Shiba Inu Whales Cut Holdings—Is a Bigger Price Drop Ahead?

The main same corner Shiba Inu lost almost 10% of its value in last week. To date, Shib is negotiated at $ 0,0000,125.

This drop in prices coincides with a significant drop in whale assets during the same period. This indicates confidence among major investors in the midst of a broader weakness on the market.

Shib market confidence is quarrel while selling whales accelerates

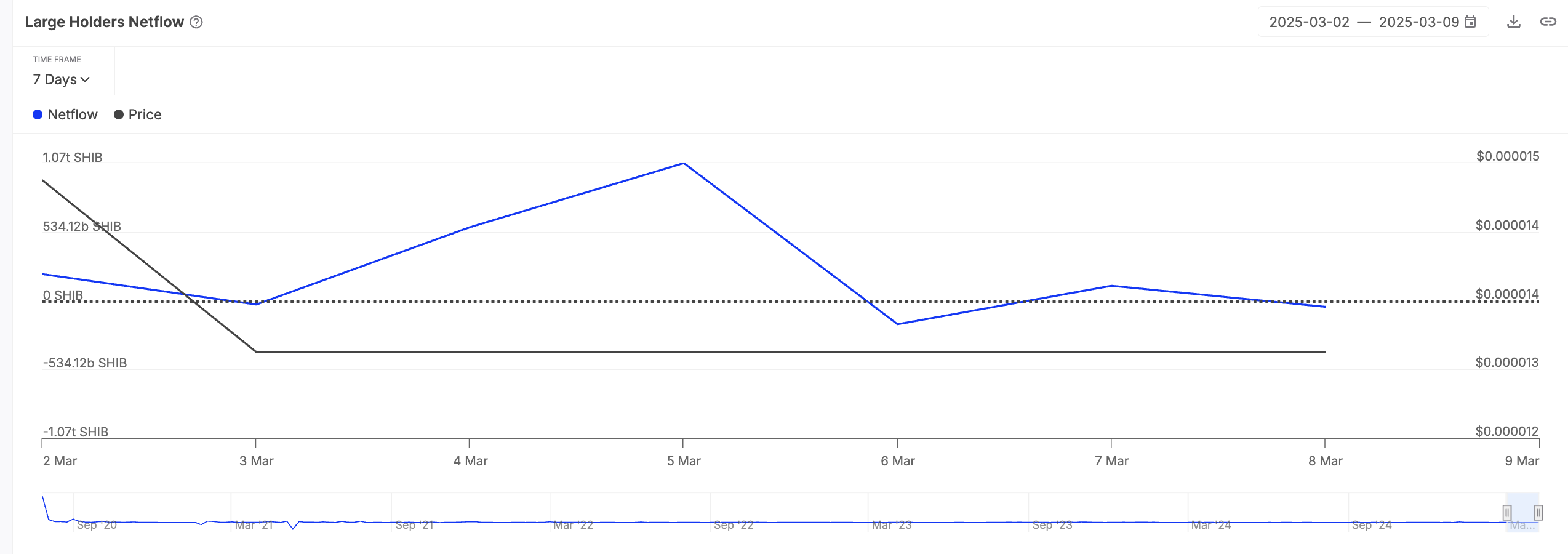

According to Intotheblock, Netflow of big Shib holders fell 123% last week. This happens in the middle of the drop in prices of 8% in the meter piece.

Large holders refer to whale addresses which hold more than 0.1% of the food in the circulation of an asset. Their Netflow measures the influx and the flow of tokens in their wallets to follow if they accumulate (positive Netflow) or unloading (Netflow negative) their assets.

When this metric falls, it indicates that the whales sell large parts of their assets, leading to an increased offer and a more downward pressure on the price.

In addition, this decrease in shib Whale Netflow could worsen the weakening of confidence among the retail merchants of Shib, encouraging them to sell their parts in anticipation of new losses. This can accelerate the drop in short -term shib prices.

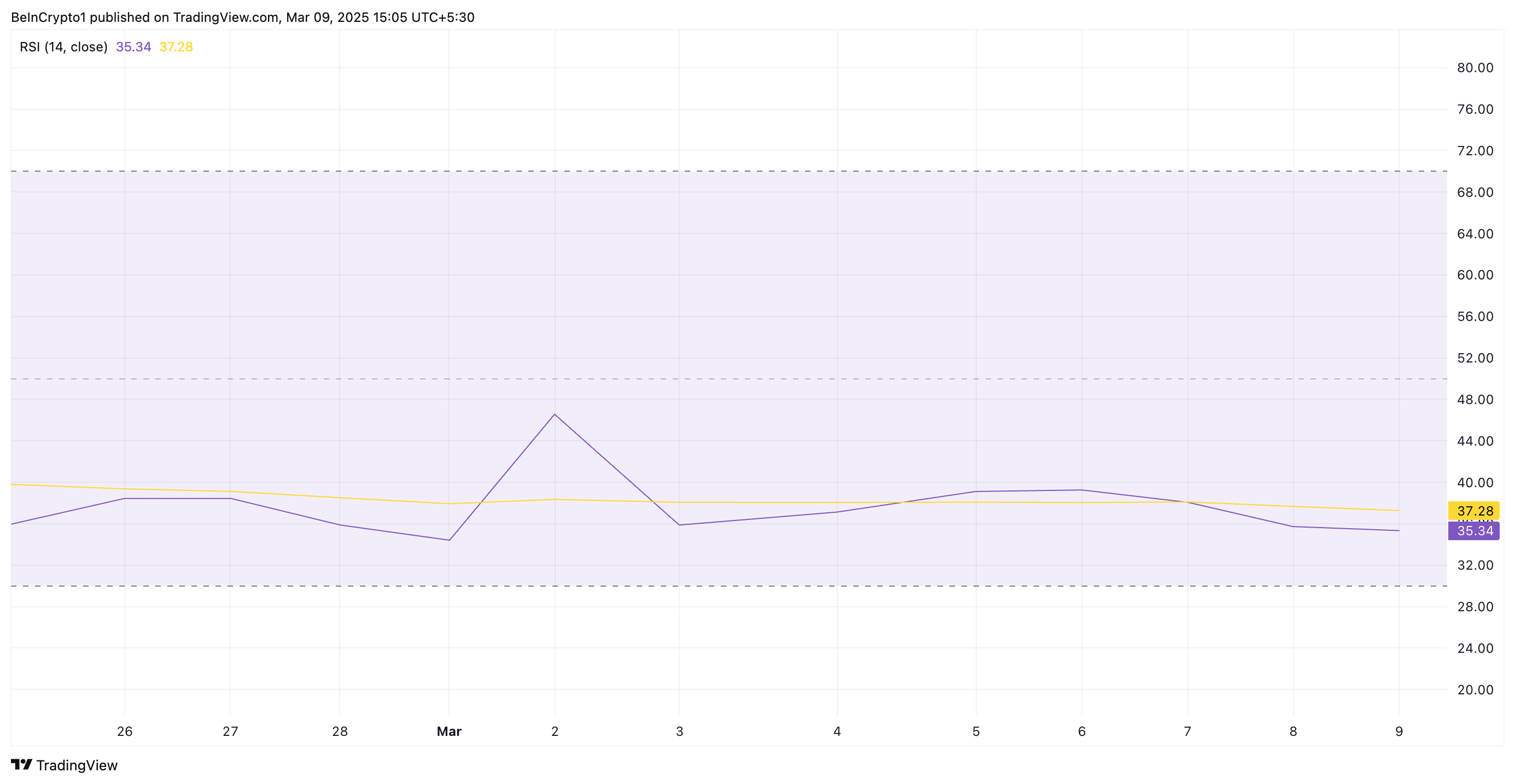

On the daily graphic, the relative force index of the fall of Shib supports this downward perspective. At the time of the press, this momentum indicator is a downward trend at 35.34.

The RSI of an asset measures the conditions of occurrence and overabundance of an asset. It varies between 0 and 100, with values above 70 indicating that the asset is exaggerated and due for a drop. Conversely, the values under the age of 30 suggest that the assets are argued and could attend a rebound.

At 35.05, the Shib RSI indicates that the asset is approaching the territory of occurrence but has not yet entered it. This suggests weakening the purchase pressure and referring to the potential of the descent unless the demand for money of meme does not resume.

SHIB holds below the descending trend line

Shib has stayed below a descending trend line since December 8, keeping its price down. This model is formed when the price of an asset regularly reduces peaks over a period, connecting these peaks with a downward ball line. This is a downward trend, indicating prolonged sales pressure among the actors of the Shib market.

If this drop continues, the shib is likely to fall to a seven -month of 0.000010107 $.

However, if the purchase pressure resumes momentum, this could lead to the value of SHIB at $ 0.0000166.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.