SOL Price Gains 21% as Market Cap Outpaces Sony

Solana (Sol) Price is up 8% over the past 24 hours and 21% over the past week, with its market cap nearing $130 billion – bigger than companies like Sony, Dior and ADP. Trading volume jumped nearly 19% in the past 24 hours, now at $10 billion, reflecting strong market activity.

Technical indicators such as Ichimoku Cloud and BBTrend suggest a bullish setup, although signs of consolidation are a potential pause in momentum. If Sol regains strength, it could test resistance at $292 and potentially reach $300 for the first time, while a reversal can bring key supports at $229 and $211 into play.

Sol Ichimoku Cloud Shows Bullish Pattern

The Solana Ichimoku cloud indicates bullish sentiment, with price currently trading above the cloud, signaling strength. The Tenkan-Sen (Blue Line) is above the Kijun-Sen (Red Line), suggesting that short-term momentum supports the bullish case.

The Green Cloud leader (Senkou Span A above Senkou Span B) provides further confirmation of a favorable trend.

The absence of steep ascending angles on the tenkan-sen and kijun-sen suggests that the trend may be consolidating rather than accelerating. A move above $270 could confirm continued upside, with the potential to test higher resistance levels.

However, a pullback in the cloud could indicate indecision or weakening momentum, with the lower edge of the cloud providing a critical support area.

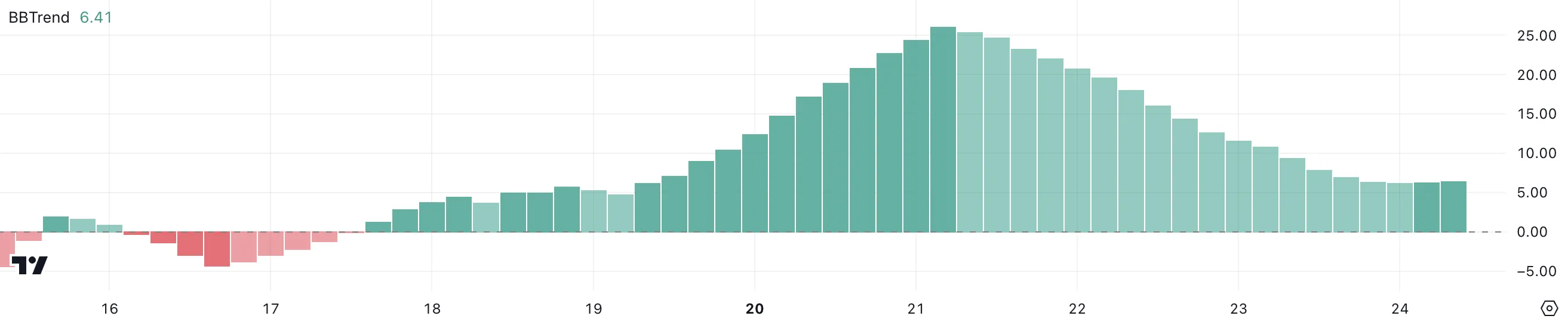

Solana Bbtrend is stable and positive

Sol BBTrend is currently at 6.41, down from its recent high of 26 just three days ago, although it has remained positive for an entire week. BBTrend, or Bollinger Band Trend, is a technical indicator that measures the strength and direction of a trend based on the interaction of price with Bollinger Bands.

Positive values indicate upward momentum, while negative values suggest a downward trend. The higher the value, the stronger the trend in its respective direction.

Although Solana Bbtrend has fallen significantly from its recent peak, its stabilization at 6.41 suggests that the decline in momentum has been halted. This could mean that the price is consolidated, potentially building a base for another upward move if buying pressure returns.

On the other hand, the current level also indicates that the trend is not as strong as it was recently, which could signal caution for traders as they wait for clearer confirmation of the next directional move.

SOL Price Prediction: Will Solana Hit $300 for the First Time?

If Solana Price can regain some major momentum, it could test its previous high of $292 and potentially rise to $295. Breaking these levels could push SOL price to $300 for the first time, marking a milestone and attracting additional bullish interest.

These levels highlight key resistance points for traders to watch as Solana attempts to continue its upward trajectory.

Conversely, if Momentum cools and the trend reverses, SOL price may test the support level at $229. A breakdown below this point could lead to further declines, with the next support at $211 and a deeper retracement to around $192 if this level is also lost.

Disclaimer

In accordance with Project Trust guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. Beincrypto is committed to accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decisions. Please note that our Terms & Conditions, Privacy Policy and Disclaimer have been updated.

![Top 6 Disk Partition Managers for You to Choose [2025] Top 6 Disk Partition Managers for You to Choose [2025]](https://i3.wp.com/media.assettype.com/analyticsinsight%2F2025-03-11%2Foxtb6o50%2FTop-6-Disk-Partition-Managers-for-You-to-Choose-2025.jpg?w=1200&ar=40%3A21&auto=format%2Ccompress&ogImage=true&mode=crop&enlarge=true&overlay=false&overlay_position=bottom&overlay_width=100&w=390&resize=390,220&ssl=1)