SOL Price Rally Faces Pressure—Is $206 the Breakout Point?

Solana (soil) jumped almost 25% over the last week, taking the momentum of a wider crypto market rally which rekindled the haus feeling through the main altcoins.

Now, price levels have seen for the last time in February, Sol attracts a renewed interest from merchants and investors. However, data on the chain suggest that not everyone is convinced that the rally will last. What does this mean for short-term Altcoin?

Solana’s merchants separate between hope and prudence

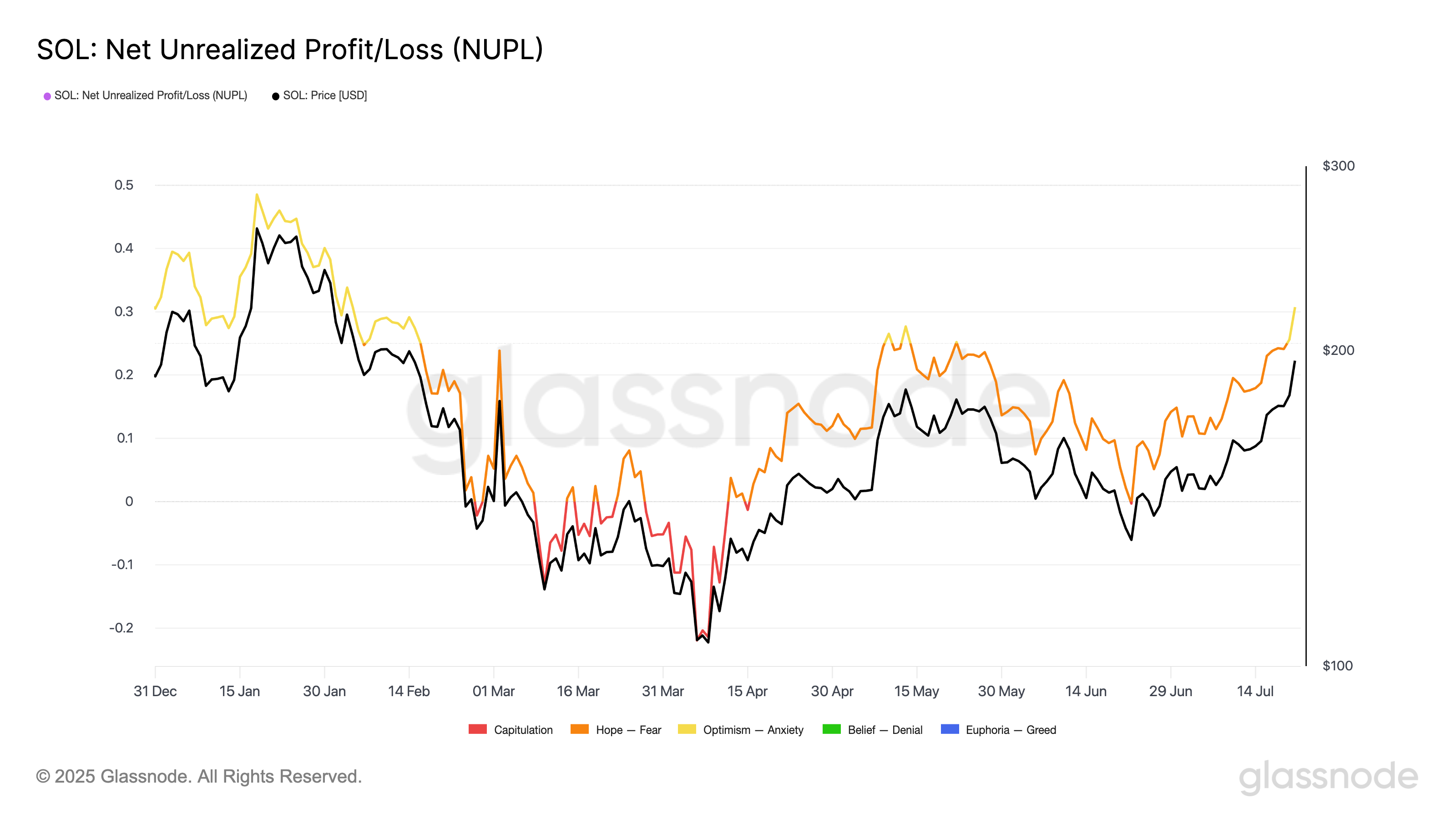

According to Glassnode, the net that is not made net (NUPL) net of ground places the market in the “Optimism – anxiety” area.

Metric Nuppl measures the difference between the total of the unparaged profits of all holders and not made losses compared to the market capitalization of an asset. It gives an overview of whether the market, on average, is in a state of profit or loss.

The market is considered in an optimism phase – anxiety when most investors are seated in modest profits. They hope but not entirely convinced that a sustained rally is underway.

Sol has displayed two -digit gains in last week and is now negotiated at $ 198.43, approaching the level of $ 206 psychologically significant, a price it last in February.

While some investors firmly stand in anticipation of a decisive break greater than $ 206, others remain skeptical about the violation of this key resistance. This tension begins to show market behavior, as evidenced by the readings of the daily graphic.

Floor climbs higher, but merchants are quietly starting to sell the top

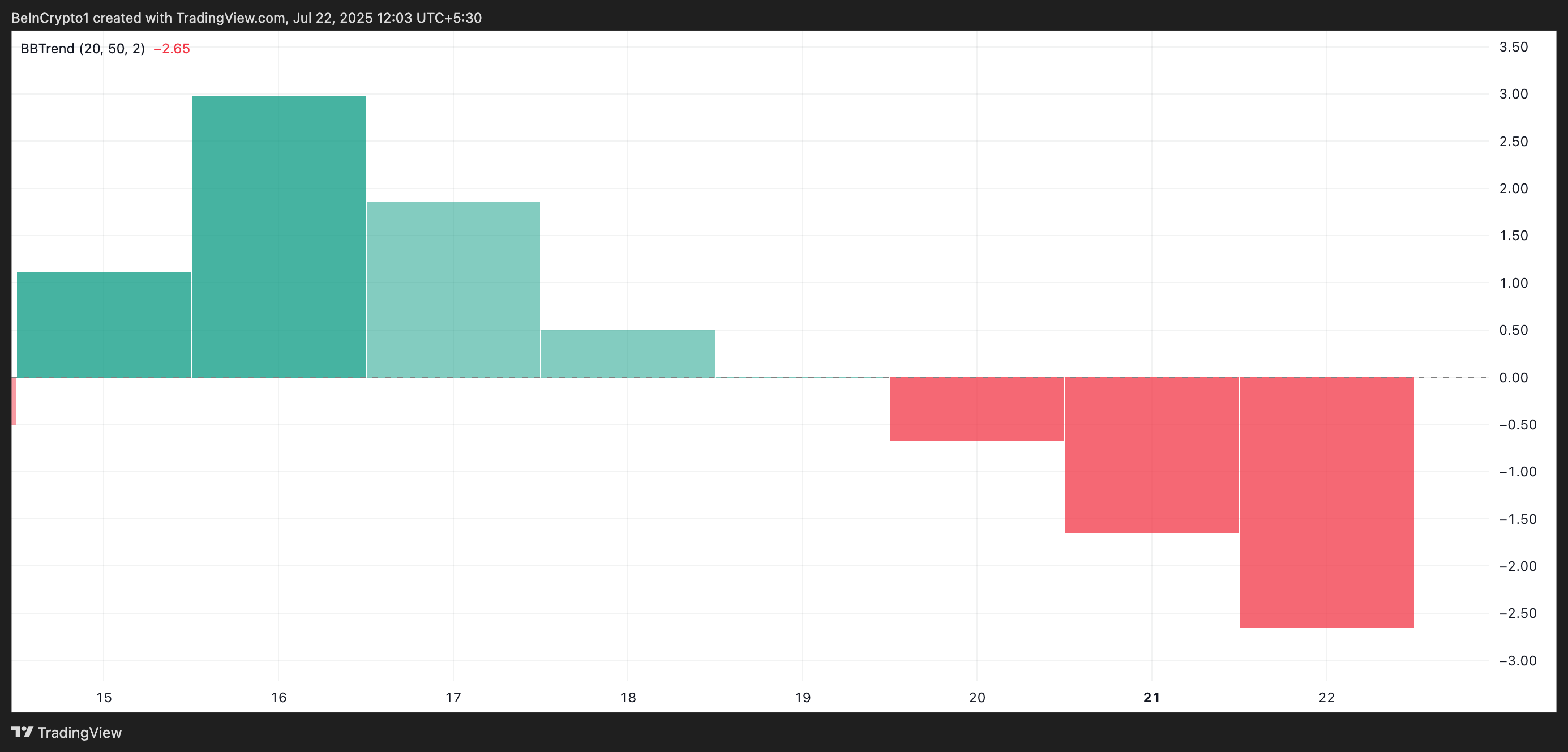

Despite the net prices rally and an increase in activity on the chain, soil bbtrend points to light sales pressure in progress. During the last three days, the momentum indicator has displayed red histogram bars whose sizes have gradually increased, reflecting the point of the sale pressure.

The Bbtrend measures the strength and direction of a trend based on the expansion and contraction of Bollinger bands. When it returns red bars, the price of the assets constantly closes near the lower group of Bollinger, reflecting a sustained sales pressure and referring to the potential of the additional decline.

This suggests that, even if the bullish feeling grows, a segment of the soil market is starting to lock profits, an early potential sign of flickering confidence.

Solana’s fate is located between $ 206 and $ 183

The resistance level of $ 206 is now a crucial level for soil. If the purchase of the pressure is intensifying and soil manages to break above this threshold, it could be transformed in a solid support zone, opening the way to a potential rally towards $ 219.97.

However, if the sales activity increases, soil could lose some of its recent gains, bringing the price back to the support area of $ 183.75.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.