Pump.fun Token Buyback Fuels Price Surge

The wave of buyout shakes the cryptography market, and Pump.fun, one of the hottest names in recent months, has officially joined the trend.

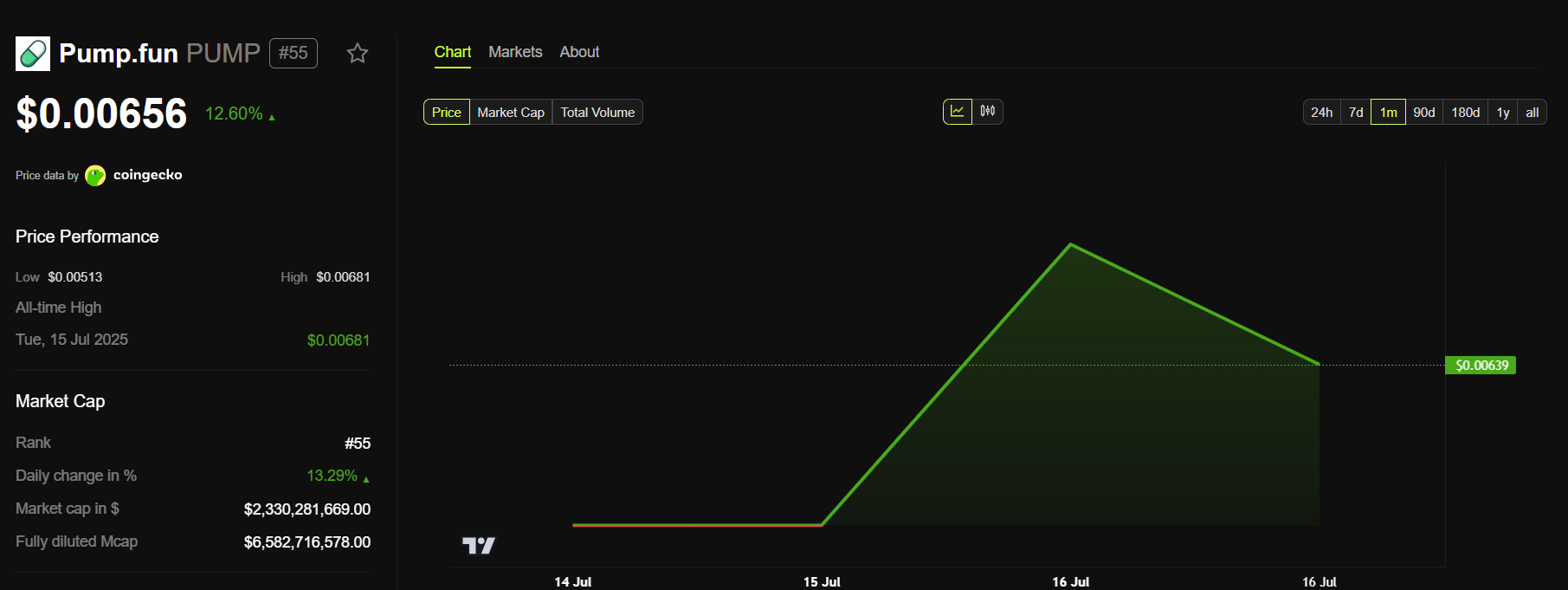

With a price increase of 15% in the last 24 hours and a transfer of $ 18 million to its buyout address, Pump attracts the growing attention of investors. But does this rally reflect a real recovery momentum or simply a temporary psychological reaction before a bubble has fun?

Does Pump.fun try to build real use for his token?

Following his recently successful ICO, Pump.fun was more and moreConsisted by the cryptographic community. Many consider the evaluation of $ 4 billion in the project as too inflated. This concern comes from the lack of usefulness of the pump token, governance mechanisms or income sharing functions within its ecosystem.

However, recent chain data have shown that Pump.Fun has transferred $ 18 million to a dedicated buyout portfolio.

According to Embercn, the platform used transaction costs to accumulate and buy 3.04 billion pump tokens. This decision immediately sparked a positive market reaction, increasing the price of the pump by more than 15%.

At the time of writing this document, Pump exchanged hands at $ 0.00,656, up 12% in the last 24 hours.

Affairs are a financial strategy widely used in traditional and cryptographic markets to reduce the supply in circulation, thus creating prices upwards. For projects like Pump.Fun, buyouts also serve as a strong marketing signal, helping to increase the confidence of short -term investors.

However, there are still doubts surrounding this movement to buy the project.

“Pumpfun sold tokens at $ 0.004 a few days ago and rachets now these same tokens with the same money for $ 0.006. The crypto is not a serious industry,” said a X user.

Pump.fun is not the only project to jump on the buyout. Other platforms such as Fet, Aave, Iost and Polyhedra (ZKJ) have also recently announced token buyout plans, some people committing tens of millions of dollars.

However, sudden price jumps and the main capital deployments do not necessarily equate the reinforced intrinsic value. Price increases drawn by redemptions – without solid technological fundamentals or clear advantages for tokens holders – can lead to artificial rallies vulnerable to net corrections if changes in market feelings.

In addition, pump. The pleasure still works largely in the segments of coins and prevented, which are known for high speculation and limited transparency.

In conclusion, redemptions can be an effective short -term tool, but added value could quickly evaporate without long -term and real useful roadmap.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.