Retail investors Struggle With Market Volatility in June

June 2025 experienced a significant increase in activity among retail investors on the cryptography market, in particular involving Bitcoin (BTC).

This decision occurred while retail investors were concerned about the escalation of geopolitical tensions could have an impact on their portfolios. Their behavior still contrasts with that of institutional investors.

What do retail investors do in the midst of political conflicts?

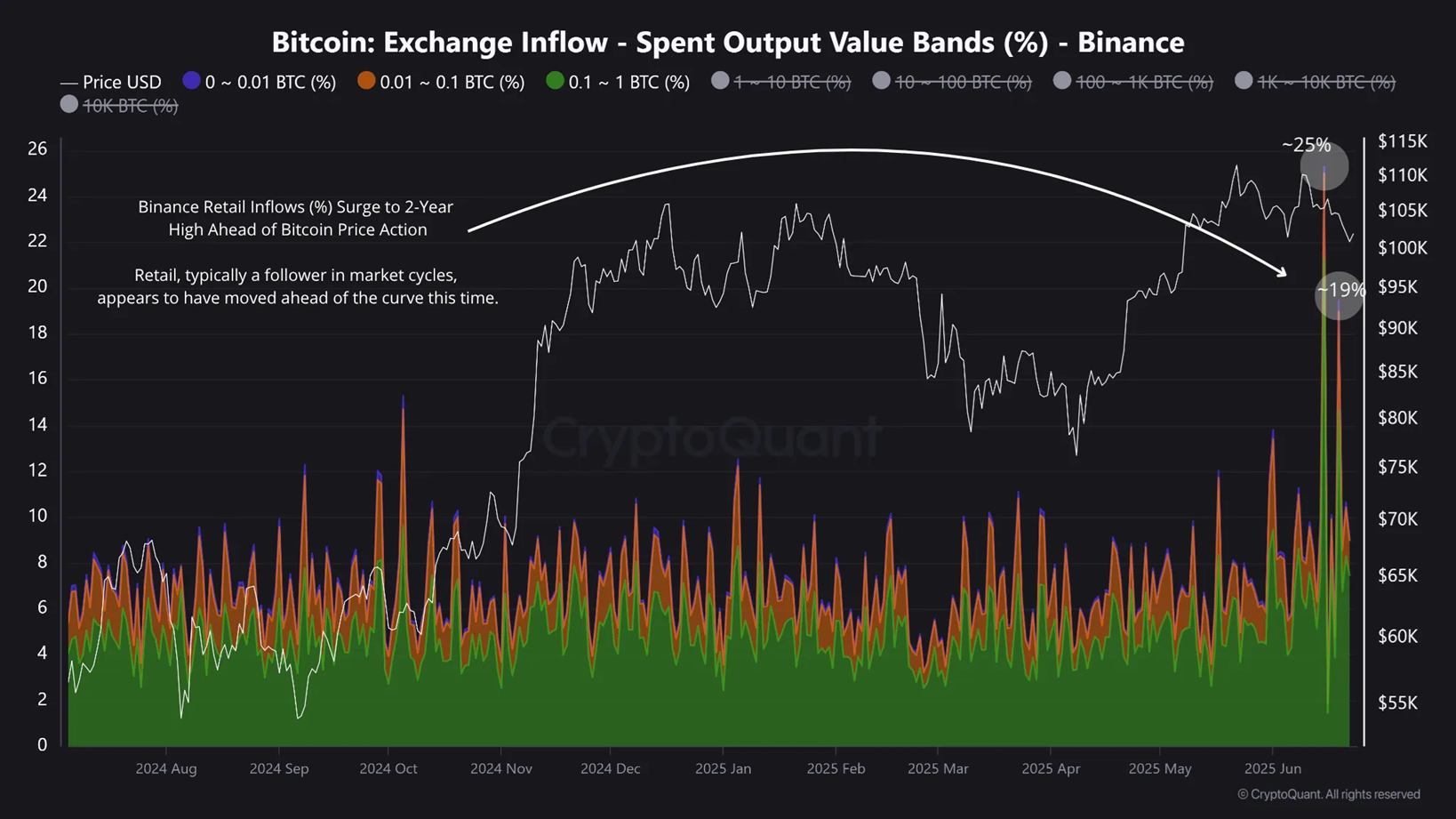

According to cryptocurrency data, on June 15, the proportion of Bitcoin entries for retail investors in Binance increased to more than 25% while the BTC has been negotiated at around $ 105,000. This has marked the highest retail BTC influx since May 2023.

A second increase took place on June 19, reaching a 19%share. These two events reflected the active participation of the group in the midst of market volatility.

In particular, the two entry tips occurred before the conflict between the United States and Iran deteriorated. However, the previous tensions between Israel and Iran may have influenced the feeling of retail. Consequently, many retail investors have moved their bitcoin to exchanges in anticipation of the worsening of conditions.

“The decision to file BTC on Binance generally indicates an intention to negotiate, not to hold. Although the participants in the retail trade are often considered as late market movers, this time, they may have been ahead of the curve. It is a rare but interesting behavior,” said cryptocurrency analyst Maartunn.

Some retail investors may have avoided the decline below $ 100,000 by sending Bitcoin to trade for sale. However, this trend has also led to an increase in short positions in the retail segment.

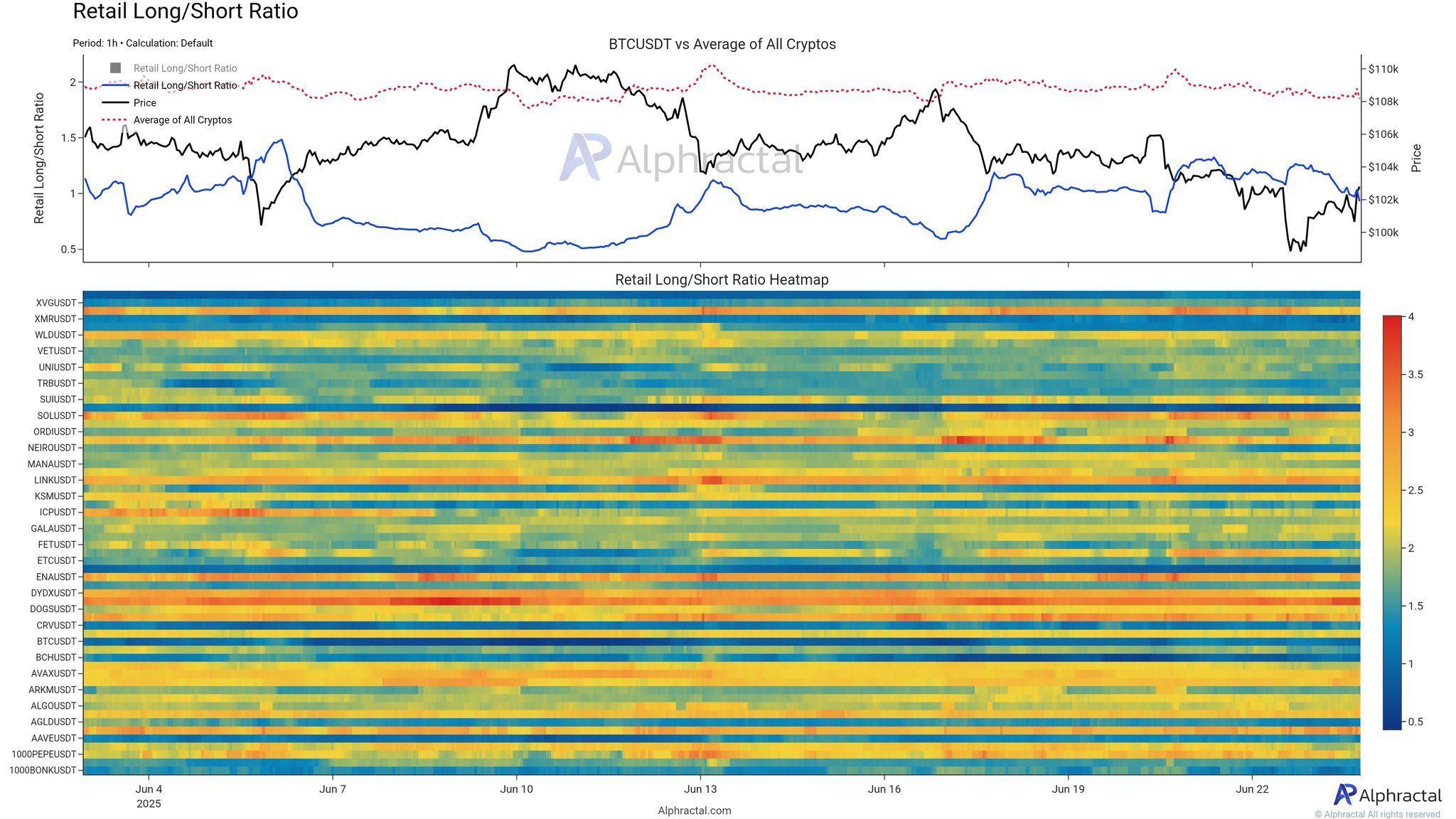

Alpharactal data have shown that the long / short detail ratio tends to decrease. Bitcoin and altcoin short-circuited retail investors. This is obvious from the thermal map, which is now largely covered with colder colors.

“The detailed positions in detail are increasing, while the whales show more interest in the long time compared to retail,” said Joao Weddson, founder of Alpharactal.

At first, it seemed that retail investors were on the right track. However, positive news – namely Trump’s announcement of a ceasefire between Iran and Israel – have sparked a rebound on the market. Bitcoin quickly returned above $ 105,000, and the total market capitalization of Altcoin (Total2) recovered by 10%.

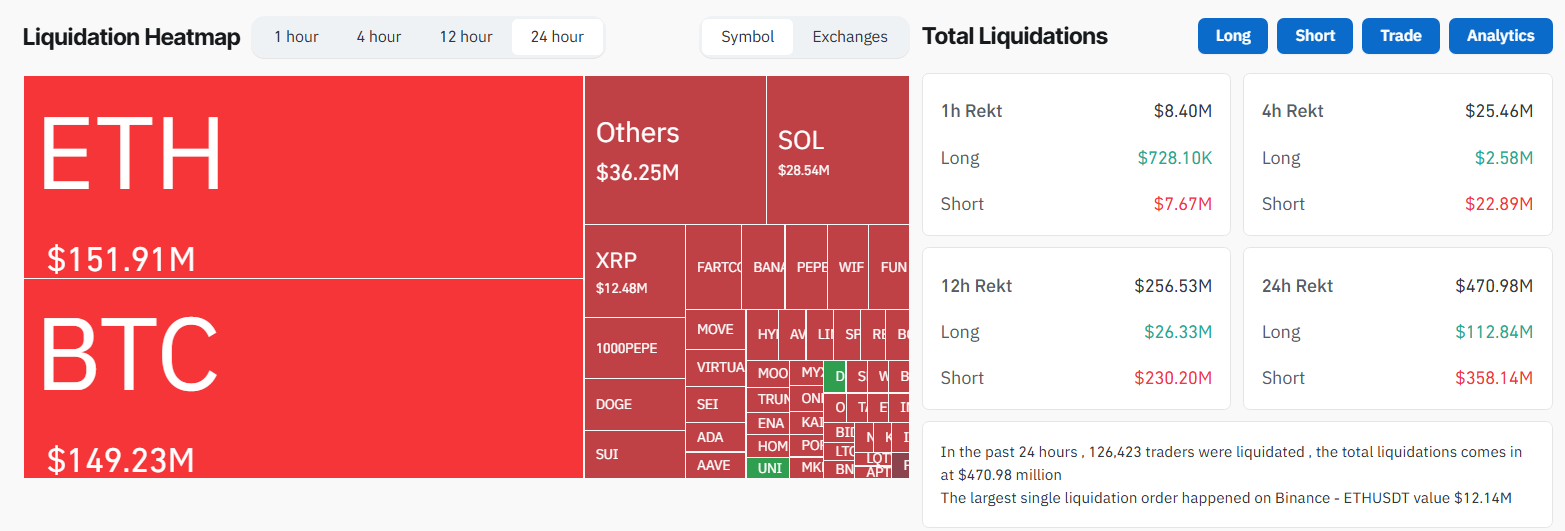

Consequently, the uncovered sellers were faced with massive liquidations, which is less than half a USD-Milliard in just 24 hours.

According to Corclass, nearly $ 500 million in posts have been liquidated in the last 24 hours. The majority of this came from short positions, the total volume of higher liquidation exceeding $ 358 million, three times the volume of liquidations in long position.

This shows how the unexpected changes in geopolitical tensions can always affect retail investors, even when they believe they are on the right track.

Meanwhile, while retail investors fight against market volatility, the institutional accumulation of Bitcoin continues regularly. This highlights an in -depth fracture between retail and institutional sales behaviors today.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.