SHIB Price Declines Amid Sharp Rise in Whale Sell-offs

Top same corner Shiba Inu shows signs of an extended downward trend while major investors increase for profit activities.

This wave of sales pressure triggered a drop in the value of the memes piece, pushing it below its ascending parallel channel – a key structure that had supported its price action from June 22 to July 27.

Shib Bulls loses adhesion while the large carriers trigger a breakdown

The first meter currency shib broken below the lower trend line of the parallel ascending channel in which it exchanged for more than a month.

For TA tokens and market updates: Do you want more symbolic information like this? Register for the publisher Daily Crypto newsletter Harsh Notariya here.

These breakdowns are interpreted as early signs of trend reversal, especially when accompanied by a weakening of demand and an increase in sales volume.

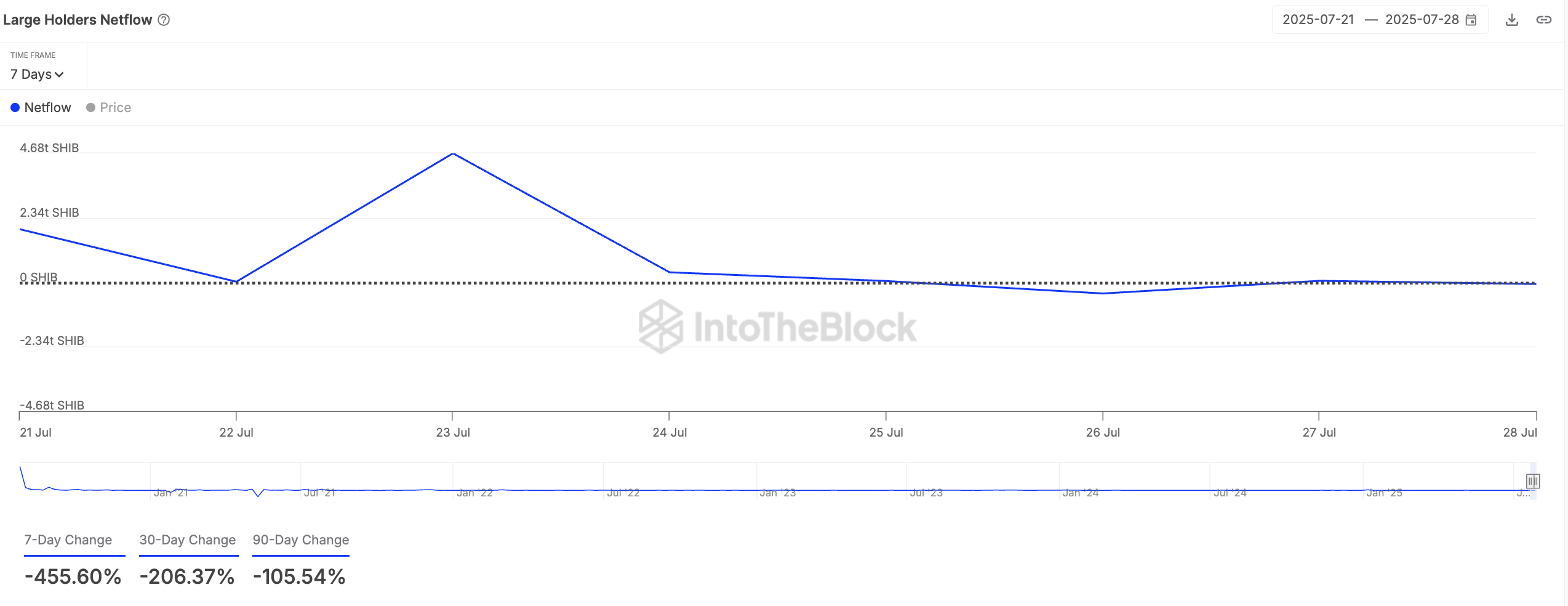

For Shib, the failure coincides with a strong increase in whale sales. The data on the intotheblock chain reveal a drop of 456% of Netflow of the big holders in last week, confirming that the main investors leave their positions and made the profits.

Large holders are whale addresses that hold more than 1% of the food in the circulation of an asset. Their Netflow follows the difference between the parts they buy and the amount they sell over a specific period.

When the Netflow of the large carriers of an asset plunges in this way, more tokens flow from whale wallets than in the carriers. This indicates an increase in profit, often a precursor of low prices.

In the case of SHIB, the sharp drop in Netflow confirms that the main investors unload their assets. This reduces market confidence and adds downward pressure to the value of the token.

Under -term retirement alludes to deeper losses

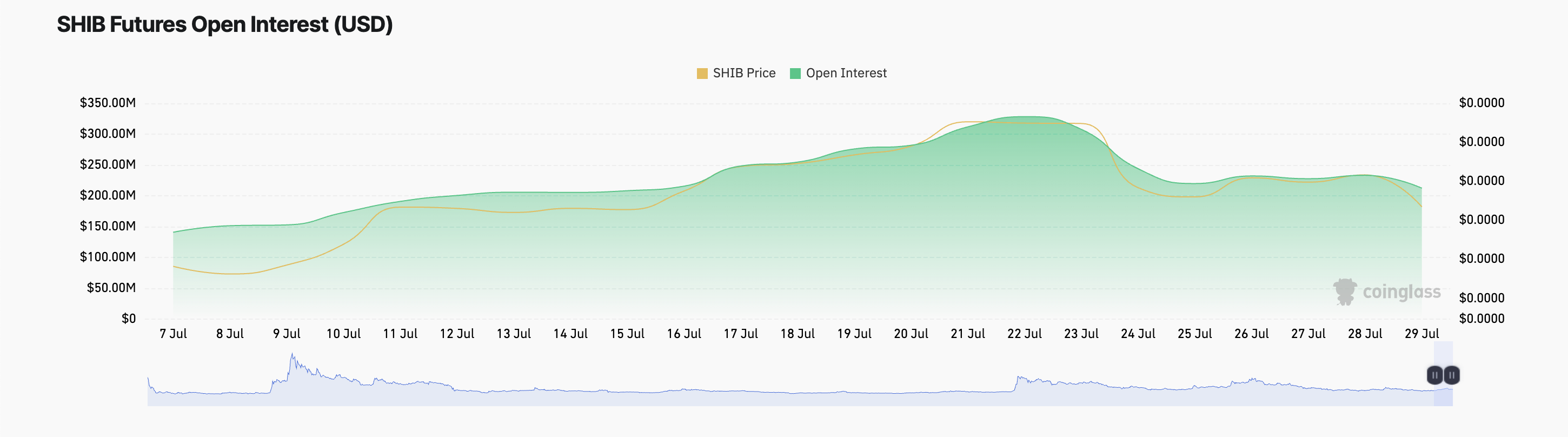

The feeling on the derivative market reflects the weakness observed on the chain. The open interests of SHIB in the term contracts have decreased regularly since July 22, diving by 35% to reach $ 212.48 million at the time of the editorial staff.

This sustained drop suggests that traders are increasingly taking place their positions, with fewer participants ready to bet on the short -term increase in the token.

When the open interest falls next to the price, it is an overall sign of the momentum. In the case of SHIB, this decrease strengthens the lower perspectives and suggests that conviction and capital leave the market.

Shib Bulls Eye 0.00001467, but the activity of whales is disturbing the path

Shib is negotiated at $ 0.0000,1351 at the time of the press, faced with high resistance at $ 0.00001362. If whale sales persist, this price barrier could strengthen and force the price of SHIB to the downward trend to the support floor at $ 0.00001239.

However, if the new request for a request, the memes piece could violate $ 0.00001362 and rise to $ 0.0000,1467.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.