SOL Price Surges as Golden Crosses Signal Bullish Momentum

Solana (SOL) has surged 15% over the past seven days, holding near the $200 mark. Its market capitalization rose to $107 billion, surpassing that of BNB. This strong performance is supported by bullish signals, including increased whale activity earlier this month and the formation of several golden crosses on SOL’s EMA charts.

Although some profit taking has occurred among whales, their activity remains high compared to historical levels. With this momentum, SOL is well-positioned to test key resistance levels and potentially break above $240.

Solana whales decline in ATH but remain at high levels

The number of addresses holding at least 10,000 SOL increased significantly between January 4 and 5, from 5,032 to 5,090. This upward trend continued with some fluctuations, reaching an all-time high of 5,104 on January 11.

Monitoring these large holders, often called whales, is crucial because their activity can strongly influence the market. Whales’ increased accumulation often reflects their confidence in the future of the asset, which could drive prices higher as their positions increase.

After peaking on January 11, the number of whale addresses declined from 5,096 on January 14 to 5,063 on January 16. While this decrease may suggest some profit taking, it is important to note that current whale numbers remain significantly higher than historical numbers. levels.

This sustained interest among major holders suggests that confidence in Solana’s uptrend potential is still strong, even with the recent fluctuations. Such stability at high levels could provide a solid foundation for SOL price growth.

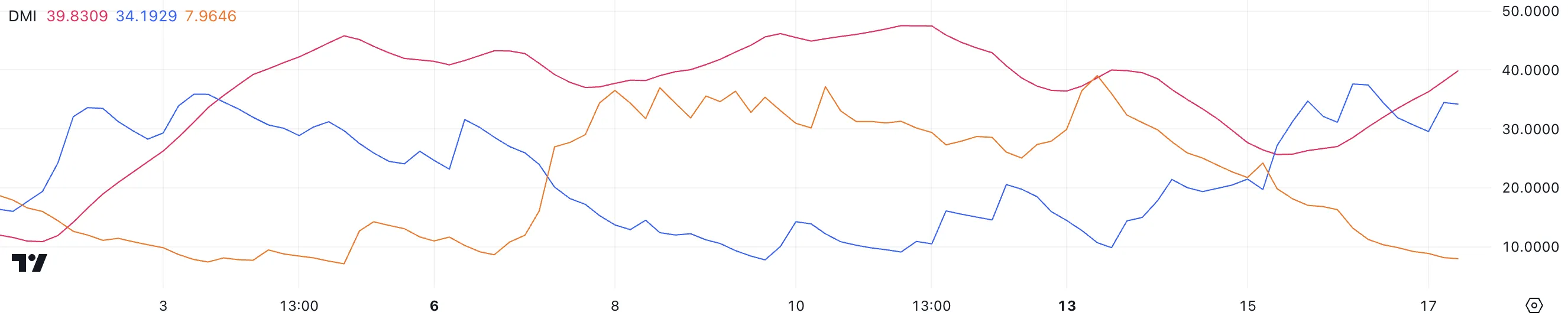

SOL DMI shows that the current uptrend is strong

Solana’s DMI (Directional Movement Index) chart shows a sharp increase in the ADX (Average Directional Index) from 25.6 to 39.8 over the past two days. This surge coincides with the start of SOL’s current uptrend and the formation of golden crosses.

The ADX measures trend strength, with values above 25 indicating a strong trend and values above 40 signaling even stronger momentum. A rising ADX during an uptrend suggests growing confidence in the direction of price movement.

Meanwhile, the +DI (positive directional index) rose from 19.7 to 34.1, reflecting increased buying pressure, while the -DI (negative directional index) fell from 24.2 to 7, 9, indicating a decline in selling pressure. Together, these changes indicate a strong uptrend, with buyers firmly in control of the market. 2

If this momentum continues, it could signal further upside momentum for SOL, as the widening gap between +DI and -DI suggests strengthening buyer dominance. Combined with the rising ADX, these indicators paint an optimistic picture of SOL’s near-term price action.

SOL Price Prediction: Will Solana Recover to December Levels?

SOL’s Exponential Moving Average (EMA) lines have shown several golden crosses recently, with the short-term line crossing above several others. This indicates strong bullish momentum, suggesting a continuation of the current uptrend. If this momentum persists, Solana price could test the next resistance level at $229.

Breaking this resistance could open the way to $234, or even $243, pushing SOL above $240 for the first time since early December 2024.

However, if the uptrend reverses and a downtrend begins, the support at $211 will play a crucial role. If this level is tested and fails to hold, SOL price could fall further to $203, with a possible extension to $185 if bearish pressure intensifies.

Disclaimer

In accordance with Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to providing accurate and unbiased reporting, but market conditions are subject to change without notice. Always do your own research and consult a professional before making any financial decision. Please note that our Terms and Conditions, Privacy Policy and Disclaimer have been updated.