Pi Network (PI) at Risk – Could It Drop Below $1 in March?

The PI network (PI) is down more than 19% in the last seven days, continuing its correction while negotiating below $ 2 since March 1. The sale pressure remains dominant, with indicators such as the DMI and the CMF reporting downward risks.

The EMA of Pi lines also suggest a potential death cross, which could lead to a deeper drop of $ 0.95 if the key support levels are working. However, if the momentum moves and buyers intervenes, PI could try to recover $ 2 and possibly push to new peaks of all time above $ 3.

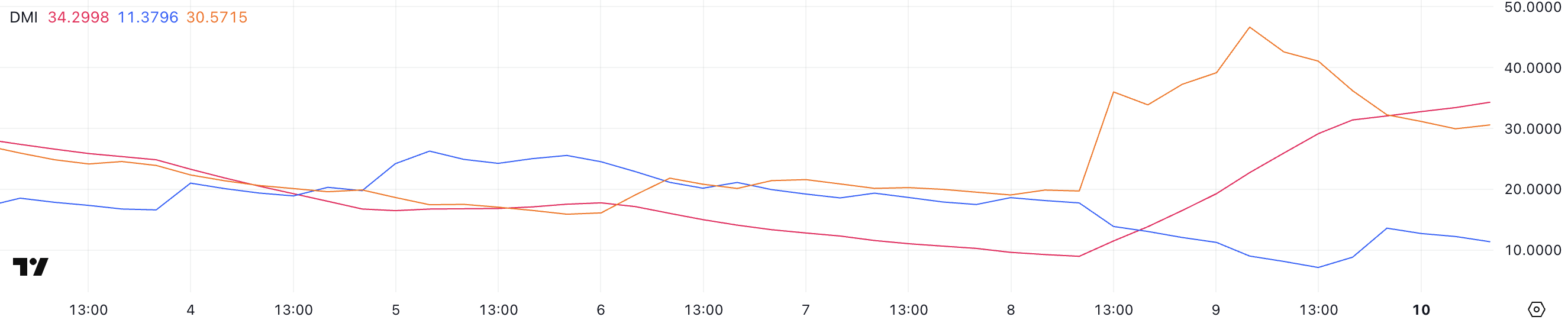

Pi Network DMI shows that sellers are still in control, despite the purchase pressure yesterday

The Pi Directional Movement Index (DMI) shows that its average directional index (ADX) jumped at 34.29, against only 8.97 two days ago.

This strong increase indicates that the current price tendency – whether optimistic or lower – is in force. Given recent volatility, traders look closely if Pi will maintain his momentum or see another change in trendy sense.

ADX measures the strength of a trend on a scale from 0 to 100, with values above 25 indicating a trend strongly and greater than 50 suggesting an extremely strong trend.

Meanwhile, the + DI of PI (positive directional index) was 11.37, against 17.7 two days ago but recovering from 7.14 yesterday. This indicates low -up but slightly improved upward attempts.

At the same time, -Di (negative directional index) is 30.57, against 19.5 two days ago but lower after reaching 46.6 yesterday.

This suggests that if the sales pressure remains dominant, bears can lose a certain momentum, leaving room for potential stabilization or a short -term rebound.

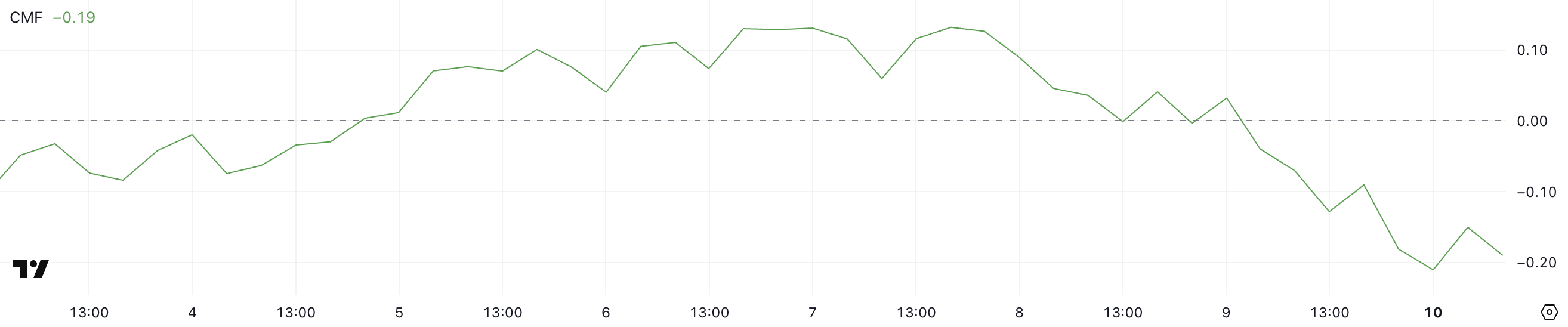

Pi Cmf reaches stockings of all time

Pi Network Chaikin Money Flow (CMF) is currently at -0.19, going from 0.03 barely one day. This sharp decline indicates a significant change in the flow of capital, which suggests that the sales pressure has increased rapidly.

A few hours ago, the CMF of PI reached -0.21, marking its lowest level of all time. This highlights the intensity of recent outings.

The CMF is an indicator that measures the weighted silver flow according to the volume in and outside an asset, ranging from -1 to 1. The positive values indicate a purchase pressure, while the negative values suggest increasing the sale pressure.

With the CMF of PI now at -0.19, near its lowest level, it indicates that the sellers control, which could reduce the price. Unless the purchase activity is coming back, Pi could stay under pressure, fighting to resume the bullish momentum.

Will the Pi network fall below $ 1 in March?

The price of the Pi network is currently negotiated between a key resistance at $ 1.51 and a level of support at $ 1.23, its EMA lines signaling a downward trend. A potential death cross could be formed soon, which could speed up the sale pressure.

If this lowering crossing occurs and pi loses the support of $ 1.23, it could drop more, potentially reaching as low as $ 0.95.

However, if Pi manages to regain an upward trend, it could first test the resistance at $ 1.51, with an escape opening the door for a movement around $ 2.

A stronger rally could push Pi over $ 3 for the first time, making new heights of all time, despite recent criticism from the CEO of Bybit.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.