Pi Network Struggles to Reclaim $2 as Selling Pressure Mounts

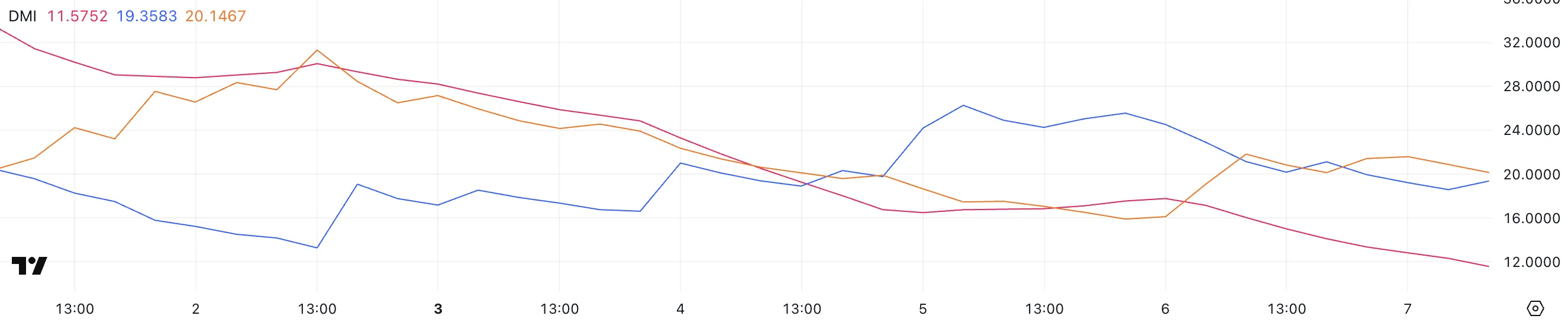

PI Network (PI) consolidated after reaching new heights at the end of February, with technical indicators showing mixed signals. The DMI graph suggests that sellers are trying to maintain control, because the + DI has dropped while the -Di increases, signaling the increase in the bearish momentum.

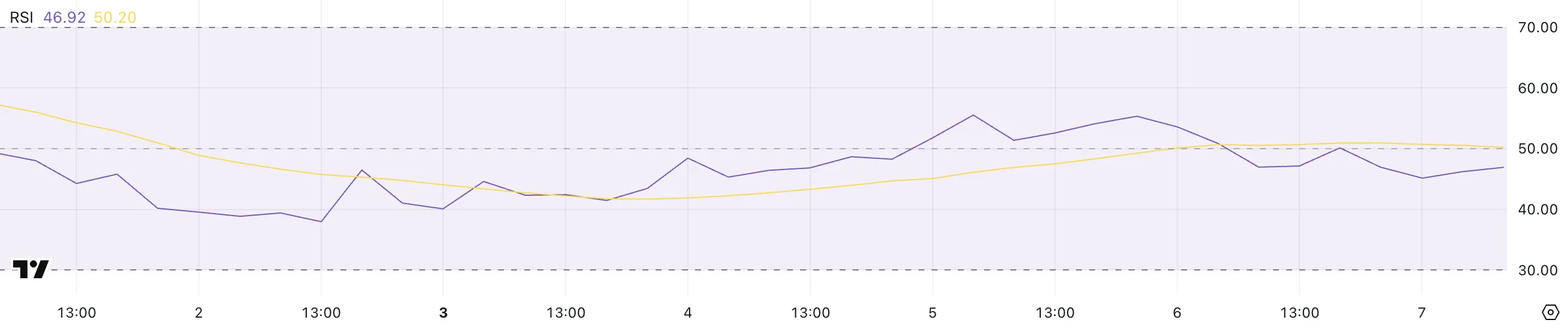

Meanwhile, the RSI remains neutral, fluctuating between 45 and 55, indicating a lack of strong directional movement. If a strong upward trend emerges, PI could exceed $ 2 and potentially test $ 3, but downward risks remain, in particular with the next unlocking 188 million tokens this month.

Pi Network DMI shows that sellers are trying to keep control

The DMI Network Graphic shows that its ADX fell to 11.5, downwards compared to 17.7 the day before.

The average directional index (ADX) measures resistance to trend on a scale from 0 to 100, with values below 20 indicating a low trend and readings above 25 suggesting a strong trend.

An ADX declining suggests that the current trend, whether optimistic or lower, loses momentum and is less likely to continue in the short term.

At the same time, PI + DI fell to 19.3 from 24.5, while -Di went to 20.1 from 16.1. This change indicates that the lowering momentum increases as the sale pressure exceeds the purchase pressure.

If this trend continues, PI could find it difficult to get on an upward momentum and can face a low low price.

For a bullish reversal, + DI should recover domination over -t alongside an increase in ADX, confirming a stronger trend direction.

Pi RSI has been neutral for 8 days

RSI of Pi Network is currently at 46.9, now a neutral position since February 27 and fluctuating between 45 and 55 in the last three days.

The relative resistance index (RSI) is a momentum indicator which measures the speed and extent of price movements on a scale of 0 to 100.

Readings greater than 70 indicate over -racket conditions, suggesting a potential withdrawal, while readings less than 30 signal control conditions, referring to a possible rebound. A neutral RSI between 45 and 55 generally reflects a strong lack of momentum in both directions.

With Pi RSI seated at 46.9, the market seems undecided, lacking in Haussier or lowering dynamics. This suggests that the price of the PI network can remain linked to the beach unless a significant change in purchase or sale pressure occurs.

For a stronger upward perspective, the RSI should exceed 55, reporting an increase in the purchase interest, while a drop below 45 could indicate growing bearish momentum, potentially causing new price reductions.

The play recently exceeded 4 million followers on X, however, the list of binance remains elusive, which could contribute to greater sales pressure.

The PI network could exceed $ 3 if a high increase trend emerges

The PI network was in the consolidation phase in recent days after reaching new heights at the end of February.

Consolidation periods often indicate a temporary break in the price movement as traders assess the following management, with the potential for continuing the previous trend or a reversal.

If the purchase of PI pressure and network yields resumes its upward trend, it could first test resistance to around $ 2. An escape above this level, combined with a strong dynamic, could push Pi to $ 3 and even higher, marking new peaks of all time.

However, if the upward trend does not materialize and pressure pressure, the PI price could enter a corrective phase. In this scenario, the price could decrease around $ 1.51. Its next price movements could be motivated by its unlocking of 188 million tokens, which will take place this month.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.