Satoshi’s 1.1M BTC Could Make Him the Wealthiest in 2025

The price of Bitcoin (BTC) is in six -figure territory, institutional capital floods the market. With this, analysts now face the question: Satoshi Nakamoto, could the nonsense creator of Bitcoin, become the richest individual on the planet before the end of the year?

With around 1.1 million BTC allocated to Satoshi, its assets are now worth more than $ 130 billion at current market prices.

$ 320,000 BTC or bust: what would it take in Satoshi to overshadow Elon Musk in 2025?

With the right conditions, Satoshi could become the richest person on the earth before the end of the year. This would mean eclipizing the estimated fortune of $ 350 to $ 400 billion in Elon Musk, largely linked to Tesla, SpaceX and X (Twitter).

For Satoshi to exceed it, Bitcoin should reach between $ 320,000 and $ 370,000, an increase of 2.7 times to 3.1x compared to current levels.

However, reaching this step means more than a simple price goal. It is a referendum on the global adoption of Bitcoin, macroeconomic upheavals and the integration of digital assets in the way investors, including institutional or tradfi, measure wealth.

Speaking to Beincrypto, several experts said It’s not meMossible for Satoshi Nakamoto to become the richest person by the end of 2025, but they recognized that the chronology was too compressed.

“If it is not in 2025, 2026 seems to be a safe bet,” said Vikrant Sharma, CEO of Cake Wallet Creator Cake Labs.

This means that although speculative, this price level is not inconceivable, the calendar requiring aggressive capital entries, tail winds and regulatory breakthroughs.

Can institutions push BTC to $ 320,000 by the end of the year?

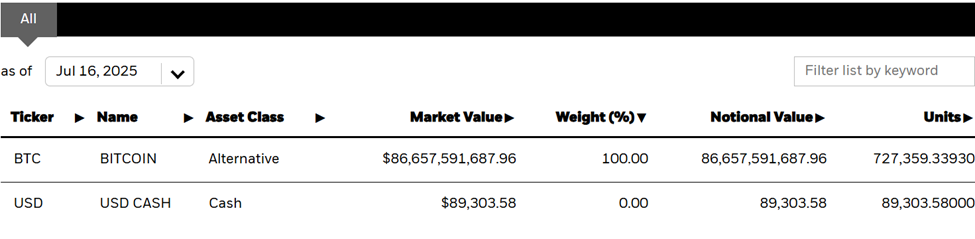

Since the approval of the Bitcoin ETFs (negotiated funds on the stock market), the institutional momentum has increased. The Ibit of Blackrock now holds around 727,359 BTC.

Capital entries in the FNB spot exceed the expectations of many analysts, with reports suggesting that Blackrock Ibit ETF could reach $ 100 billion in assets this month.

However, Bitcoin’s transition from $ 118,000 to $ 320,000 in five months requires more than just continuation. It requires acceleration on a historic scale.

“For Bitcoin to reach $ 320,000 in five months, institutional purchases must exceed everything that is witness to date. It would take something enormous-as the United States announcing a Bitcoin or sovereign funds and a CEO of the Maksym Sakharov, co-founder and CEO of the banking of the chain.

Even with the stress of the treasure, the dominant pivots and the geopolitical instability acting as rear winds, the chances that everything aligns in 2025 is slim, but not impossible.

“This would require the opposite of a black swan event … implacable institutional entries, upward new regulations, the main flexibility policies of central banks and large companies adding BTC aggressively,” said Okx Global CCO Lennix Lai.

The Exclusion Paradox: why Satoshi is not on the rich list

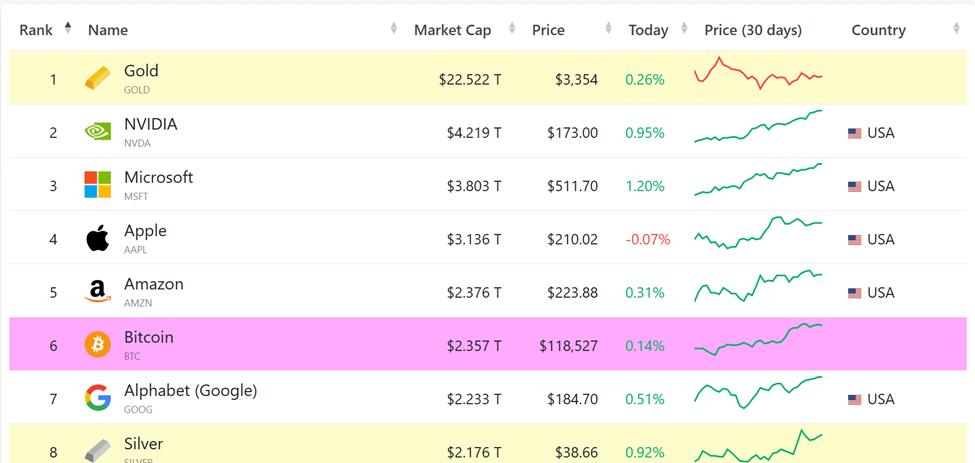

Although he had enough bitcoin to compete with the nation states, Satoshi does not appear on the lists of Forbes or Bloomberg. Crypto, although a class of assets of 3.9 billions of dollars, remains underrepresented in the classification of consumer heritage. Experts largely attribute it to problems of childcare, attribution and transparency.

“Satoshi would classify 11th in the world if they included his Bitcoin holdings,” said Sakharov.

While the founders of exchanges like Changpeng Zhao (CZ) of Binance or the CEO of Coinbase Brian Armstrong have cut, a large part of their wealth is counted via the company’s assessments and not of the self-discuite crypto.

“It is absurd at this stage … Their methodology seems more and more outdated,” he added.

Meanwhile, Sharma noted that Bitcoin’s outfit in the self-leather is justified given its weight among the greatest class of assets by market capitalization.

Sharma also attributed this choice to the constant movements of central banks to depreciate Fiat, which makes bitcoin more attractive.

“Why would you not hold the 5th asset class by market capitalization? With central banks that are constantly taking measures to depreciate Fiat, a transition to a sounds of money seems inevitable,” Sharma told Beincryptto.

Cust on sight, disclosure and future of billionaire wealth rankings

Infrastructure must make up for the Crypto to be treated with equality with actions or real estate. The audit of childcare, the verification of the car leather and the report standards are always in development.

According to Sakharov, procedural challenges are now eclipping technical concerns, wealth managers still missing reports that give Crypto the same confidence as actions.

“If wealth is maintained through ETF or Bitcoin cash companies, it is easy to report, but the auto -custodie complicates disclosure – and Forbes is not yet equipped for this nuance,” added Sharma.

However, the winds change, the audits becoming more common. Heritage managers warm up to recommend crypto allowances from 5 to 10%.

Sovereign funds also envisage the BTC, which could lead to the integration of crypto holdings in the world’s billionaire rankings.

The billionaire that no one can find

Meanwhile, Bitcoin is no longer fringes. From ETF to treasury vouchers, including comparisons from gold from the central bank, the pioneer crypto has fully entered the institutional era.

However, its most enigmatic holder, Satoshi Nakamoto, remains an anomaly, holding a fortune greater than whole nations, but always absent from all rich lists.

Whether Bitcoin reaches $ 320,000 this year or next year, some may find it interesting to know who Satoshi is rather than if he becomes the richest person in the world.

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.