Ethereum (ETH) on the Verge of Crash, $1,000 Calling?

In the current tariff war between the United States and other countries, the cryptocurrency market has dropped considerably. In the middle of this, Ethereum (ETH), the second largest cryptocurrency, is on the verge of a major accident.

According to CoinmarketCap data, ETH has lost almost 25% of its value in just five days of negotiation and has reached a brand or breakup level.

Ethereum (ETH) Price action and technical analysis

While examining the weekly ETH table, it seems that the asset has recently lost its long -standing support for the ascending trend line that has been in place since July 2022.

After ventilation, the assets has continued to lower, during which he lost two key support levels at $ 2,200 and $ 1,830, and has now reached another level of critical support at $ 1,530.

Ethereum price prediction

According to an expert technical analysis, if this decreased momentum does not stop, the price could crash hard.

The daily graphic reveals that if the price of the ETH does not hold this level of support and closes a daily candle below $ 1,450, there is a high possibility that it can drop by 30% to reach its next level of support to $ 1,000 in the near future.

After the continuous decrease in prices, the ETH is now negotiated below the exponential mobile average (EMA) on four -hour, daily and weekly times, indicating a strong downward trend.

Current price momen

At the time of the press, ETH is negotiated nearly $ 1,550 and has lost almost 10.50% of its price in the last 24 hours. However, during the same period, the volume of negotiation of the asset jumped from a 550%record, indicating increased participation of traders and investors compared to previous days.

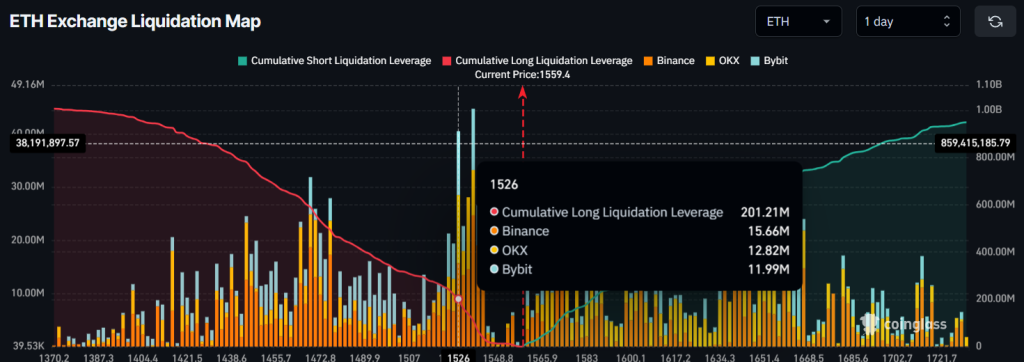

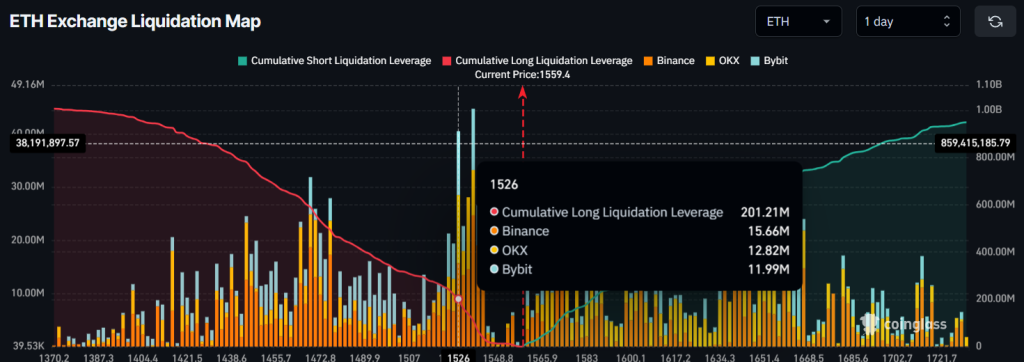

200 million dollars in bull bet

This record increase in the volume of exchanges includes the liquidation of short and long positions of traders, accumulation or sales of recent traders, and all other ETH -based commercial activities.

Despite the massive price crash in the last 24 hours, traders seem optimistic and strongly bet on the bullish side, according to the Coiginglass chain analysis company.

The data reveal that traders are currently over-deposal in terms of support of $ 1,526, having built for 201 million dollars in long positions. On the other hand, $ 1,571 is another over-exposed level, where traders have built $ 100 million in short positions.

While examining these levels and the positions of traders, it seems that the Bulls are currently dominating and could potentially liquidate a value of $ 100 million in short positions. However, if the feeling of the market continues to remain unchanged, this could also lead to the liquidation of long positions of traders.