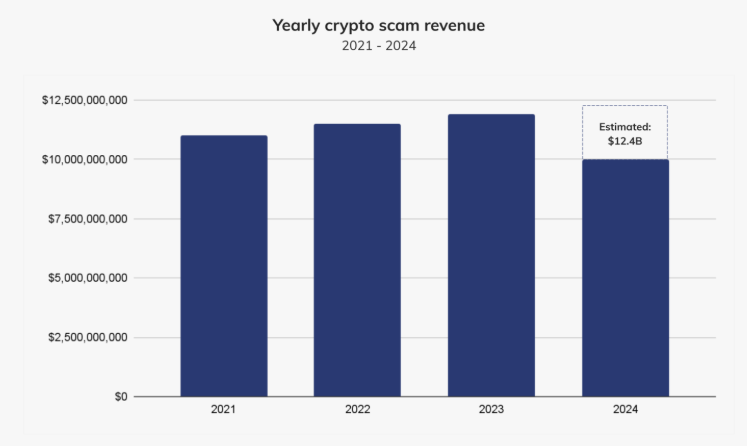

Pig Butchering Scams Drive Crypto Fraud to $9.9 Billion in 2024

A recent report of the blockchain analysis company revealed that cryptographic scams generated at least $ 9.9 billion in illicit income in 2024. The most important contributor to this overvoltage was the “pig butcher” scams .

Pork butcher’s scams often combine investment fraud with Romanesque scams. In these scams, the authors strengthen confidence with the victims before convincing them to invest in false cryptographic platforms.

The chain-analysis reveals a growing threat of pig massacre

The analysis channel warns that the $ 9.9 billion estimated in scam income for 2024 are probably conservative. Instead, the final figures could potentially exceed $ 12 billion. The report highlights an increase of nearly 40% of plugs in pigs from year to year, representing 33.2% of total income from the cryptographic scam.

According to the report, many of these operations come from Southeast Asia. In addition, the report highlights the growing sophistication of crooks, citing illicit services such as Huione guaranteed, a Peer-to-Peer (P2P) platform which facilitates fraud. More specifically, it is a telegram-based market serving fraudsters from Southeast Asia, including those responsible for so-called Pork butcher’s scams.

This platform offers crooks money money laundering tools, stolen personal data and social media management services. Since 2021, Huione’s guarantee has been treated more than $ 70 billion in cryptographic transactions, solidifying its role in the fraud ecosystem.

Research has also revealed that recent launches of Huione Guarantee, USDH Stablecoin and Blockchain Project Xone. These launch have raised concerns concerning the new avenues so that fraudsters obscure their transactions.

The report strengthens a recent incident during which Tether froze 29.62 million USDT linked to Cambodian criminal activities involving the group Huione. Recently, Elliptic also exposed the Huione guarantee as a market of several billion dollars for online fraudsters.

AI Generative and other methods of cryptographic fraud

Chainalysis also highlights the role of generative AI in improving scam tactics, allowing fraudsters to pretend to be victims. More specifically, this helps them get around identity verification and create very convincing investment platforms.

In addition to the scams of pig butcher and generator, other methods of cryptographic fraud experienced substantial growth in 2024:

- Poisoning at the address: The crooks send small transactions from addresses, imitating the contacts of a victim and encouraging them to transfer funds to fraudulent wallets.

- Cryptography racks: Phishing attacks increased by 170%, with incidents involving false titles of American titles and the exchange commission (dry).

- Live scams and sextrusions: The deep scams generated by AI and blackmail tactics have become more common.

- Employment scams: The fraudsters have uslder legitimate companies, encouraging victims to pay fraudulent training costs or tax deposits.

The use of cryptocurrency automatic counters in scams has also increased. According to Chainalysis, the American FBI has reported a ten -time increase in consumption losses since 2020. Frauders frequently have exploited these automatic ticket distributors to receive funds from victims who are convinced that they make legitimate payments.

“Although automatic crypto ticket distributors are used for legitimate purposes, they are also popular among crooks, and in recent years, the FBI has received thousands of reports on cybercriminals using automatic cryptographic ticket distributors for Receive payments for scams, “said an extract from the report.

The analysis channel also cites a case in which the crooks have deceived an American citizen by depositing $ 15,000 in automatic Bitcoins distributors on the pretext of repairing a computer virus. The authorities intervened, recovering part of the funds.

Based on these results, the analysis chain recognizes the growing challenges of law enforcement organizations in the fight against cryptocurrency fraud. While centralized exchanges (CEX) remain the main channel for laundering illicit funds, the rise in decentralized financing platforms (DEFI) complicates the monitoring of assets.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.