SOL Price Holds $200 as Whale Activity Slows Down

The Solana (soil) price oscillates nearly $ 200 level, its market capitalization trying to recover the $ 100 billion mark and the daily negotiation volume at $ 4 billion. Meanwhile, the number of Solana’s Bales decreased after reaching a summit of 5,167 on January 25, now at 5,067.

This change in the activity of whales, combined with a weakening of the strength of trends in the DMI and to Recreted EMA lines, suggests that Sol is at a critical point, with bull and lowering scenarios always at stake.

The Solana whales descend after reaching a top of all time

The number of Solana whales – address holding at least 10,000 soil – culminated at a top of 5,167 all time on January 25 before starting a drop. Although there was a brief resumption at 5,131 on February 4, the number continued to decrease, now to 5,067.

Monitoring the activity of these major holders is crucial, because whales often play a key role in market trends. Their accumulation can report confidence and a potential price wave, while dropping the addresses of whales can indicate distribution, increasing the risk of pressure.

Although the current number of whales remains relatively high compared to historical levels, it approaches its lowest point in the last month. This suggests that some major holders can reduce their exposure, which could introduce volatility if the trend accelerates.

However, the overall number is still high, which means that there is a significant presence on the whale on the market. The fact that this trend continues to decrease or that stabilizes will be a key factor to determine the next movement of Solana prices.

Solana DMI shows that the sales pressure is busy, but the purchase of the pressure remains low

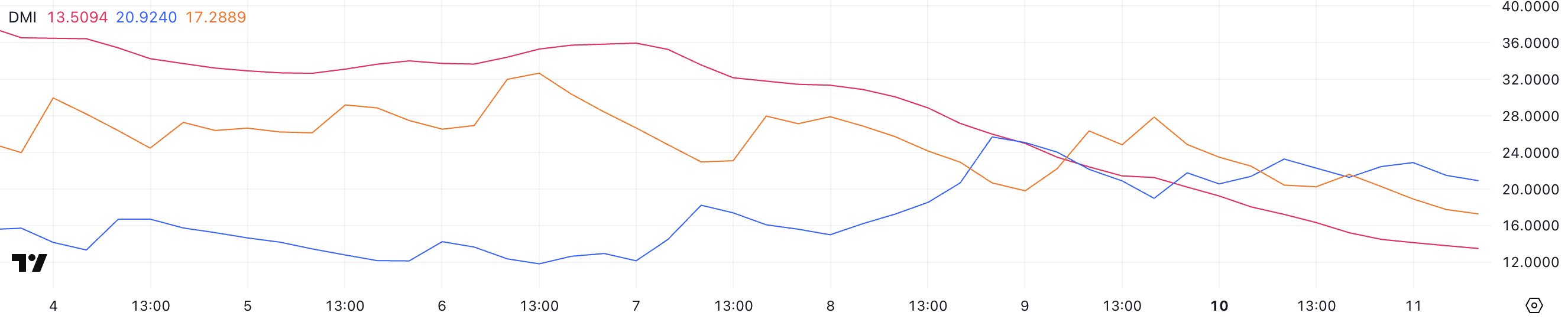

The Solana DMI graph shows a sharp drop in the strength of trends, the ADX falling to 13.5 against 31.5 in the last three days. ADX, or average directional index, measures the strength of a trend, with readings above 25 generally indicating a strong trend and values below 20 suggesting a moment of low or non -existent trend.

The ADX is now much less than 20 years, it points out that Solana’s recent trend has considerably lost its strength, leaving the market without a clear directional bias.

Looking at the directional indicators, + DI is 20.9 and fluctuated between 19 and 23 in the last two days, while -Di went from 27.8 to 17.2. This suggests that the down pressure has grown considerably, but the bullish momentum has not reinforced enough to establish a clear rise.

With the two converging and ADX indicators at very low levels, Solana is currently in the consolidation phase rather than a decisive trend. Until a stronger directional movement emerges, the ground price can continue to negotiate itself on the side, while waiting for a catalyst to define its next movement.

Sol price prediction: Will Solana soon test the resistance of $ 220?

The Solana prices graph indicates that its EMA lines are shrinking, suggesting a reduced momentum and the absence of a clear trend direction. If the bullish momentum of yields and an upward trend develops, the ground price could first test the level of resistance of $ 220.

A break above this could trigger new gains, which could potentially push the price to $ 244, its highest level since the end of January.

On the other hand, if a downward trend emerges and strengthens, Sol Price could retest its key support at $ 187. A break below this level would expose the price down, with the potential to lower as low as $ 176, marking a correction of 12.5%.

This scenario would indicate that the sellers took control, increasing the probability of a continuous lower movement. The EMA lines being always convergent, the market remains undecided and the next decision will depend on the fact that buyers or sellers take the lead.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.