Why Bitcoin Miners Are Winning Right Now

The mining difficulty of Bitcoin reached a summit of 127.6 Billions in August 2025. This decision reflects a continuous expansion of the power of global calculation, securing the network.

However, despite the increased technical challenge, the profitability of minors climbs quietly, a rare dynamic analyst could point out a new phase of the Bitcoin market cycle (BTC).

The difficulty of bitcoin extraction reaches a high record

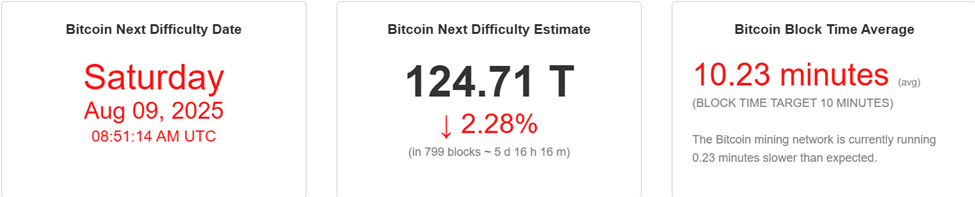

The next mining difficulty adjustment scheduled for August 9, should slightly drop the metric to around 124.71 Billions.

This adjustment aims to bring back the average block time to the 10 -minute target, down compared to the current 10 minutes and 23 seconds.

These periodic recalibrations are fundamental for Bitcoin design. They maintain the coherent emission and the stability of the network despite fluctuations in the hash rate.

The anomaly, however, is that the difficulty in the higher bitcoin extraction has not resulted in pressed margins for minors.

In contrast, the network data showing the revenues of minors reached a post-rewarded peak of $ 52.63 million per Exhash per day.

“The turnover of bitcoin minors per day is at a current level of 52.63 million, against 56.35 m yesterday and against 25.64 m a year ago. This is a change of -6.61% compared to yesterday and 105.3% compared to a year ago, “said Ychart.com analysts.

This is a strong signal, given the increase in energy costs and increasingly competitive mining.

In a recent article, Blockware Intelligence, a Bitcoin mining analysis company, underlined this divergence.

“The case of bull for Bitcoin? BTC / USD exploitation increasing faster than mining difficulties. In the past 12 months:> BTC / USD + 75%> Mining difficulty: + 53%. Beneficiary margins for bitcoin minors increase,” said the firm in a recent article.

The growing beneficiary margins indicate a bullish change

Historically, such a dynamic, where the price of bitcoin increases faster than the mining difficulty, occurred during the first stages of the bull market cycles. Similar models were observed in 2016 and again in mid-2010, which preceded the main price rallies.

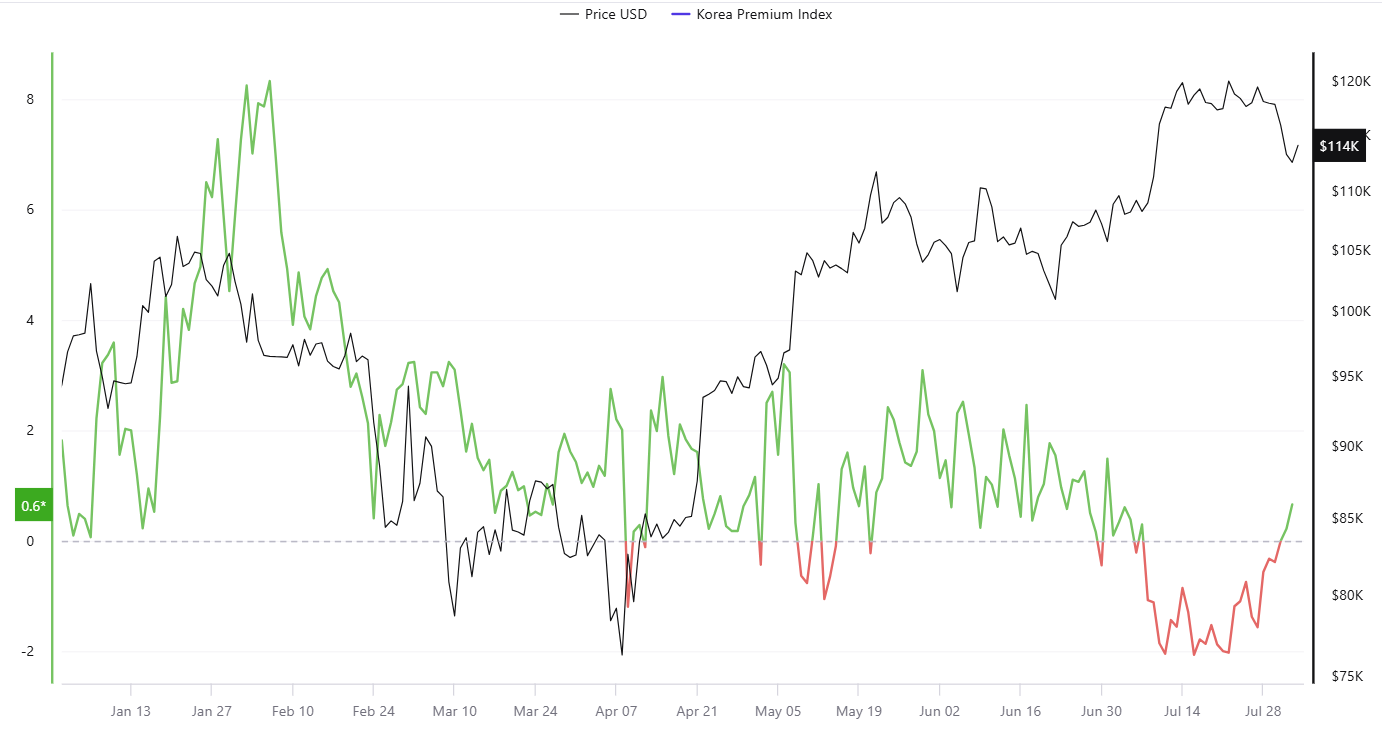

The growing profitability also reflects a more in -depth dynamic of demand, the data showing that the present Kimchi premium in South Korea is + 0.6%. In particular, this indicates a strong regional appetite for BTC.

Kimchi Premium represents the price difference between local exchanges and global spactive markets.

This, associated with the deployment of more effective ASIC machines and the rise in institutional mining investments, suggests that the mining sector is both healthy and optimistic about the medium -term trajectory of Bitcoin.

Beyond the margins of minors, the story of the shortage of Bitcoin remains intact. With more than 94% of the total of 21 million BTC already extracted, the stock / flow of pioneer cryptography ratio now amounts to around 120, double that of gold.

This long -term rarity positions Bitcoin as a cover against inflation and monetary release, even if the short -term price action remains moderate.

However, the wider market has not yet evaluated the basic principles of the fundamentals for improving the network. After the summits of July, Bitcoin is recovering at levels below $ 115,000, reporting a temporary decoupling between chain technical health and the feeling of investors.

Analysts attribute this disconnection to macroeconomic opposite winds, trade policies and changing capital flows. Meanwhile, minors seem to be at the top of the rest of the market.

The combination of increasing difficulties, the increase in margins and strong regional demand could mark a turning point in the mining economy and the wider cycle of Bitcoin. If history rhymes, the growing force of the network could soon echo a price.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.