PI Network Falls to New All-Time Low—Why the Token Could Slide Even Further

The PI price fell to a new hollow of all time of $ 0.39 at the start of the Asian negotiation session on Friday, intensifying the lowering concerns across the market.

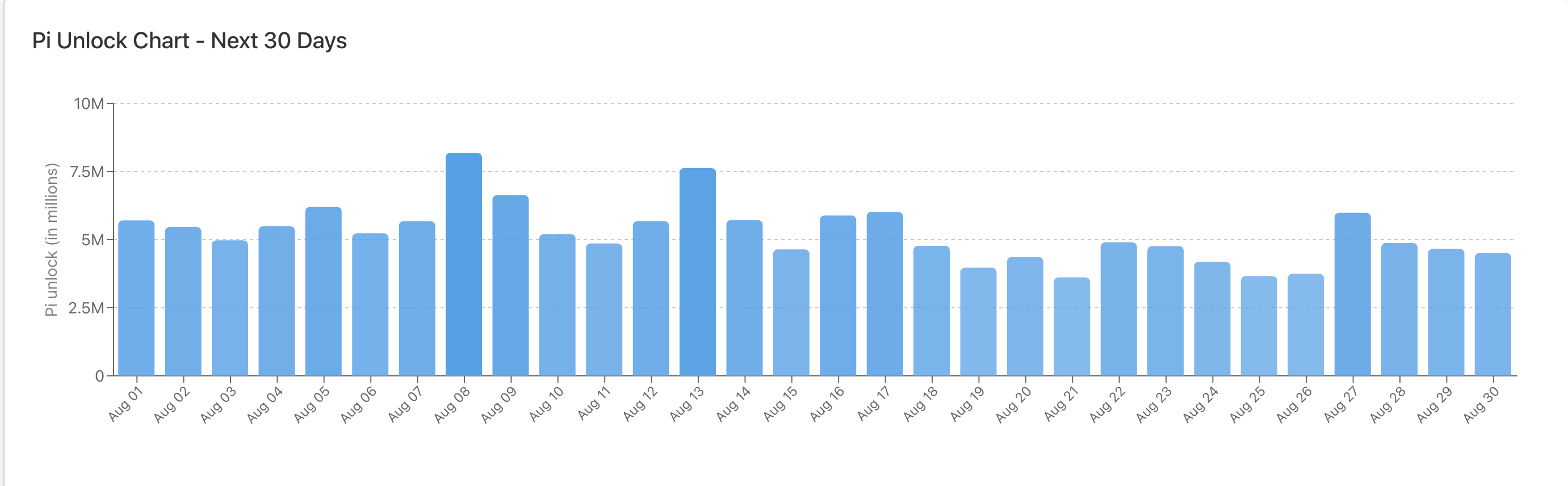

Although it was slightly rebounded to negotiate $ 0.40 at the time of the press, the drop in prices reflects the mounting pressure before the unlocking of 150 million Pi tokens, which will take place over the next 30 days.

150 million Pi tokens to test the market breaking point

According to Piscan data, 150 million tokens, valued at 64 million dollars at current market prices, should be unlocked over the next 30 days.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

The unlocking of large-scale tokens like this exert a significant drop in the prices of cryptographic assets, in particular in low-demand environments. Unless PI demand is a strong and sustained increase, the downward trend in Altcoin can continue or even accelerate.

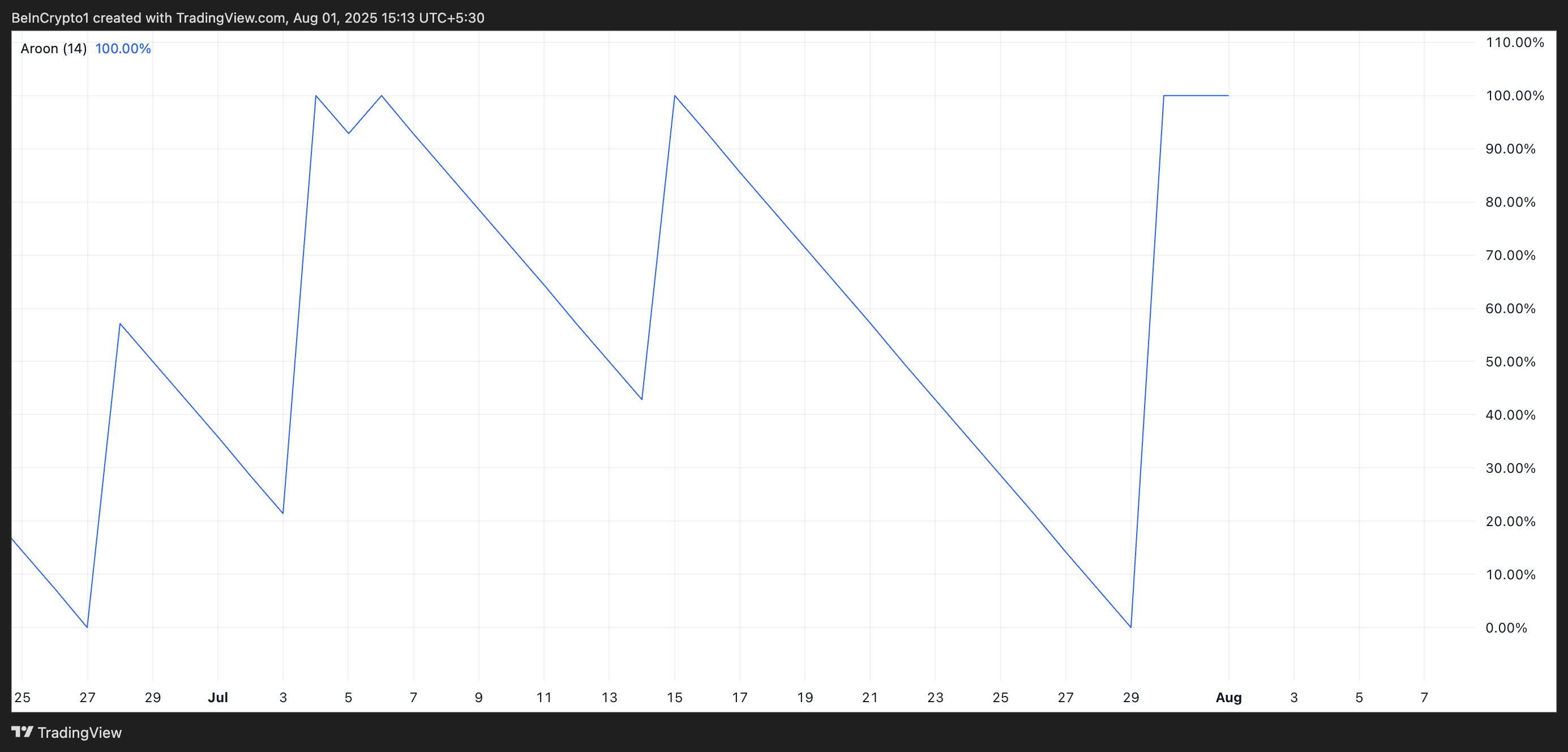

Technical indicators paint an equally dark image. The descending line of Aroon, which measures the strength of recent trends, is currently 100% on the daily PI graphic. This indicates that the decline is sharp and that the sellers control firmly.

The recent recent crossing observed on the indicator of divergence of average convergence of medium pi (MacD) is the recent crossing of the divergence of the divergence of the Mobile Average Convergence (MACD). The readings of the graph of a Pi / USD day show that the MacD (blue) line has crossed under the signal line (orange) during today’s session.

This crossover is a classic confirmation of the changing momentum in favor of the Bears, which suggests that the sale pressure has decisively discouraged any persistent bullish feeling.

Pi slides, but the RSI occurrence can offer a short -term stay

With a release of imminent massive tokens, PI may find it difficult to end up in the bases unless the feeling improves and requires that overvoltages absorb the incoming offer. If the demand remains low, PI could review its $ 0.39 at all times low and decrease more.

However, there is a catch. The PI (RSI) relative force index is 32.02, less from the brand to 30 brands which indicates occurrence conditions.

The RSI indicator measures excessive market conditions and occurs as an asset. It varies between 0 and 100. The values greater than 70 suggest that the asset is overflowed and due for a drop in prices, while the values less than 30 indicate that the assets are occurring and can attend a rebound.

Although this suggests that the lowering momentum remains dominant, a short -term rebound could be on the cards if buyers intervene to defend the current price level. In this case, the PI price could climb to $ 0.46.

The post -i network falls to a new lower of all time – why the token could slide even more first on Beincrypto.