Pi Network Hits All-Time High as Trading Volume Surges

The PI network (PI) has skyrocketed more than 70% in the last 24 hours, proposing its market capitalization to $ 16 billion and its volume to more than $ 2.3 billion in the last 24 hours.

Although it reaches new peaks of all time almost $ 3, this technical divergence suggests a volatile path to come for PI. The merchants are looking closely with the token navigate between the bullish momentum that could lead it around $ 4 and warning panels that could start a decline to support levels as low as $ 1.7, or even $ 0.79.

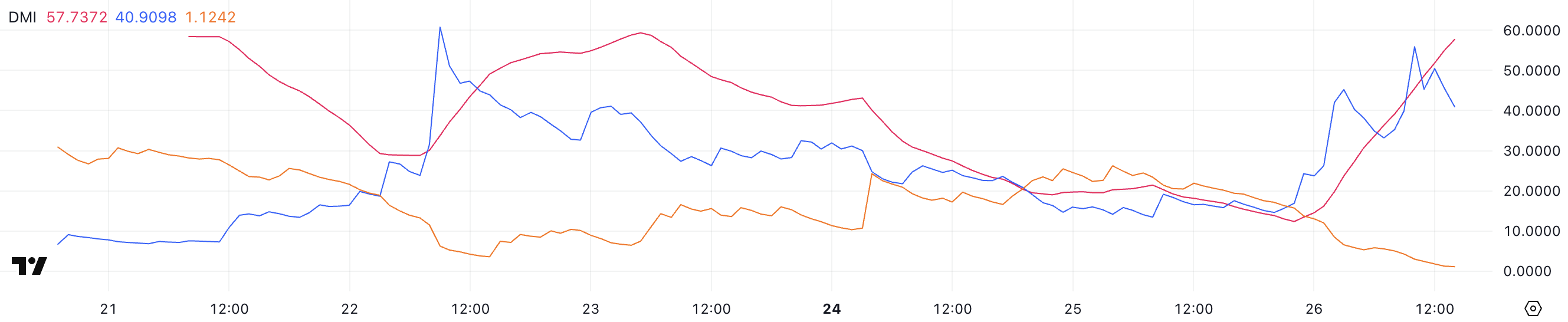

Pi Network DMI shows that the upward trend is very strong

The Directuelle PI Network Movement Index (DMI) displays remarkable momentum, its average directional index (ADX) going to 57.7 against 12.3 only one day.

ADX is a key technical indicator that measures the strength of a trend regardless of its direction. Readings below 20 generally indicate a low trend, 20-40 suggest a moderate trend and values greater than 40 indicate a strong trend.

This spectacular increase in the ADX of PI of a low-to-very strong territory indicates a significant intensification of the force of the underlying trend.

Completing this ADX overvoltage, the PI positive directional indicator (+ DI) climbed high at 40.9 from 14.6 two days ago, while its negative directional indicator (-DI) dropped to 1.1 from 19.4 during the same period.

When + di is significantly higher than -Di, as is currently the case with Pi, it confirms a strong upward trend. The combination of a high ADX value with a large propagation between + DI and -DI suggests that the PI network is experiencing a particularly powerful rise trend with minimum sales pressure.

If these technical signals maintain their current configuration, they could indicate a continuous price of price for the short -term PI, because the market seems to be under a strong purchase control with minimum resistance.

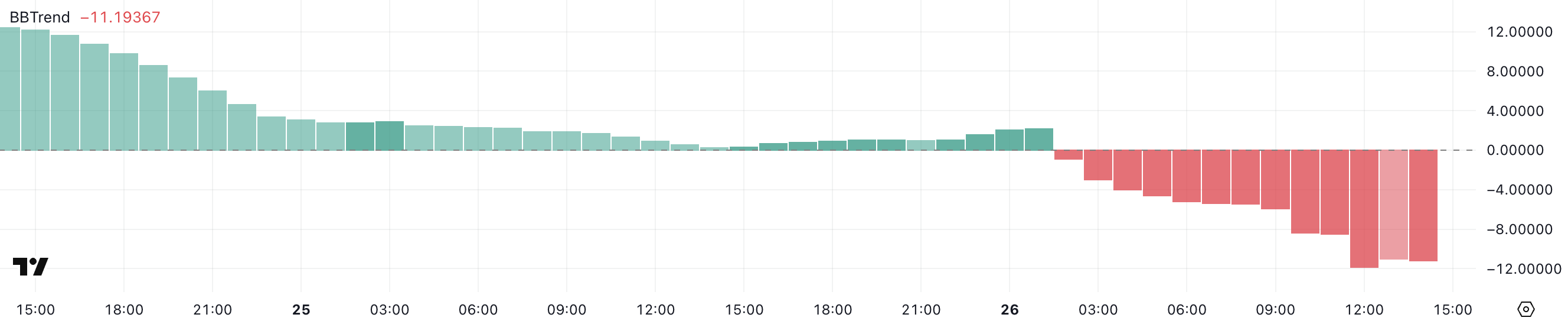

Pi bbtrend is negative despite prices overvoltage

Despite the overvoltage of current prices, the Bollinger de Pi band trend indicator (Bbtrend) dropped to -11, marking a spectacular drop in reading 51.2 three days ago, after having placed between 1 and 3 yesterday.

The BBTREND indicator is a specialized technical tool that measures the price movement compared to Bollinger strips. It essentially quantifies how the price is trendy in these channels based on volatility.

Positive readings indicate an upward price movement compared to the bands, while the negative values suggest a movement down or a reversion to the intermediary.

This sharp drop to -11 in Bbtrend de Pi could point out that the current increase in the increase becomes considerably overexious and potentially vulnerable to a correction or consolidation phase.

When Bbtrend becomes in particular negative after an increase in prices, this often indicates that the asset has evolved too quickly and is now negotiated at levels which can be unbearable in the short term.

This technical warning panel suggests that PI could feel a withdrawal to its Bollinger band from the middle, a period of lateral consolidation, or at least, a deceleration in its momentum upwards.

Can Pi Network reach $ 4 in March?

The price of the PI network has reached new heights of all time there are just hours as its price approached the $ 3 bar for the first time.

With this strong ascending dynamic, PI could potentially continue its ascent, breaking the psychological barrier of $ 3 and testing higher resistance levels at $ 3.5, or even $ 4 in the short term.

This impressive rally demonstrates the growing market interest and the purchase pressure that could maintain the increase more if the positive feeling persists.

However, as indicated by Bbtrend’s negative reading, this rally can be surprised and at risk of inversion. If the downward technical signal materializes in price action, PI could undergo a substantial correction, initially falling to test the support at $ 1.7.

If this level does not hold, the additional decreases at $ 1.42 become likely as the sales pressure intensifies.

In a scenario where a strong downward trend sets in, the PI price could undergo an even more dramatic withdrawal at $ 0.79, which would represent its lowest level in five days and a significant retirement of the current summits.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.