Pi Network,Pi Crashes 45% After Hype Fades, What’s Next?

Pi Coin plunged 45% after a brief rally fueled by the 2025 consensus announcements, with indicators and a weakening momentum on the chain and a downward perspective unless new catalysts emerge.

Key factory facts:

- Pi Coin is down 45% compared to its recent summit, currently negotiating at $ 0.6984.

- The market capitalization increased by 95% in 5 days, then fell by $ 3.7 billion in 3 days.

- The higher concentration of 100 portfolios increased from 98.76% to less than 5% from May 6 to 16.

- EMAs at $ 0.79 at $ 0.85 turned into resistance, confirming the bearish momentum.

- The analyst’s prospects remain cautiously in the midst of discoloration indicators and failed support.

PI Network (PI) is currently negotiated at $ 0.6,984, down more than 45% compared to its recent $ 1.57 summit with market capitalization now at $ 5.1 billion. From May 8 to 13, PI market capitalization increased from $ 4.5 billion to $ 8.8 billion, dubbing almost five days. But on May 16, it fell to $ 5.1 billion, losing more than $ 3.7 billion in just three days.

This clear drop in the short-term price increase caused by major announcements-including the closure of the central pi node and the launch of a 100 million dollars venture capital fund, both revealed during the 2025 consensus (May 13-14).

Rapid rise and fall show that the PI price always reacts to news rather than regular growth. While the rally has briefly drawn the attention of the market, the rapid drop increased the prudence of traders.

PI / USDT technical analysis: indicators show a low impulse and a lower bias

The rally that started May 8 Pi raised above $ 1, culminating in $ 1.57 on May 13motivated by major news. But the purchase of power has faded just as quickly.

Now Pi is negotiated under the 20, 50, 100 and 200 days EMAS – stacked between $ 0.79 to $ 0.85 – who overturned in the resistance. THE MacD has become lower, the line crossing almost the signal. The histogram, although not yet red, shrinks, signaling the discolorating purchase pressure. THE RSInow 42point towards neutral impulse at the deposit.

THE Volume on the balance sheet (OBV)which reflects the purchase in relation to the sales pressure, fell 12% of its recent summitindicating a slowdown in net accumulation. Resistance is $ 0.79 at $ 0.85.

Pi Coin is now testing key support levels at $ 0.68 and $ 0.59, Which were important price areas before the rally on may 8. Instatead of Moving Sideways in a Range, the Price has dropped from the peak and is now settling where buyers previously stepped in, waiting for MOVE Again.

A fall below $ 0.59 could open the way to $ 0.45. PI network analysis remains cautiously Unless Pi recovers its EMA with a strong volume.

PI on the metric chain: portfolio concentration shift and volume drop

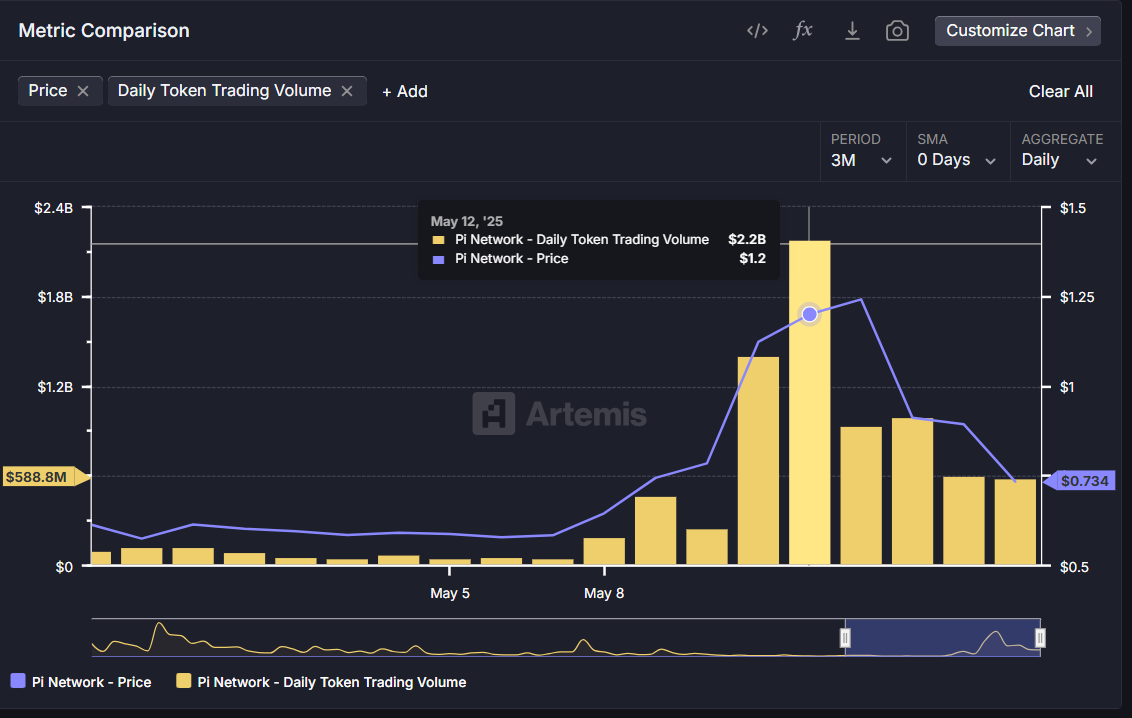

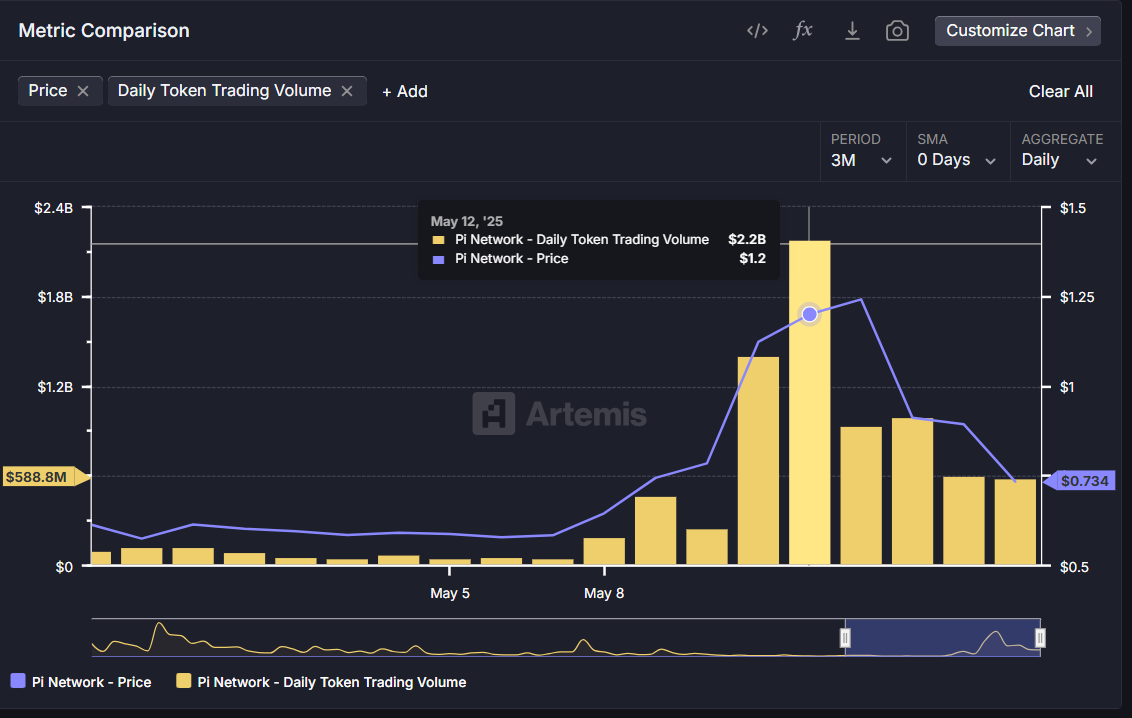

The volume has increased to $ 2.2 billion on May 12Then fell to $ 588 million before May 16down 73%Suggesting a discolored media threshing cycle.

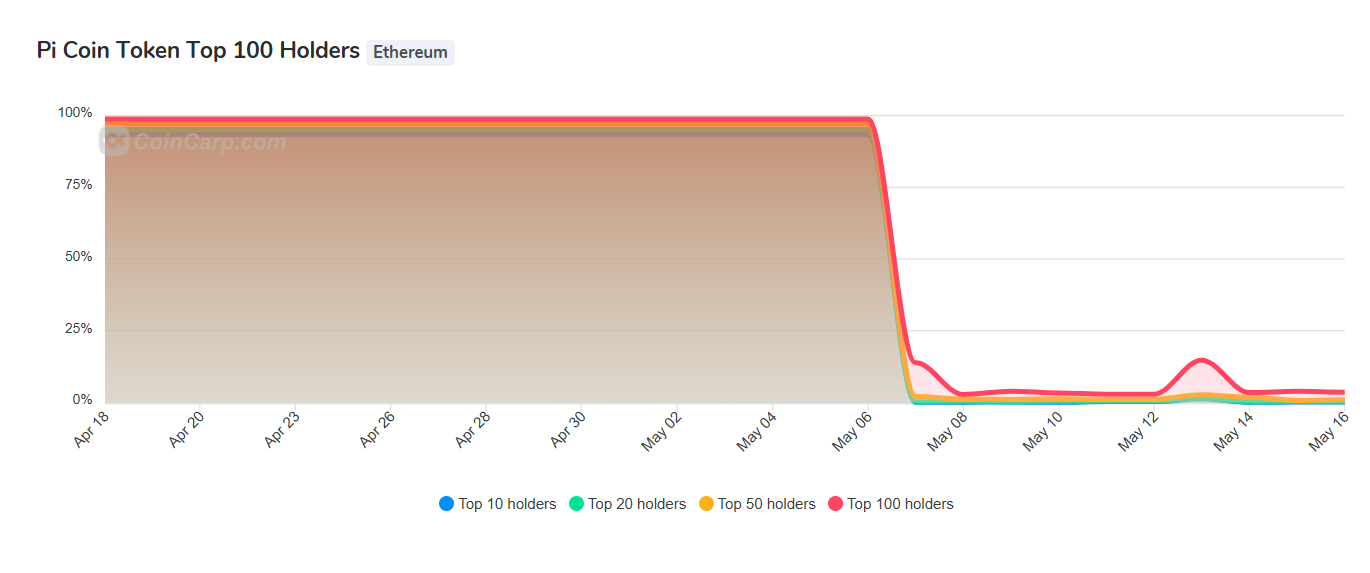

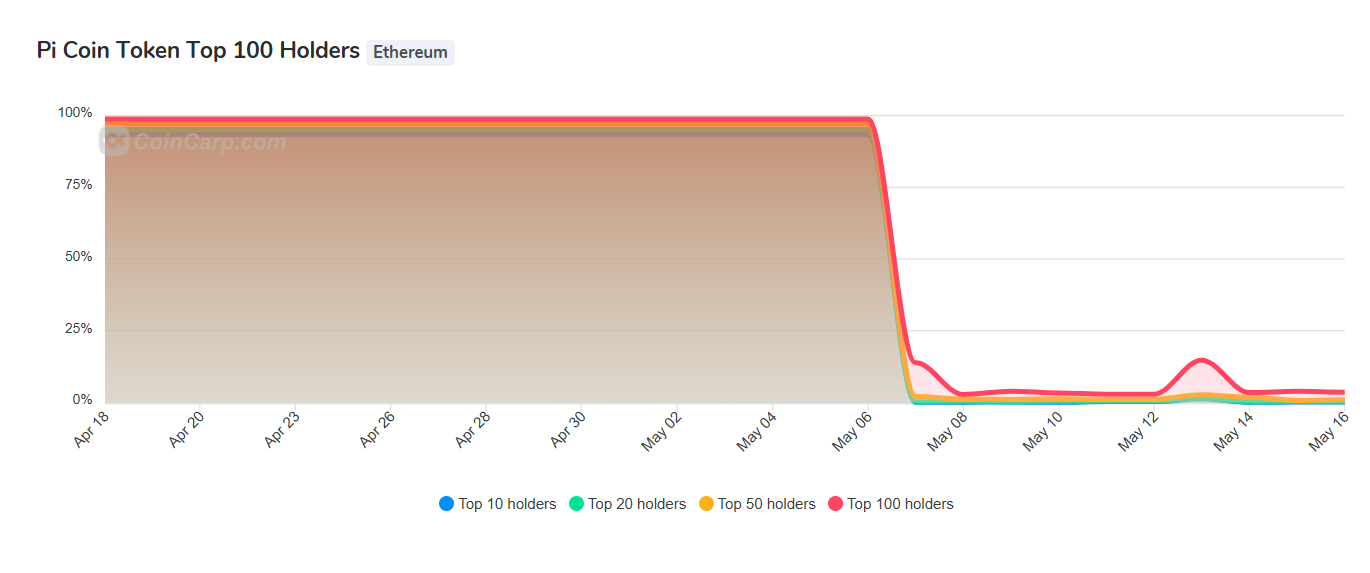

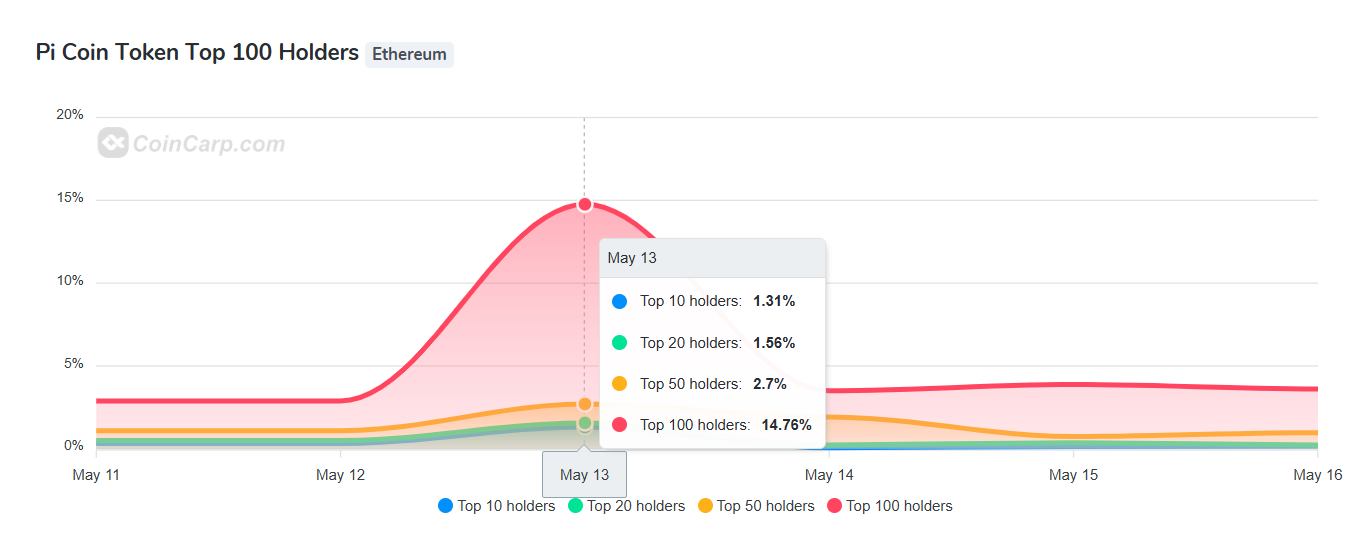

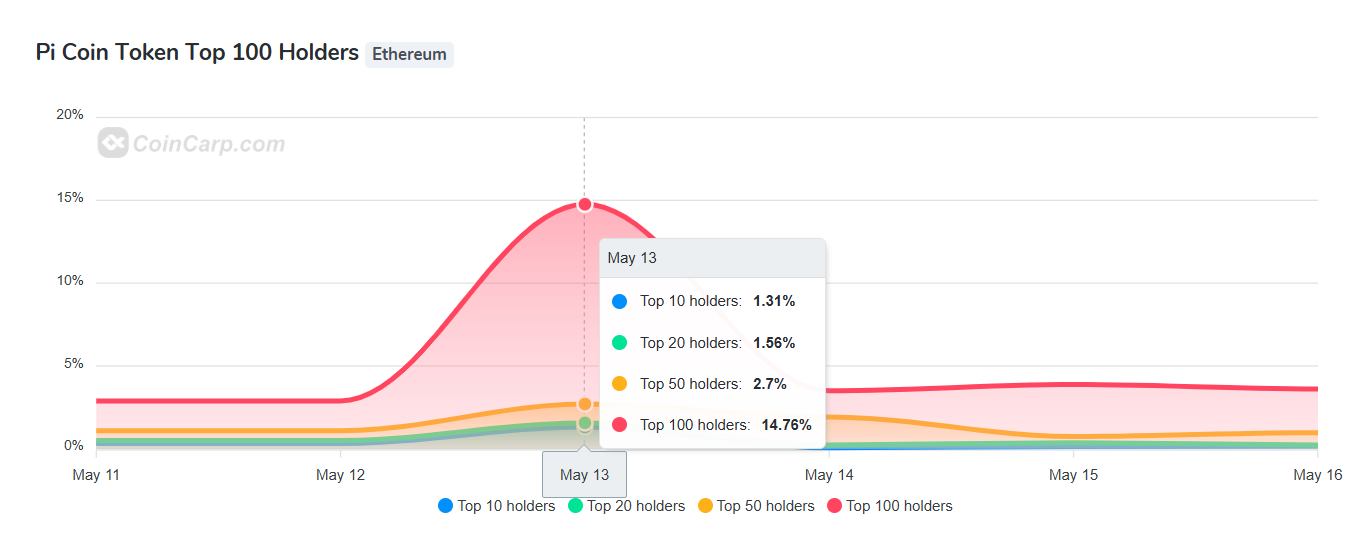

The CoïnCarp graph, which displays the distribution of the portfolio by the ranks of the holders, shows that the Higher wallet concentration suddenly 98.76% May 6 has 14.76% by May 13Before setting up under 5% before May 16.

On May 13 specifically, the 10 best holders just had 1.31%and the top 50 held 2.7%. This dramatic change probably reflects Internal portfolio retouring Rather than the distribution of actual retail sales. Rapid redistribution during the rally aligns with the lower lower technical indicators, showing that the main holders may have made profits during the media threshing phase.

Conclusion: the reactive feeling of events keeps pi volatile corner

The 45% rally of the PI network and the subsequent steep correction were driven by short -lived media threshingespecially announcements made during Consensus 2025 (May 13-14).

This reflects how feeling based on events Always support the Pi price more than fundamental progress. Quick swing to market capitalization – a Has $ 3.7 billion in just three days – reveals how sensitive PI remains in headlines.

In the future, potential catalysts such as a Activation of maintenance Or Adoption of the ecosystem could revive interest. Until then, Pi coin is likely to continue to negotiate on the speculative momentumAnd traders should closely monitor support areas for other attempts to lower or substitution.