SafeMoon’s 190% Rally Cools as Momentum Fades

Safemoon (SFM) has experienced extreme volatility in recent weeks, fueled by a major change towards a model focused on the community and a progressive armored vehicle. This transition helped SFM increase by almost 350% in a month, but the technical indicators now suggest that the momentum could disappear.

The ADX readings show that the strength of the trends has weakened, while RSI fell from almost opposite levels, indicating the cooling request. The fact that Safemoon can maintain its upward trend or faces a deeper retirement will depend on the purchase of pressure yields or if market enthusiasm begins to decline.

Safemoon Adx shows that the upward trend could be relaxed

The Adx de Safemoon is currently at 20.5, after reaching 40 before on February 11 and 32 on February 14.

This decrease in the ADX suggests that, while Safemoon has known a strong trendy dynamic in recent days, after its progressive aerial mouth, this force has since weakened.

The ADX (average directional index) does not indicate the direction of the trend but rather measures the force of a continuous trend. An ADX falling into an upward trend can point out that the safemoon’s purchase dynamic slows down, which makes you important to see if this trend can be maintained or if it may lose steam.

ADX values help to determine whether a trend is strong or low, generally using 25 as a threshold-the readings above this level indicate a strong trend, while the readings below suggest a lower moment or consolidation.

With Adx de Safemoon now at 20.5, he plunged below this key threshold, which means that if SFM is still in an upward trend, the strength of this trend has faded.

If ADX continues to drop, it might suggest that the Safemoon rally is short of momentum, increasing the chances of lateral movement or a potential retirement.

However, if Adx bounces above 25, this would confirm that buyers regain strength, strengthening the continuation of the upward trend of Safemoon.

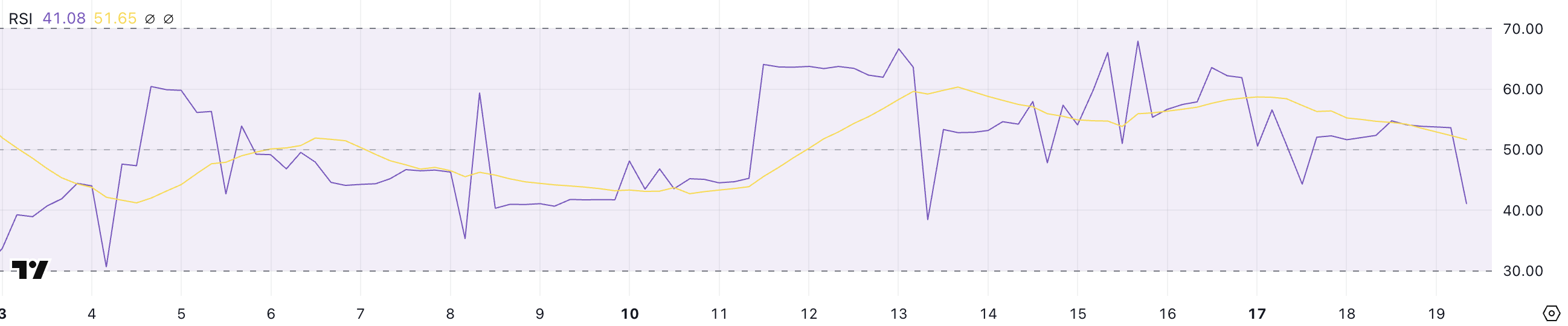

SFM RSI is still neutral, despite the recent increase

Safemoon RSI is currently at 41, going from 67.9 only four days ago. This drop suggests that the purchase of the momentum has cooled considerably after a brief period of strength.

The increase in RSI four days ago coincided with the announcement of Safemoon that it would launch a piece of solara sole, as part of its transition to a community -oriented approach.

This triggered an increase in purchase pressure, pushing RSI near the surachat levels, but the recent decline indicates that the initial excitation has faded, leading to a slowdown in demand.

RSI, or the relative resistance index, measures the momentum on a scale of 0 to 100, where the values above 70 signal the conditions of surouche and the correction potential, while less than 30 indicates levels of occurrence and A rebound potential.

The SAFEMOON RSI at 41 suggests that if the asset has lost part of its recent bullish momentum, it is not yet in a deeply occurred territory. If RSI continues to fall around 30, this could indicate that the sales pressure increases, which leads to an additional price drop.

However, if it stabilizes and decreases above 50, it would suggest a renewed interest in the SFM, potentially allowing another rise.

Safemoon remains very volatile

No one knew what would happen with Safemoon after the dry and the doj accused its leaders a few years ago.

However, the recent progressive airliner and the transition to a community -oriented approach seems to have had a positive impact on the medal, fueling a massive increase of 153% between February 11 and February 15.

If this bullish momentum continues, Safemoon could soon test $ 0,00013, with the potential to climb to $ 0.00015, or even $ 0.00020 if the demand remains strong.

However, if market attention cools and enthusiasm fades, SFM could fall into a downward trend, leading to a possible 0.000037 retest, marking a significant correction from current levels.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.