Q1 2025 Data Reveal Sky-High Costs and a New Pecking Order in Bitcoin Mining

In the first quarter of 2025, the Bitcoin mining industry was confronted with many challenges due to the event in half and the increased difficulty of the network.

This analysis will use the data from Bitcoin operating companies listed in Bitcoin such as Cipher Mining, Riot Platform, Core Scientific, Hut 8 Corp, Terawulf, Bitfarms and Cango to summarize, compare and assess their financial performance, their mining results and their development strategies.

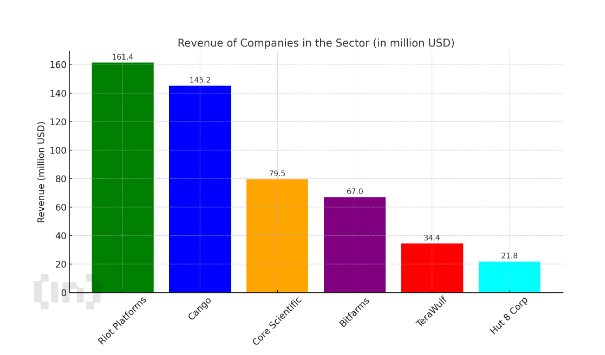

Financial performance

Bitcoin mining companies in T1 2025 have presented significant disparities in financial performance.

RIOT platforms recorded the highest income to $ 161.4 million, mainly Bitcoin Mining (142.9 million dollars), with a production of 1,530 BTC. However, the extraction costs per unit increased to $ 43,808 / BTC, compared to $ 23,034 / BTC from year to year, reflecting the impact of the reduction by half and the increased difficulty of the network.

Core Scientific declared an impressive net profit of $ 581 million, largely driven by non -monetary evaluation adjustments ($ 622 million). Income dropped from 55.7% to $ 79.525 million and the adjusted Baiia was negative at $ 6.107 million.

Bitfarms experienced an increase of 33% to $ 67 million, but its gross beneficiary margin rose from 63% to 43%, with a net loss of $ 36 million. CANGO achieved a turnover of $ 145.2 million, with $ 144.2 million in Bitcoin mining, producing 1,541 BTC at a high average cost of $ 70,602 / BTC.

Meanwhile, Hut 8 Corp and Terawulf were faced with significant challenges, revenues decreasing by 58% ($ 21.8 million) and $ 34.4 million, respectively, in parallel with substantial net losses ($ 134.3 million and $ 61.4 million).

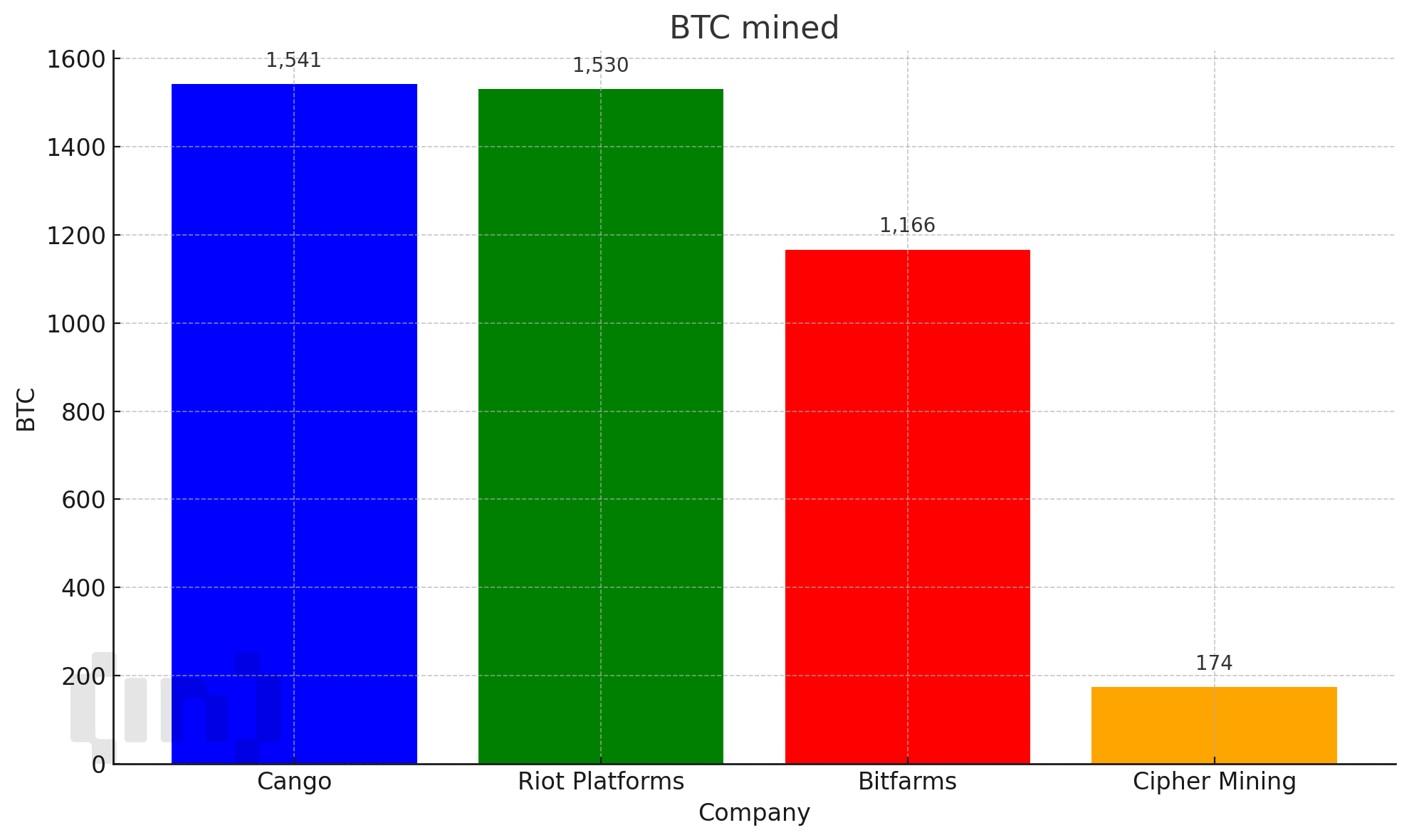

Bitcoin mining outlet and exploitation

Regarding the mining output, LED Cango with 1,541 BTC, followed by Riot platforms (1,530 BTC) and Bitfarms (1,166 BTC). Cipher Mining has extracted 174 BTC in April but sold 350 BTC, reducing its assets to 855 BTC, of which 379 BTC were guaranteed.

The Riot platforms held the largest Bitcoin reserve with 19,223 BTC without restrictions, Bitfarms held 1,166 BTC and Cango maintained significant and short-term investments (347.4 million dollars).

Core Scientific has not disclosed specific Bitcoin holders, but focused on expanding services managed with a 250 MW contract for Coreweave, which is expected to generate $ 360 million in revenues by 2026.

The first quarter of 2025 was difficult for Bitcoin extraction companies due to half the bitcoin reduction and the increase in network difficulties. The riot platforms and the Cango carried out results and income, but the high operating costs have posed challenges. Core Scientific and Hut 8 rotate towards sectors such as AI to reduce dependence on mining.

Post T1 2025 data reveals costs from top to bottom and a new hierarchical order in Bitcoin Mining appeared first on Beincrypto.