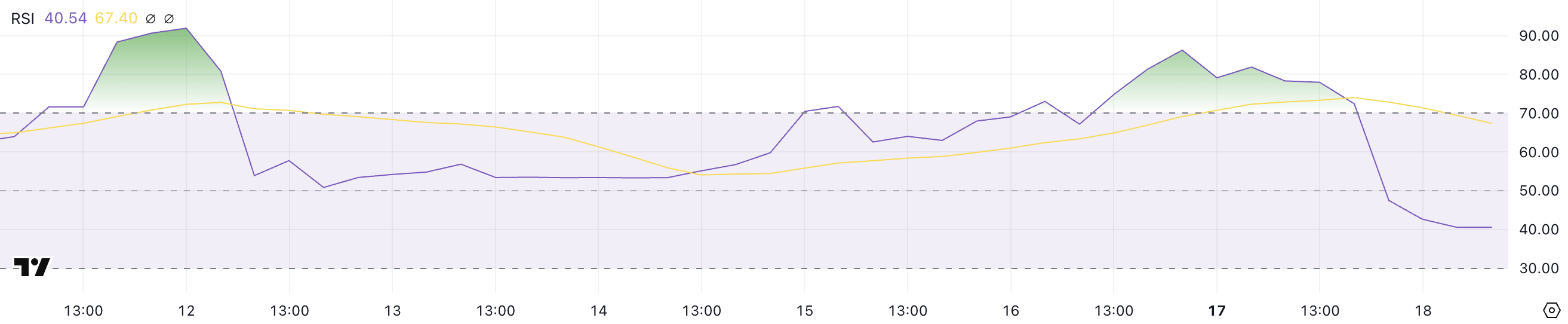

Pi if is broken after touching 86

Pi Network RSI is currently 40.5, from 86.2 two days ago after spending more than a day over 70.

The relative resistance index (RSI) measures the momentum on a scale of 0 to 100, with values greater than 70 indicating surachat conditions and less than 30 suggesting occurrence levels.

A sharp decline as this often indicates a weakening of the purchase pressure and a potential change in the feeling of the market, because certain exchanges, such as the Binance, count on community votes to decide to list the assets.

With RSI de Pi now at 40.5, this suggests that the asset has lost significant bullish momentum but has not yet reached the territory of occurrence. This level implies that sellers control, but the action of the prices remains uncertain.

If RSI continues to drop around 30, this could indicate more the decline, while stabilization around the forties could suggest consolidation before the next movement.

PI-Prix Pi: The current price aligns with the potential launch price

The EMA lines of the PI network remain optimistic, with short -term lines even higher than those in the long term, but they decrease rapidly because the Pi Iou price has dropped by more than 8% in the last 24 hours.

If this downward trend continues, a cross of death could form, a lowering signal which often precedes more.

If a death cross occurs, Pi iou could test the $ 53.3 support and lose this level could send it as low as $ 33.6.

However, if the price bounces, it can target resistance around $ 100, a potential of 38% of current levels.

This is aligned with a recent technical perspective by Beincrypto discussing the possible launch price of the PI network.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.