Dogecoin Price Stuck Under $0.20

Dogecoin (Doge) was hardly hit by selling pressure, lowering 15% last week when she has trouble finding support. Technical indicators continue to show a strong downward trend.

If the decline persists, DOGE could soon test the support at $ 0.142, and a break below this level could push it less than $ 0.14 for the first time since October 2024. However, if the Batfourage of the part even resurfaces and the purchase pressure yields, DOGE could attempt a recovery of the main resistance levels at $ 0.19 and $ 0.22 potential.

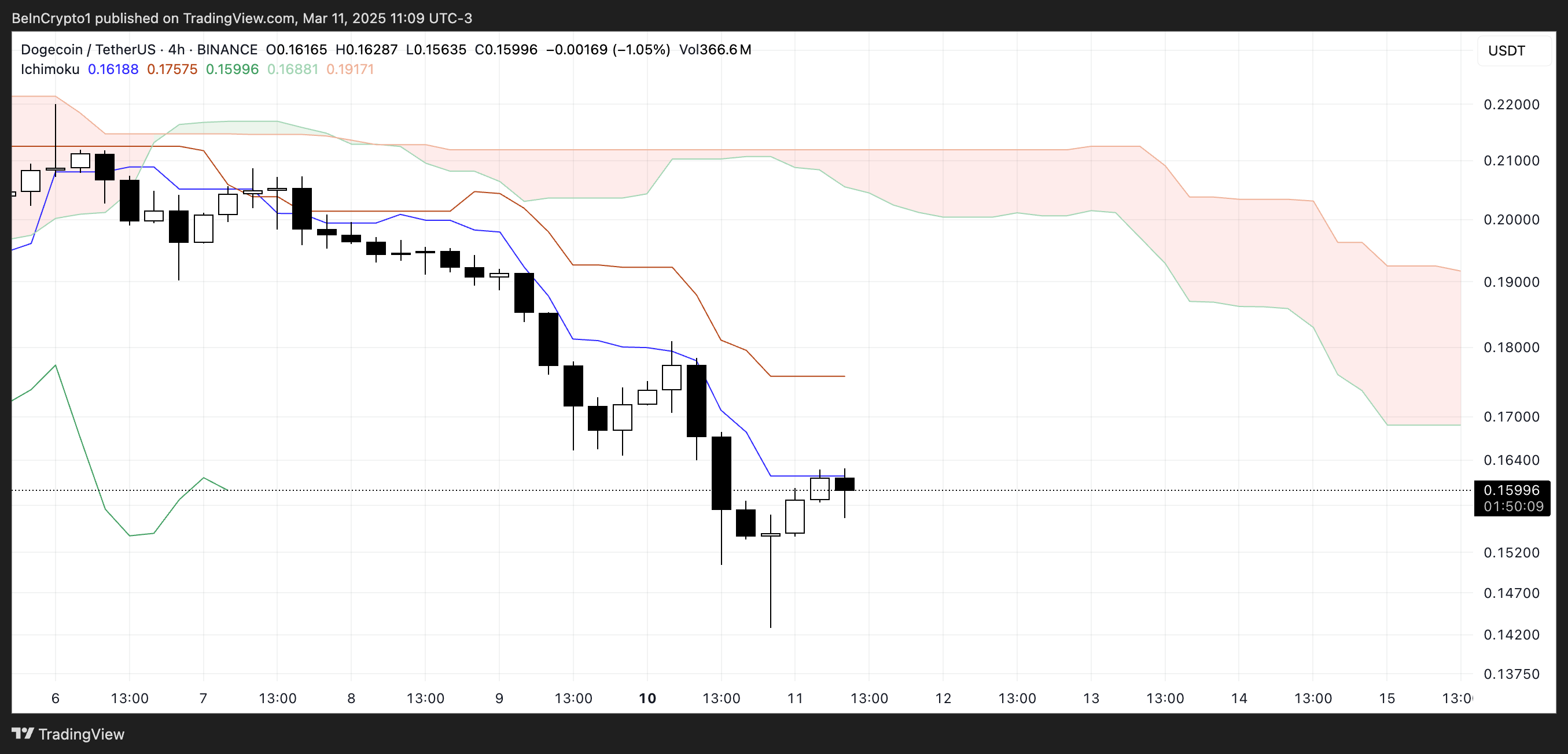

Doge Ichimoku Cloud paints a downward image

The table of the Dogecoin Ichimoku clouds shows a strong downward configuration. The price is negotiated below the Blue Tenkan-Sen (conversion line) and the Red Kijun-Sen (basic line).

This positioning indicates that short -term momentum remains negative while DOGE struggles to break these levels of resistance.

The cloud of Ichimoku (Kumo) in front is red, strengthening the in progress lowering feeling, while the cloud itself is positioned well above the current price.

The descending slope of Tenkan-Sen and Kijun-Sen also confirms the strength of the downward trend, making fragile recovery attempts unless Doge can recover these lines.

A movement in the cloud would indicate a potential transition to a neutral phase. However, for the moment, the trend remains clearly down.

Until the price breaks down over Tenkan-Sen and Kijun-Sen or the cloud becomes green, all upward movements could be temporary withdrawals in a wider drop trend.

If the sales pressure persists, Doge could continue to decrease, potentially testing lower support levels in upcoming sessions.

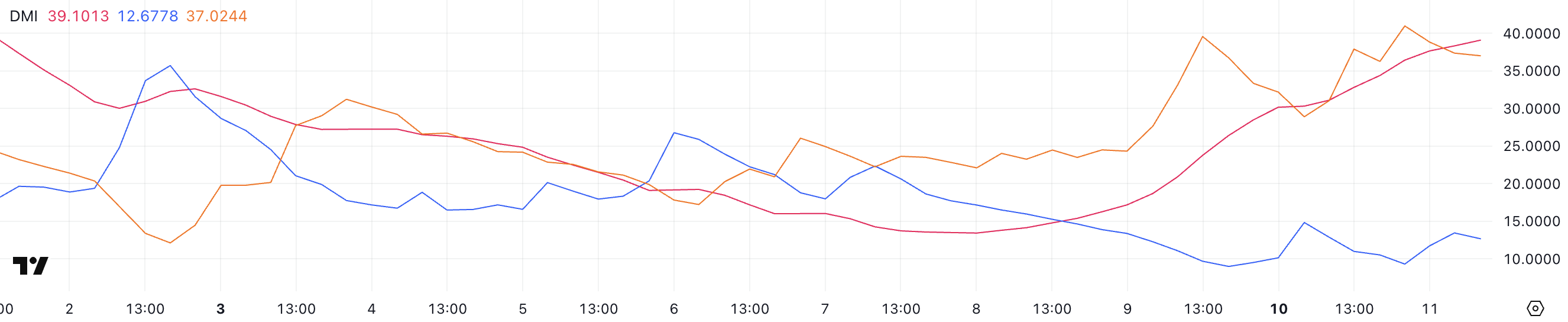

Dogecoin DMI shows that sellers are largely in control

DADECOIN’s DADECOIN (DMI) graphic of the DADECOIN MODIAL index (DMI) shows that its average directional index (ADX) is currently at 39.1, a strong increase compared to 17.1 only two days ago.

ADX measures resistance to trend, with values above 25 indicating a strong trend and those less than 20 suggesting low or variant market conditions.

The rapid increase in the ADX confirms that the downward tendency of Dogecoin is intensifying, indicating that the sellers remain firmly in control. As ADX rises above, it strengthens the idea that the current downward trend is growing.

The -Di (negative directional index) went to 37, against 28.91 one day, while the + DI (positive directional index) fell to 12.67 from 14.83.

This widening difference between -DI and + DI indicates that the sales pressure prevails considerably on the purchase. With -Di continuing to increase and + di downward trend, the price of Doge is likely to remain under pressure unless a strong reversal of the momentum occurs.

The + DI should start to increase while the -Di decreases for any signs of potential recovery. For the moment, the dominant trend remains down and DOGE can continue to test lower support levels.

Dogecoin will have trouble recovering $ 0.20 soon

Doge Price has dropped by 18% in the last seven days, strengthening its downward trend while the sales pressure continues to dominate.

If this downward trend persists, Doge could soon test the level of key support at $ 0.142, a critical critical price that could determine if new decreases are likely. A break below this level would allow Dogecoin to lower below $ 0.14 for the first time since October 2024, solidifying the lowering feeling.

Given the structure of current prices, the absence of high purchase pressure suggests that the path of the slightest resistance remains down unless the momentum changes.

However, if the media threshing of the same currency returns and the purchase pressure increases, DOGE could get out of its lower structure and recover the levels of resistance of the keys.

The first major resistance to watch would be $ 0.19. If Doge successfully succeeds in this level, it could point out the start of a wider recovery. A sustained rise trend could then push the price to $ 0.22, and if the bullish momentum is more strengthened, Doge could reach $ 0.24.

In order for this scenario to materialize, DOGE should see an influx of volume of purchase and a change of trend indicators, signaling a potential reversal of its current trajectory.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.