Solana Death Cross Forms, Pointing to Potential Breakdown

A week ago, a death’s cross appeared on the graphic of a day of Solana (ground), signaling a growing lower momentum.

While the price of the part has since consolidated in a range, the sales pressure increases suggests a potential short -term rupture.

The Cross of Solana’s death and the sluggish fuel fears

The Beincrypto evaluation of the graph of a day -to -day / USD day reveals that a death cross emerged seven days ago. It is a lowering pattern formed when the short -term mobile average of an asset (50 days) crosses its long -term mobile average (200 days).

It confirms a shift from an upward trend to a downward trend, indicating a weakening of the momentum and an increased risk. Since the model emerged, the soil price has exchanged in a narrow range. He has since oscillated between the resistance formed at $ 136.92 and a support floor of $ 121.18.

However, with the assembly of the sale pressure, Sol appears in progress for ventilation below this level of support. The widening gap between its SMAS of 50 days and 200 days reinforces the probability that this will happen in the short term.

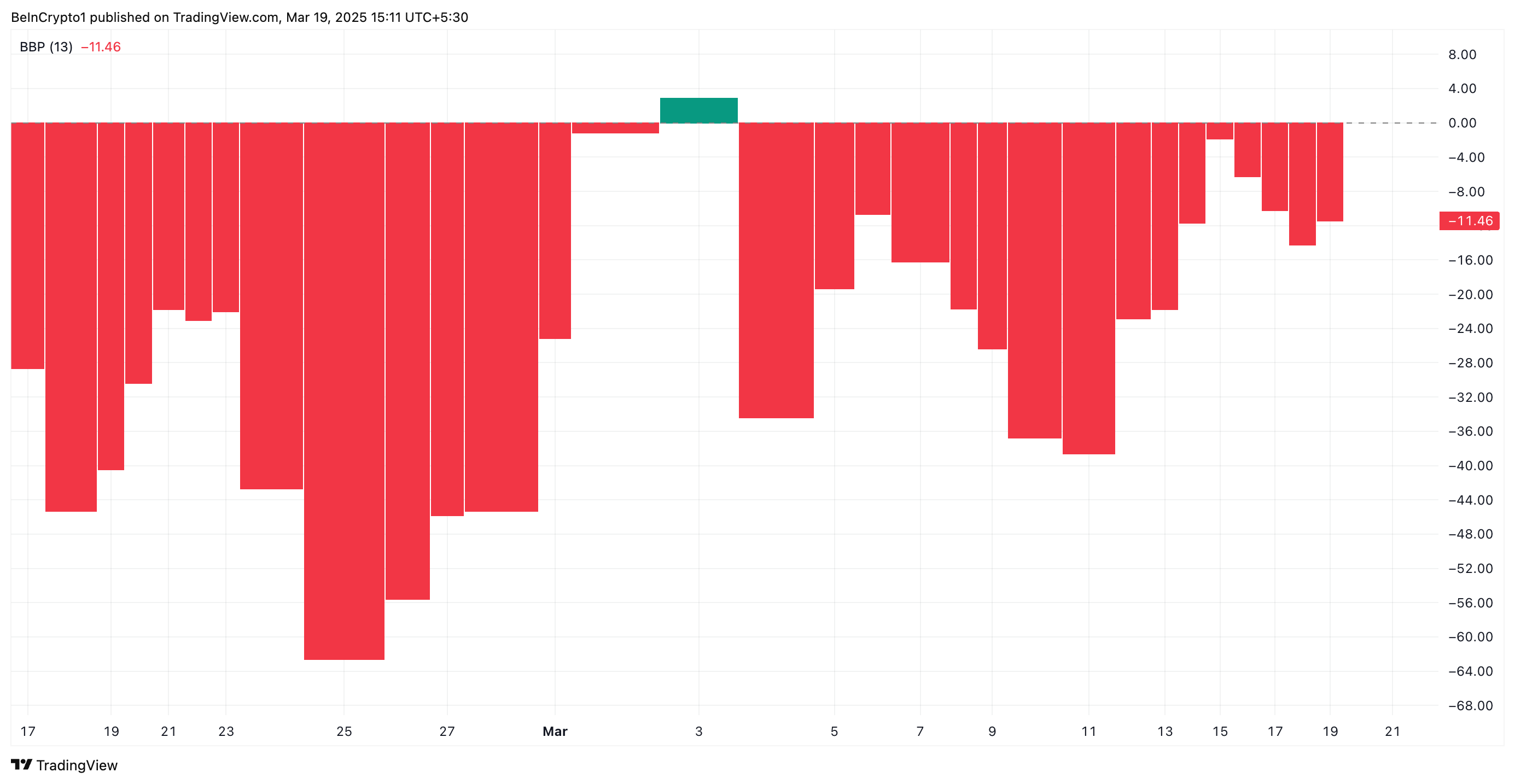

Adding to this lower perspective, the rays index of the negative soil elders indicates that the sellers take control. This indicator is currently at -11,46 at the time of the press.

The rays index of the elderly measures the strength of buyers (Bull Power) and sellers (power) by comparing the high and low prices of an asset to its exponential mobile average (EMA). When the index is negative, this indicates that the power of bear is dominant.

This confirms the increase in sales pressure among soil merchants and refers to the probability of a break below the support formed at $ 121.18.

Sol Bears Eye $ 110 as a sales pressure support-Will he support?

The soil ventilation below the support area of $ 121.18 would exacerbate the downward pressure on its price. Such a violation would offer another confirmation of the downward trend on the market and could drop the price of the room to $ 107.88.

On the other hand, if the feeling of the market improves and Sol requires peaks, it could pierce resistance at $ 136.92 and go up to $ 152.87.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.