Shiba Inu Clings to Support Zone — Momentum Remains Blunted

Shiba Inu (SHIB) shows early recovery signs, gaining ground from recent stockings because its RSI rebounds and key support levels are maintained. Despite these positive signals, Shib did not manage to break above the RSI 51 bar and continues to deal with the pressure of the lowering alignments of the EMA.

At the same time, whale activity has continued to decrease, suggesting a reduced confidence in large holders and raising questions about long -term support. With the action of the prices stuck between the main support and resistance areas, the next shib movement will probably depend on how the momentum is strengthening – or fades once again.

Shiba Inu Momentum improves, but RSI rejection signals have caution

Shiba Inu has seen a change of momentum, with its relative force index (RSI) passing to 47 from 30.18 only three days ago, reporting a recovery of close conditions.

However, it should be noted that Shib failed to cross the 51 RSI mark yesterday, suggesting that the bullish momentum remains fragile for the moment.

While the recent rebound reflects the softening of the sale pressure, the inability to push in a clearly optimistic territory indicates a continuous hesitation among the buyers.

The RSI, or relative force index, is a Momentum oscillator which assesses the speed and extent of price changes, helping to identify the conditions of over -racket or occurrence.

The readings less than 30 point to the levels of occurrence, while the values greater than 70 suggest an exaggerated territory. With the Shib RSI now at 47, the asset remains in a neutral area – neither over -extended nor deeply reduced.

This mid -range positioning leaves room for a break or a reversal, depending on how prices are developing around current resistance and support levels.

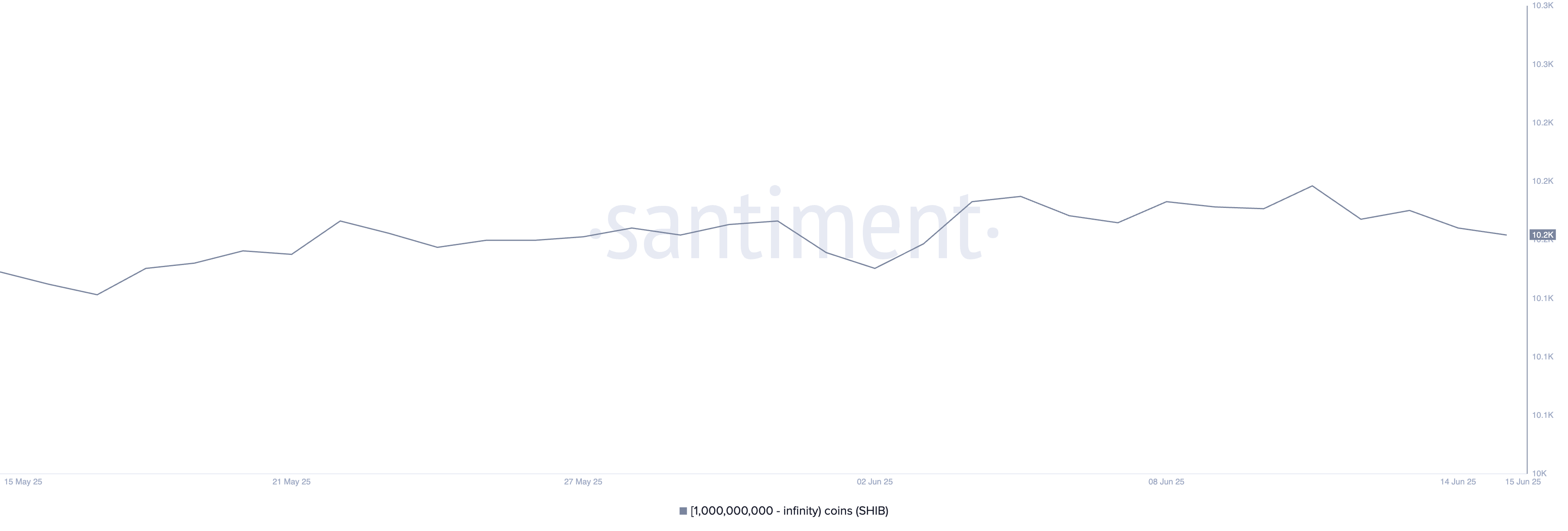

The drop in shib whales signals the potential weakness to come

The number of Shiba Inu whales – portfolios having at least 1 billion tokens – has gradually decreased since June 11, going from 10,250 to 10,231.

Although the decline may seem modest, it reflects a slow but regular reduction in the participation of large holders, which could point out a weakening of confidence among the main players.

A constant decreased trend in whale activity is often correlated with a decrease in support during the volatile phases, which makes SHIB more vulnerable to price oscillations.

Monitoring the behavior of whales is essential because major holders can influence price movements through sudden purchases or sales. An increasing number of whales often suggests long -term accumulation and confidence, while declining number can involve a distribution or exit.

With SHIB whale wallets, this could indicate that the main investors take advantage or hide against the additional decline.

If this trend continues, it can add pressure on the price of Shib, especially if the interest in retail does not compensate for whale outings.

Shib has a key support, but the Emas Bearish keep the bulls in check

Shiba Inu Price recently tested and held the level of key support at 0.00001119, offering a temporary floor despite wider lower signals.

The exponential mobile averages of the token (EMAS) remain in a lower alignment, with short -term EMAs positioned below those in the long term – indicating a low pressure in progress.

If this medium is retest and does not hold, Shib could slide towards the following critical level at 0.0000114, potentially opening the door for more decline.

However, if changes in feeling and shib manage to increase the momentum, the price could question the immediate resistance to $ 0.0000128.

An escape above this level can trigger a rally to $ 0.0000136, and if the purchase pressure continues, even a thrust at $ 0.0000146 is possible.

For the moment, Shib is trapped between the areas of crucial support and resistance, and a clear rupture in both directions will probably define its short -term trajectory.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.