PinLink (PIN) Price Jumps 15%, Nears $90 Million Market Cap

The price of Pinlink (PIN) has grown, increasing by 15% in the last 24 hours when it approaches a market capitalization of $ 90 million. The technical indicators have mixed signals, RSI cooling from almost dropped levels while the ADX suggests that the upward trend is always strong but possibly stabilizing.

A recent golden cross in EMA lines indicates that if the bullish momentum continues, the pine could test the resistance at $ 1.17 and potentially push towards $ 1.41 or even $ 2 if AI, Depin and Rwa found a traction. However, if the upward trend loses force, PIN could hold the support at $ 0.70, with a deeper correction up to $ 0.51 still on the table.

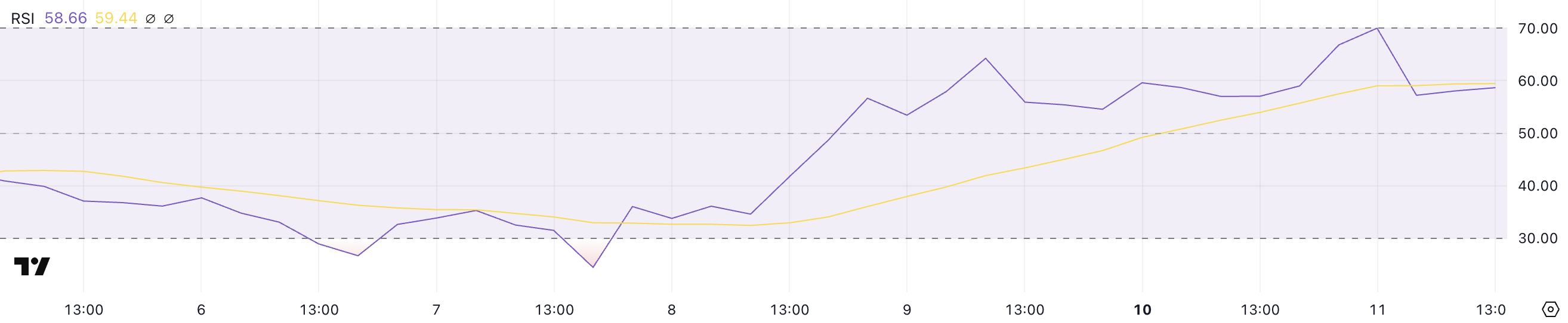

Pinlink RSI is still neutral after having almost touched the Surachat area

Pinlink is defined as the first Rwa-token-token market. It aims to reduce costs for developers of artificial intelligence while allowing new sources of income for owners of deputy assets.

By integrating real world assets (RWA) into decentralized physical infrastructure networks (TPO), Pinlink aims to provide an effective market to developers to access the resources linked to AI at lower costs.

At the same time, asset owners can monetize their infrastructure, creating a more decentralized and profitable ecosystem.

Currently, the PIN RSI is 58.6 after having briefly touched 69.98 a few hours ago, going to only 24.4 four days ago. The relative resistance index (RSI) is an indicator of Momentum which measures if an asset is exaggerated or occurred, ranging from 0 to 100.

Readings greater than 70 suggest over -racket conditions and potential withdrawal, while the values less than 30 indicate the Surolon conditions and the possibility of a rebound.

With the pine RSI which increases sharply in a short time but which is now cooling from the exaggerated territory, he suggests that the purchase of the pressure has been strong but stabilizes now.

If RSI continues to maintain above 50, Pin could maintain upward impulse, but if it decreases more, this may indicate a weakening of demand, increasing the risk of short-term correction.

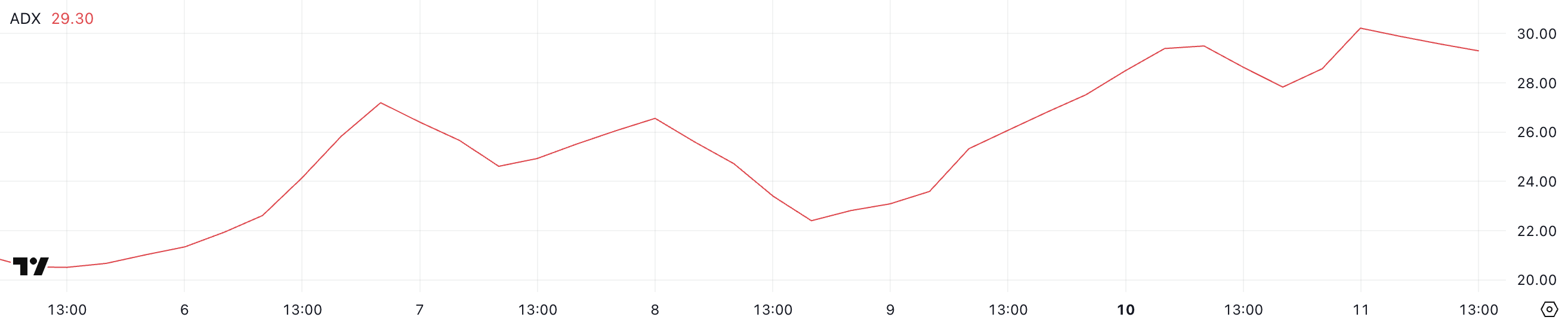

Pin Adx shows that the upward trend is still strong, but could be supported

Pinlink Adx is currently at 29.3, slightly down compared to 30.2 a few hours ago, after reaching 22.4 only three days ago. The average directional index (ADX) is a key indicator used to measure the resistance of a trend rather than its direction.

Readings above 25 generally indicate a strong trend, while values below 20 suggest a moment of low or non -existent trend. An increasing ADX indicates that a trend – whether optimistic or downward – is in force, while a decreased ADX may indicate the momentum of discoloration or potential consolidation.

With Adx de Pin currently at 29.3, the indicator suggests that the upward trend is still in force but can slow down slightly. The recent increase of 22.4 confirms that Pin has established a stronger trend in the past few days, strengthening the bullish momentum.

However, the small decrease of 30.2 could indicate that resistance to the trend stabilizes rather than accelerating.

If Adx remains above 25 and continues to rise, it would confirm that the upward trend of altcoins is gaining ground, but if it begins to decrease around 20, it could point out that the bullish momentum is weakening, leaving to Place for potential consolidation or change on the direction market.

Can Pinlink prices: Pinlink reach $ 2 in February?

The EMA lines of Pinlink indicate a bullish signal, because a short -term mobile average has just crossed another short -term line, forming a golden cross. If this upward trend remains strong, Pin, which is based on Ethereum, could test its next resistance at $ 1.17, and an escape above this level could push the price to $ 1.41.

In addition, if the accounts around AI, Depin and RWA take up the momentum, Pinlink could benefit from a renewal of market interests, which has potentially led its price to the $ 2 mark.

Learning, if Pin does not support its current bullish momentum and the trend is reversed, it could face a retain for the level of support of $ 0.70.

A break below this level could speed up the sales pressure, resulting in a deeper drop of $ 0.51 – a potential correction of 50% compared to current levels.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.