SOL Battles Selling Pressure as Solana DEX Usage Grows

Solana (soil) has increased by almost 18% in the last 30 days. The upper ground structure remains technically intact, although certain key momentum indicators show signs of weakening.

At the same time, Solana continues to dominate the volume of Dex and the classification of blockchain income, strengthening its strong position in the wider ecosystem. Here is a more in -depth examination of the latest technical and chain developments for Solana.

Hauver structure intact for Solana, but key momentum signals weaken

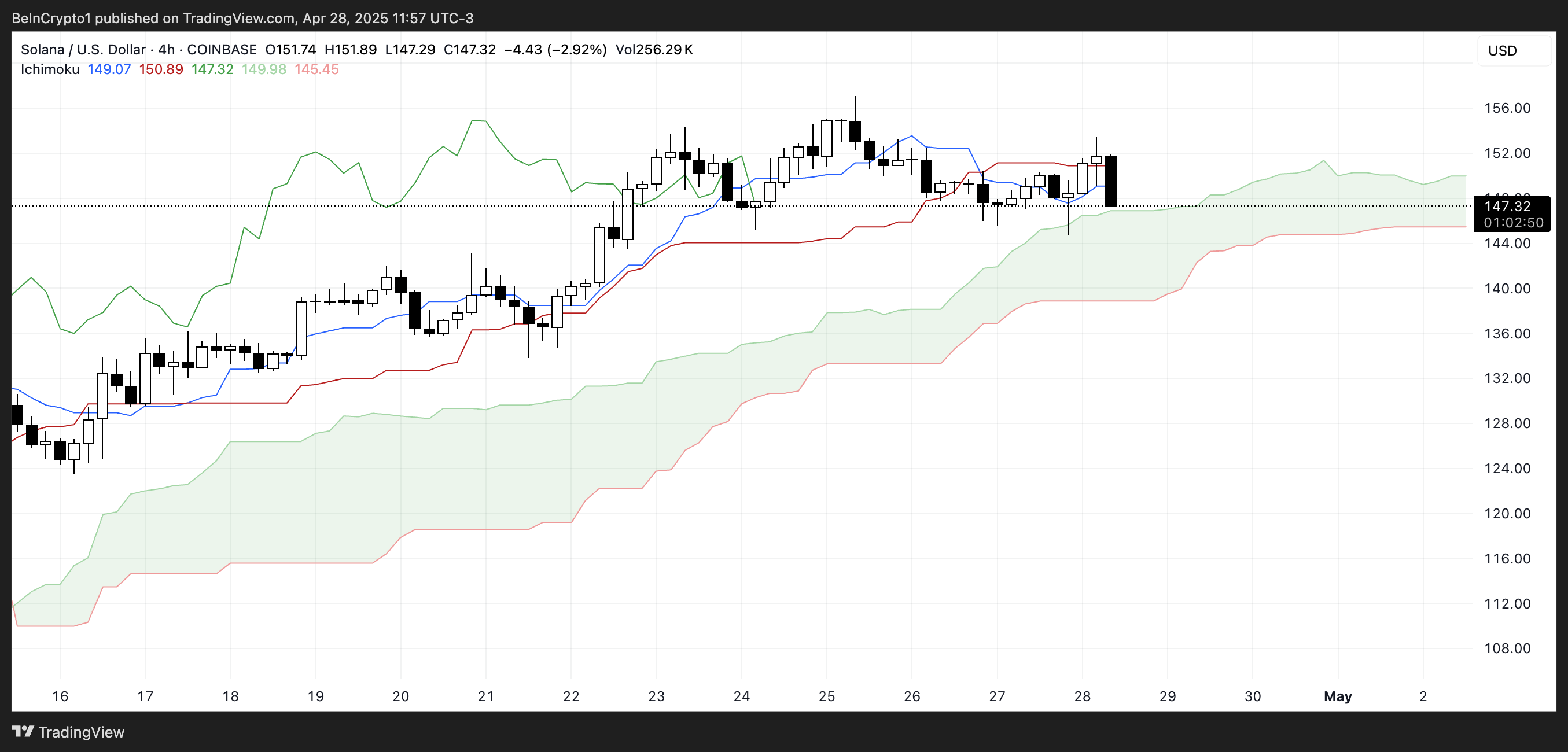

The Solana’s Cloud Ichimoku graphic shows the price test support near the top of the green cloud.

The blue basic line (Kijun-Sen) and the red conversion line (Tenkan-Sen) flattened and took place near the candles, signaling a short-term loss of momentum.

The green lead duration (Senkou Span a) remains above the red duration (Senkou Span B), but the narrowed distance point to weaken the bullish momentum.

The institutional momentum seems to build, because Defi Development Corp aims to become “Solana microstrategy” with a plan of $ 1 billion and a coinbase ratio highlighting business treasures in Solana.

If soil remains above the cloud, the bullish structure remains intact, but a drop inside could trigger a deeper consolidation.

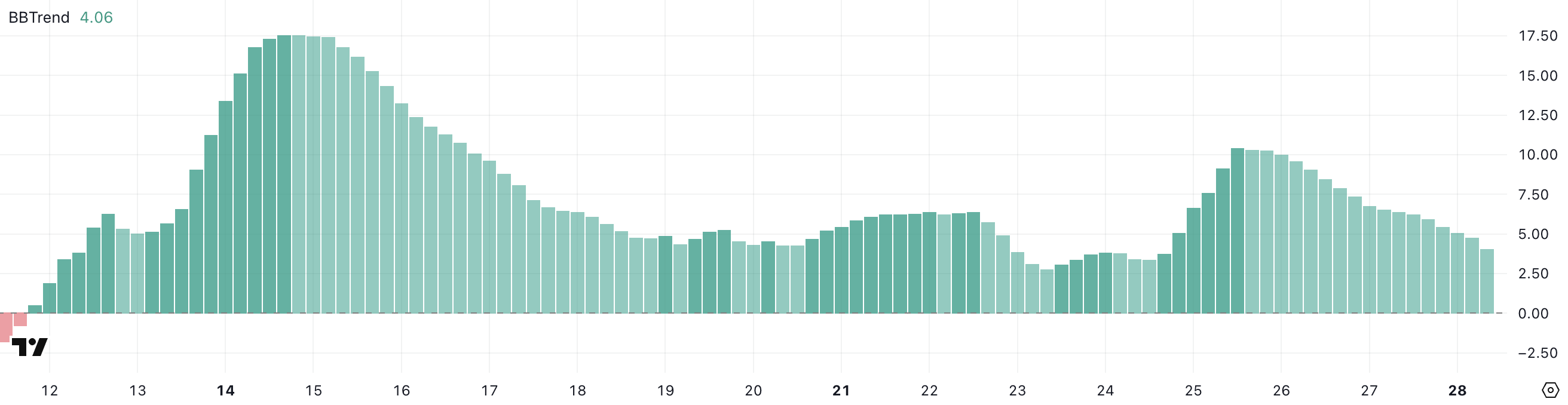

The Bbtrend soil indicator also weakens, currently 4.06 down against 10.43 three days ago.

Despite this, Bbtrend has remained positive for 17 days since April 11, showing that the wider momentum remains.

The Bbtrend measures resistance to trend by expansion or contraction of the Bollinger strip; A falling bbtrend often signals a slowdown in the momentum or consolidation.

If Bbtrend continues to drop, soil could lose more momentum, but the buyer’s recovery could still lead to a new breeze attempt.

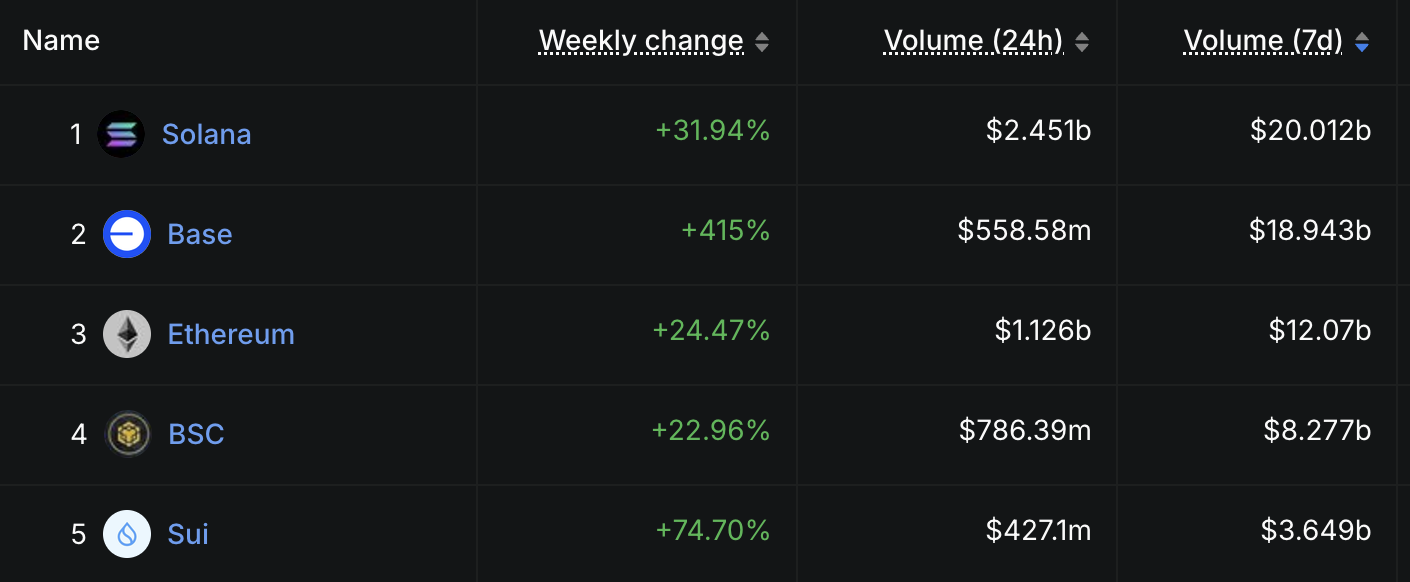

Solana continues to dominate the volume DEX and the application costs

Solana continues to dominate the volume DEX between different channels, recording $ 20 billion in the volume of negotiation in the last seven days.

In the last last 24 hours, Solana’s DEX volume reached $ 2.4 billion. During last week, Solana’s DEX volume increased by almost 32%.

Beyond the Dex activity, the applications based on Solana dominate the graphs concerning the revenues and the costs of the blockchain.

Six of the first 10 channels and protocols – excluding stages like Tether (USDT) and Circle (USDC) – are directly linked to the Solana ecosystem, with Pump and Jito leading.

Soil in the key decision area with 23% upward potential on breakout

The exponential mobile average lines of Solana (EMA) remain optimistic, the short-term EMAs are still positioned above the long-term EMA.

However, Sol is now negotiated very close to a critical level of support at $ 145, which has become an important area to monitor. If this care is tested and fails, Solana Price could quickly switch to the next support area around $ 133.82.

In a deeper sales scenario, the downward trend could expand around $ 123.41, considerably weakening the current bullish structure.

On the other hand, if buyers retreat and strengthen the upward trend, soil could rally to test the resistance level of $ 157.

A successful rupture greater than $ 157 would strengthen the bullish momentum and potentially open the way to a movement around $ 180, offering around 23% of the current levels.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.