PI Network Price Faces Downward Pressure After Short-Lived Rally

Last week, the Pi token attempted a bullish break, exceeding a descending parallel channel that capped its price for several weeks.

However, the rally was short -lived. Pi failed to keep his earnings and find himself quickly, signaling what now seems to be a manual cat rebound.

Pi faces strong sales pressure

A rebound in dead cats is a temporary short -term recovery in the price of an asset in a prolonged downward trend. This informs traders by thinking that a reversal is underway, only for the price to resume the fall in new stockings.

The escape of Pi looked like a recovery after several weeks of decline. However, the inability to support the rally and the drop that followed confirms that it was a dead cat rebound, with a downward momentum threatening to push its low of all time.

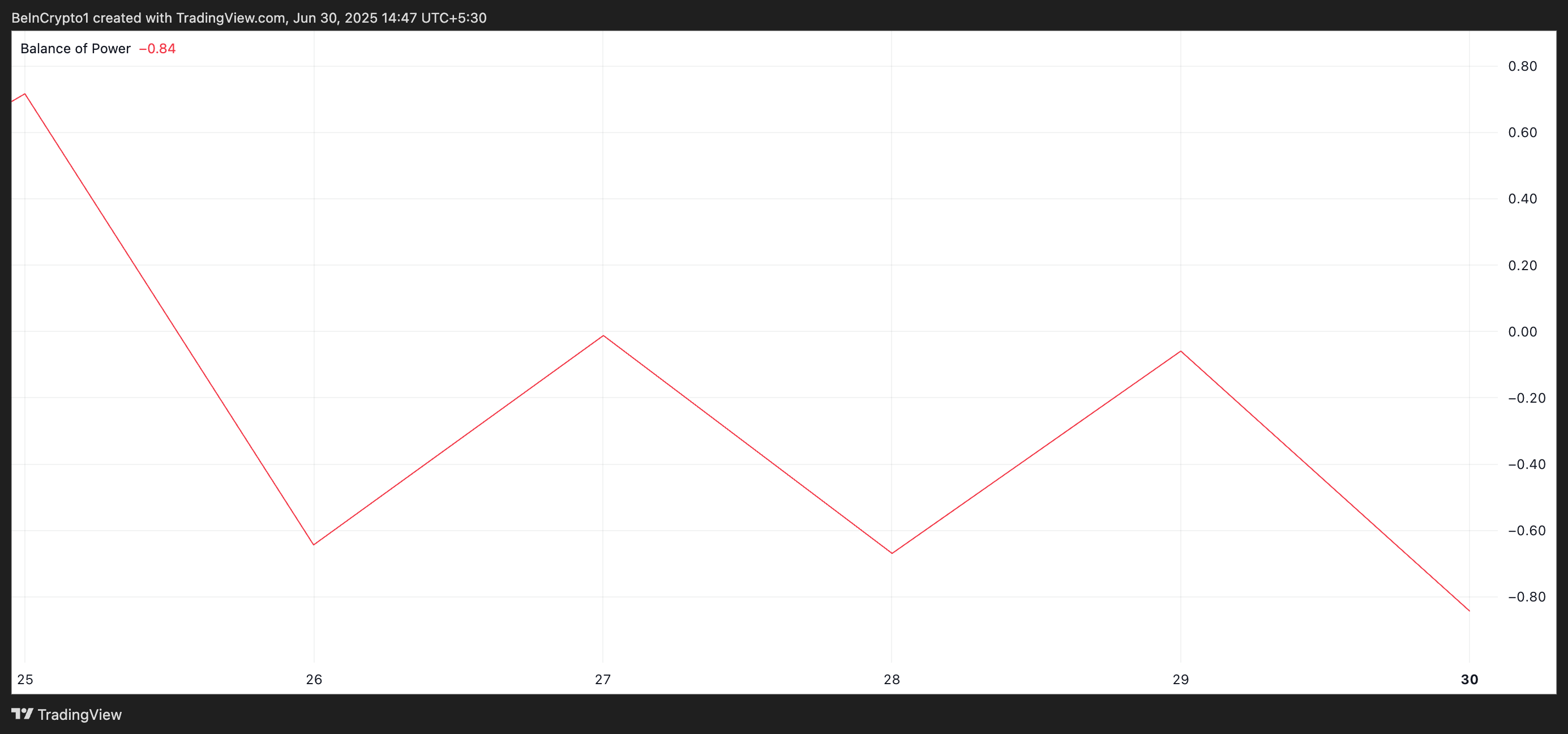

The readings of the PI / USD graph of a day show its balance of powers (BOP) at -0.84, which indicates that the pressure of the sale remains significant.

The BOP indicator measures the strength of buyers compared to the sellers on the market, helping to identify the changes in momentum. When its value is positive, buyers dominate the market on sellers and stimulate more recent price gains.

Conversely, negative BOP readings point out that sellers dominate the market, with little or no resistance to buyers. This confirms the sustained downward pressure and weaken investors’ confidence.

Negative BOP readings to reinforce the lowering perspectives, which suggests that the sales activity could continue unless the new request is resurfacing.

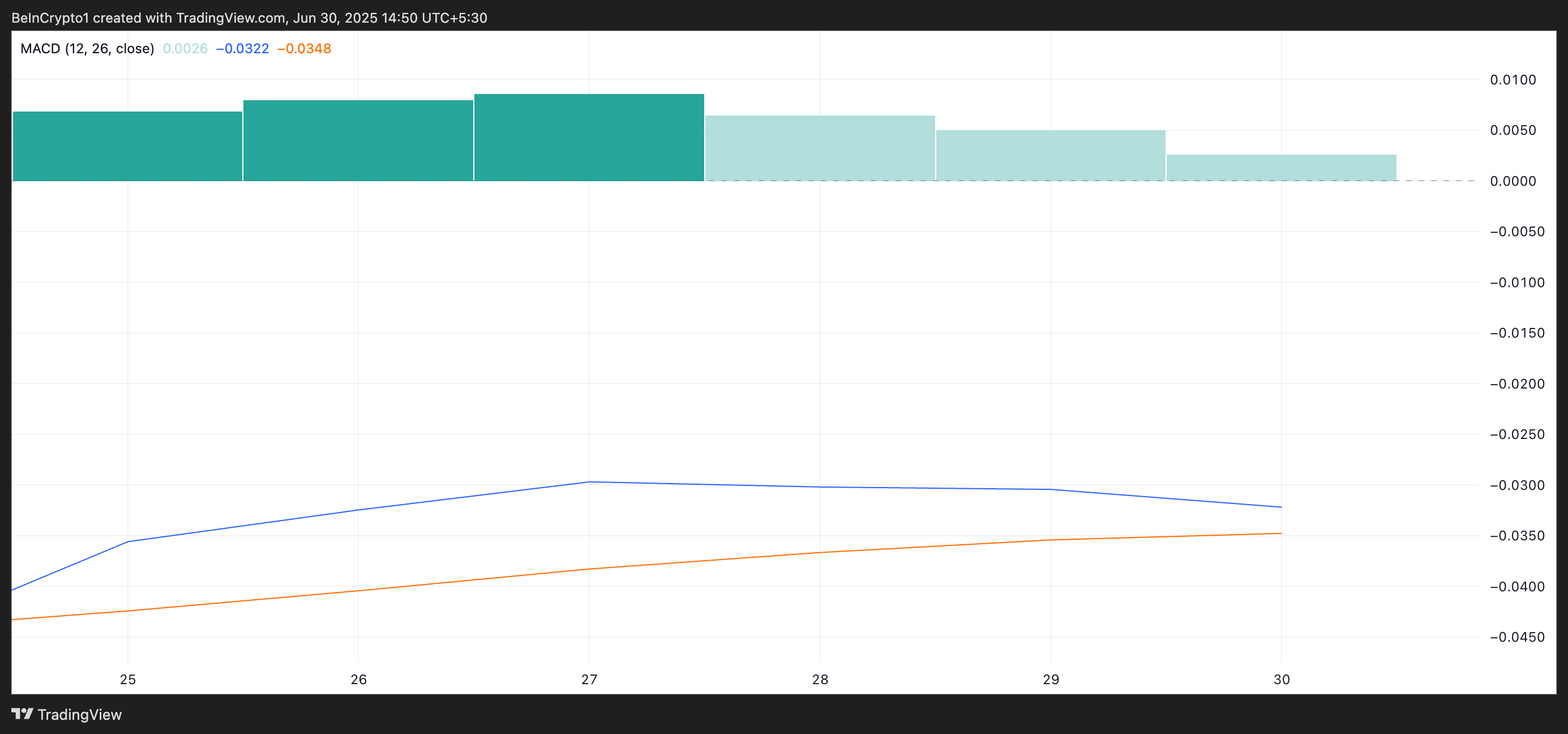

In addition, the indicator of divergence of MOBILE MOBILE (MacD) of PI confirms the lowering bias against the Altcoin. At the time of the press, the MacD line of PI (blue) is based under the signal line (Orange).

The MacD indicator identifies trends and momentum in its price movement. It helps merchants to identify potential purchase or sale signals via crosses between the MACD and the signal lines.

As with Pi, when the MacD line rests under the signal line, this indicates a bullish momentum, suggesting a decreasing purchase activity. Traders see this configuration as a sales signal. Therefore, this could exacerbate the downward pressure on the PI price.

Merchants have a support of $ 0.40 while PI is struggling to hold the ground

If the downstream pressure persists, Pi could slide even more, deepening the losses for the holders who bought last week’s rupture. In this scenario, the value of the Altcoin could revisit its lower $ 0.40.

Conversely, if the feeling of the market moves and the peaks of purchasing activity, the price of PI Network could bring together at $ 0.66.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.