Pi Network (PI) Surges 11%—Will the Uptrend Hold?

The PI network (PI) is back in the spotlight after a price wave of 11% launched by the withdrawal of more than 86 million OKX tokens, arousing speculation of the compression of the coordinated offer. This decision has intensified bullish feeling, especially since technical indicators are starting to align with price action.

Momentum indicators such as the DMI and EMA suggest an increasing force, and a golden cross -training potential alludes to the possibility of continuous escape. However, not all signals are fully confirmed – measures based on a volume like the CMF show a persistent indecision, which makes the next few days to confirm the management of PI.

Technical indicators support the pi rally in the midst of supply shock speculation

The PI network (PI) jumped 11% after more than 86 million tokens were removed from the OKX Exchange, considerably reducing the PI reserves of the platform to only 21 million.

The sudden exodus of tokens has triggered the speculation of a compression of the coordinated offer, certain investors interpreting the movement as a strategic effort by major holders to limit the supply in circulation and potentially increase the price.

Community voices on X described the event as a “power movement”, emphasizing an increasing confidence in the future trajectory of the asset.

Although this has triggered a bullish momentum and increased Pi at the top of the list of Coingecko trends, questions persist concerning its fundamental long -term principles, in particular its deployment of maintenance, exchange lists and broader development of use cases.

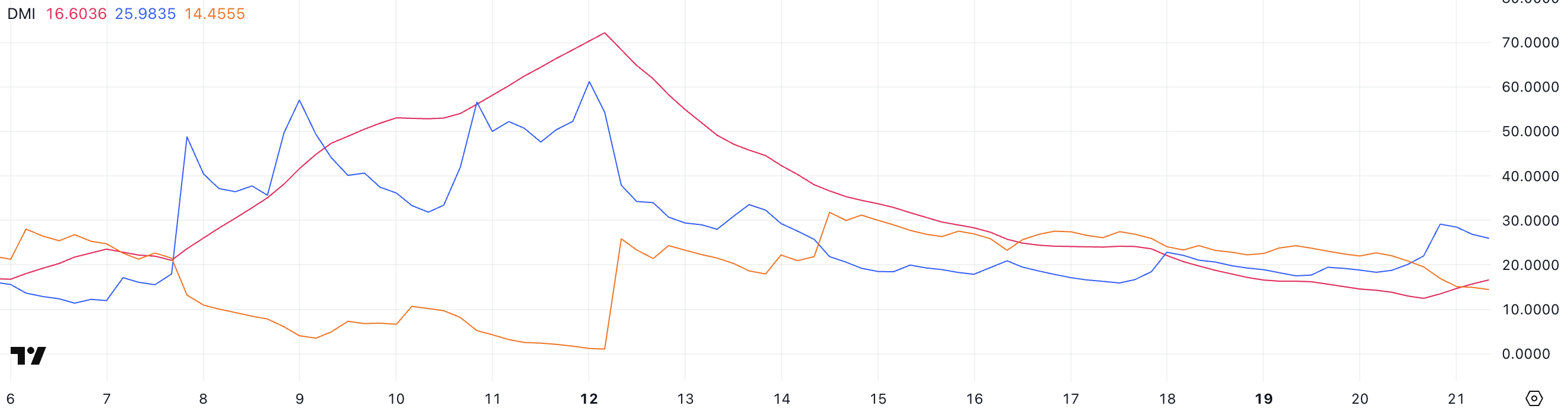

From a technical point of view, the PI (DMI) directional movement index shows signs of increasing force. ADX – a metric that measures the strength of a trend – went from 12.46 to 16.6 in the last day, indicating that the momentum is building. As a rule, ADX values greater than 20 indicate a development trend, the readings above 25 considered to be strong.

Meanwhile, the + DI line, which follows the upward pressure, is 25.98 – up to 20.14 yesterday, although slightly down its peak earlier in the day at 29.15. The -Di, representing the down pressure, fell significantly at 14.45 from 20.84 yesterday.

This divergence suggests that the bulls take control and that the sellers return, supporting the story that the PI network can enter a more decisive trend if this moment continues.

Pi cmf falls after a brief tip, signaling the pressure of purchase of the fall

Despite recent overvoltage, Pi Cmf is now at -0.03.

Chaikin Money Flow (CMF), a volume -based oscillator which measures the purchase and sale of pressure over a given period. CMF values vary from -1 to +1, with readings above 0 suggesting an accumulation (purchase pressure) and less than 0 indicating the distribution (sale pressure).

The closer the value, the more the pressure it reflects.

Currently, the CMF of PI is at -0.03 -a significant improvement compared to -0.17 two days ago, but a decline of +0.09 of yesterday.

This change shows that if the overall sale pressure has released considerably, the recent dive under the zero line suggests that buyers have not fully taken control. A CMF hovering in the neutral area could involve indecision on the market or a break after the recent gathering.

In order for the bulls to resume their momentum, the CMF would ideally need to repel in a positive territory and to hold, confirming sustained capital entries and supporting the file to continue upwards.

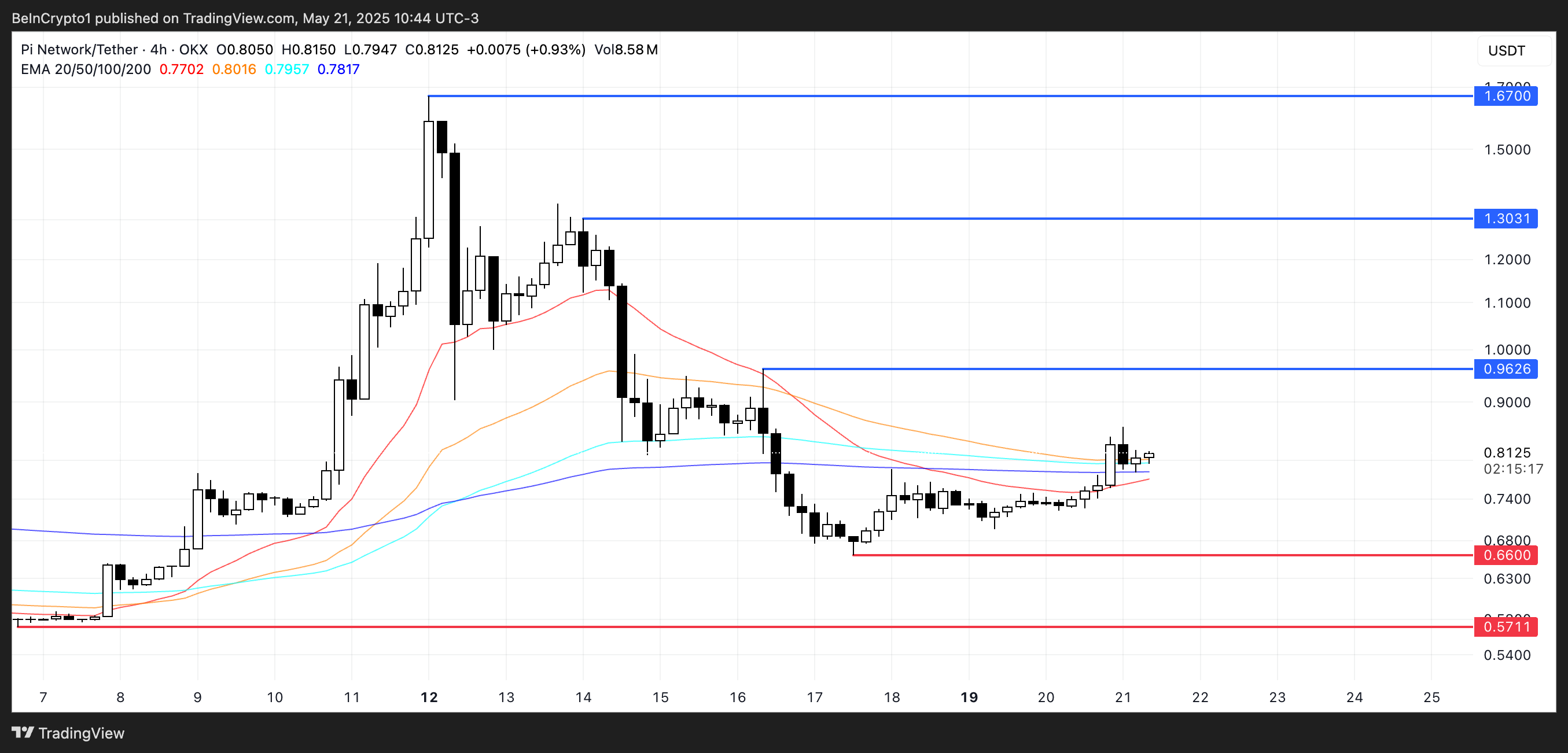

The configuration of Golden Cross is built for PI, but the resistance of the keys still in play

The EMA lines of the PI network are starting to line up in a bullish configuration, with a potential golden cross training on the horizon. A golden cross occurs when a short -term EMA crosses a long -term EMA, signaling the possibility of a sustained positive trend.

If this model confirms, Pi Price could take enough momentum to challenge the resistance at $ 0.96.

An escape above this level can open the door to additional gains to $ 1.30, and with a strong follow -up, the price could even reach $ 1.67 – levels not seen in the recent negotiation activity.

However, the bullish scenario is not guaranteed. If the current upward trend loses steam and the purchase pressure is weakening, the PI network could trace itself to test the support at $ 0.66.

A ventilation lower than this level would probably make the feeling more bearish, exposing the token down around $ 0.57.

While technical signals are looking optimistic for the moment, traders will wait closely if the golden cross materializes and if the resistance levels can be convincingly eliminated.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.