PUMP Underperforms Despite Pump.fun’s Buyback and Liquidity Program

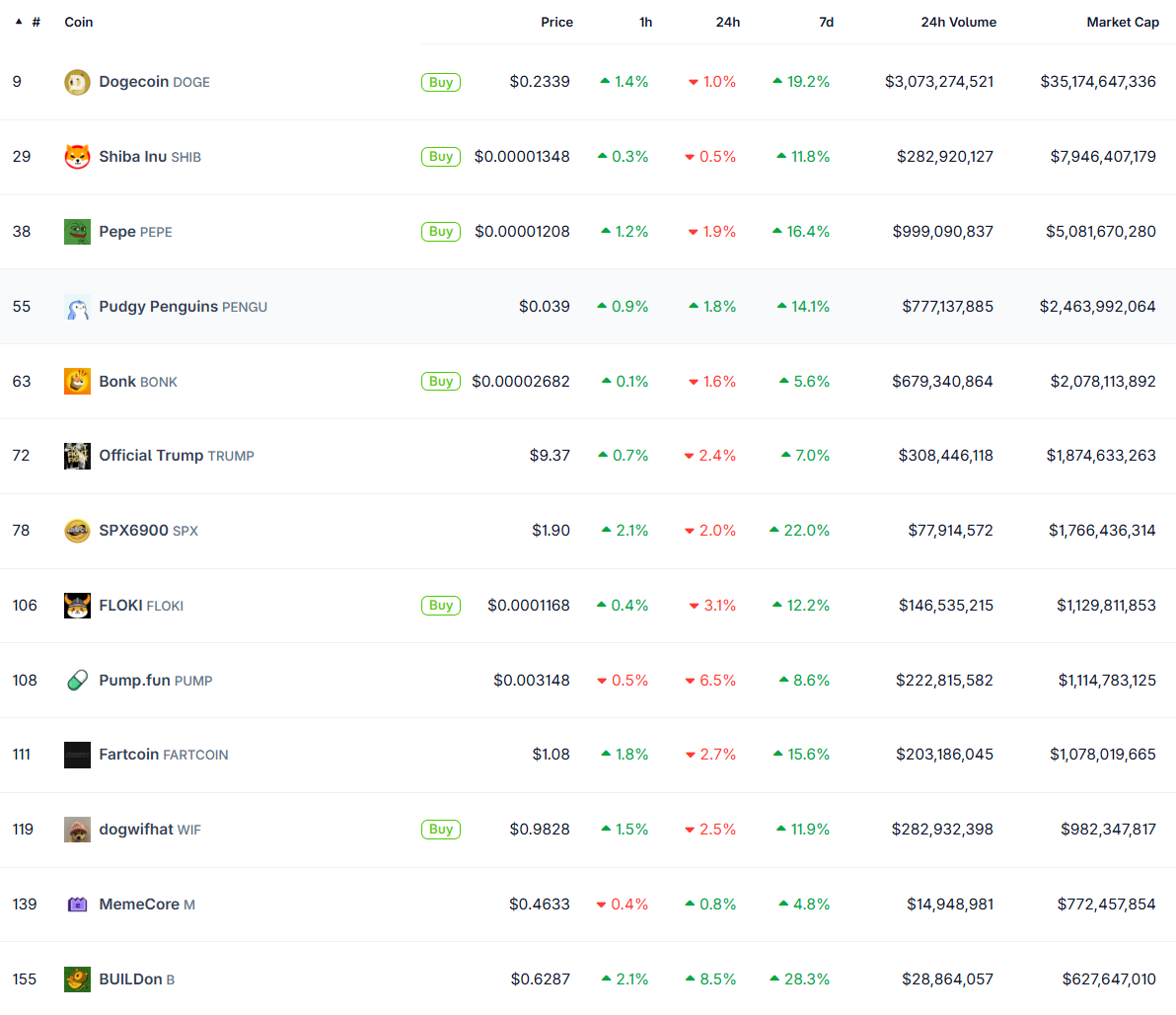

The pump, the native token of the Launchpad Pump. Fun native, has slipped another 6% in the last 24 hours, effectively underperforming compared to other coins.

With solara memeas of meters with periodic thicker cycles, sustained attention and capital injection could give the pump.

Pump.fun to support organic and active communities

Pump.fun introduced the Glass Full Foundation (GFF), a liquidity support program designed to inject significant capital into coins projects in its orbit.

According to the team, this decision is part of a wider mission to extend the Solana ecosystem and feed its purest and hard cults.

With GFF presenting itself as a vehicle to accelerate the most organic, active and promising communities of the platform, the Launchpad will allocate the funds directly to the ecosystem tokens. This means providing liquidity to ensure healthier market activity and greater investor confidence.

“The Foundation has already started with several projects receiving initial support and will continue to deploy capital,” said Pump.Fun in his article on X (formerly Twitter).

Liquidity remains essential for the survival and growth of memes to smaller capitalization. GFF aims to reduce the volatility of these tokens by directly injecting the funds into ecosystem tokens.

This decision could also reduce close differences and give projects more track to develop their communities.

While Glass Full Foundation represents a daring commitment to feed the ecosystem of the pump.

The price of the pump increased by a modest 0.8% in the last 24 hours and was negotiated at $ 0.00,33,364 at the time of writing this article. Coindecko data show that the memes part underperform compared to its peers in the sector.

The lukewarm reaction highlights the prudence of investors in a volatile sector of coins. He follows days of anticipation in the Pump community after Alon Cohen, the founder of Launchpad, promised a big announcement.

After the announcement, whale interactions with the pump fueled a 15% increase in the price of the token.

Pump.fun draws $ 12 million canon of token buyout

Many investors expected the revelation to trigger another step in the price of the token, given the objective of the initiative to support liquidity and purchasing power.

Although the initiative can have long -term advantages, short -term traders are looking for a more direct price catalyst, such as a major exchange list, token burn or publications.

“Is it an air card?” wrote Abhi, a popular user on X.

Pump.fun gives them better by using a token repurchase, a bullish catalyst that often strengthens demand by reducing supply.

Arkham Intelligence says that Pump.fun buys more than $ 5 million in pumps. According to the blockchain analysis firm, this marks a subsequent purchase after a precedent of almost $ 7 million, with partial assets stored on Squads Vault.

“It is not only the purchase of the pressure, it is a complete feedback loop, the pumping pump pumps the fire,” said a user.

Some users consider these initiatives to be the push of the network to secure its market share in the parts of players even against players like Bonk.

The underperform post-pump despite the PUMP redemption and liquidity program. The buyout and liquidity program appeared first on Beincrypto.