This is Why The Federal Reserve Might Not Cutting Interest Rates

Several social media accounts linked to the crypto circulate rumors that the Federal Reserve will soon reduce interest rates. These focus on an out-of-context quote from Neel Kashkari, president of the Federal Reserve Bank of Minneapolis.

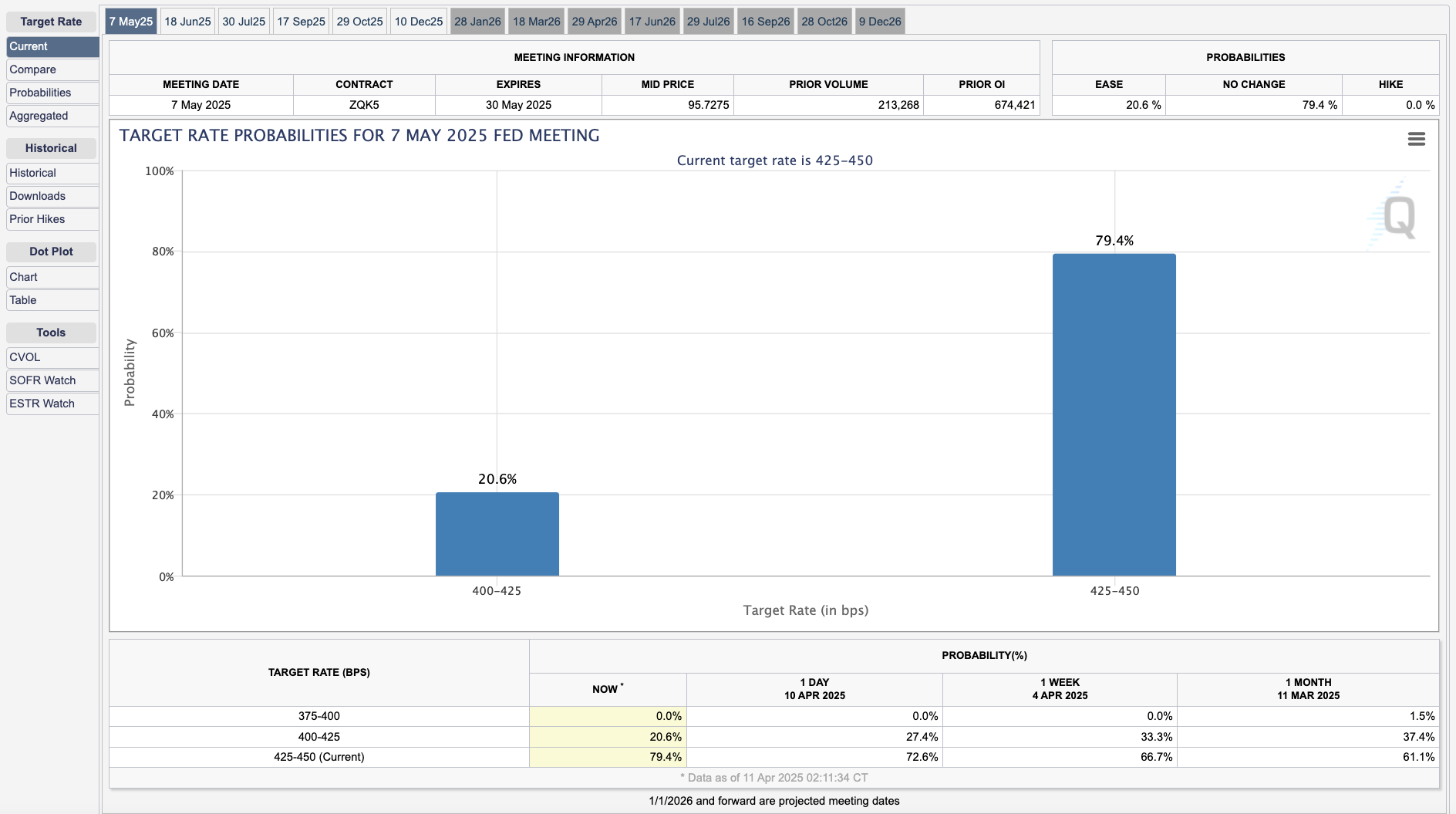

Susan Collins, president of another regional Fed bank, reiterated the low probability of reductions in any rate. Currently, the CME group estimates 20.6% of the chances that they occur next month.

Rumors of reducing the rates of the federal reserve are unleashed

As Trump’s prices have caused a huge amount of market instability, the cryptographic space has desperately been desperate for a bullish story. A recurring hope was that the Federal Reserve would reduce interest rates, which seems very improbable.

Today, in a CNBC interview, a quote from Neel Kashkari, president of the Federal Reserve Bank of Minneapolis, has fueled new rumors:

“There are tools to provide more liquidity to the markets on an automatic basis to which market players can access, in addition to the exchange lines you have spoken of for global financial institutions. These tools are absolutely there,” said Kashkari.

Shortly after this interview, several eminent crypto accounts began to circulate from this outside context. They suggested that the federal reserve was about to reduce interest rates to avoid potential economic disorders.

Some of these erroneous claims have managed to accumulate thousands of views and republication on the idea that the Fed “will print money”.

However, in the full interview, Kashkari clearly said what he meant by “tools”. He stressed that the Fed is not concerned with global trade and that its “double mandate” is to focus on inflation and employment in the United States.

In other words, the tariff situation does not modify the low probability of the federal reserve to reduce interest rates.

After these rumors began to circulate, another superior discussed the tools of the federal reserve concerning interest rates.

In a later interview with the Financial Times, Susan Collins, president of the Federal Reserve Bank of Boston, said Fed policy in a very direct language:

“We had to deploy fairly quickly, various tools [to address the situation.] We would be absolutely ready to do so if necessary. The main interest rate tool that we use for monetary policy is certainly not the only tool in the toolbox, and probably not the best way to meet the challenges of liquidity or operation of the market, “said Collins.

Collins and Kashkari both have roughly equivalent positions, at the head of one of the 12 banks of the federal reserve distributed throughout the country. The two have tried to clearly communicate that the federal reserve does not plan to reduce interest rates at the moment.

Despite this, rumors on social networks can quickly become uncontrollable.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.