Solana Exchange Balance Reaches 14-Day High

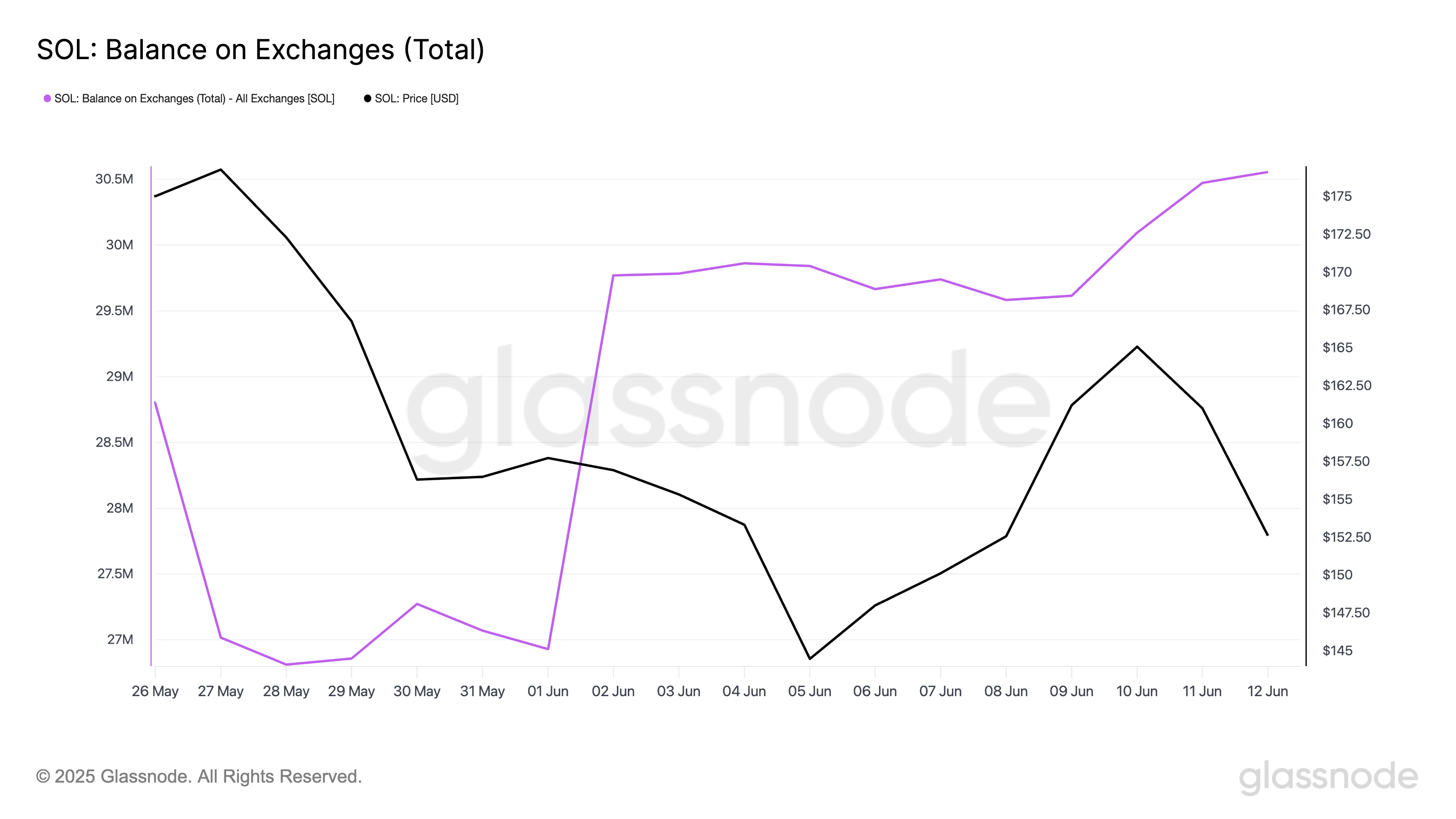

The total amount of Solana parts detained on the exchange addresses has reached its highest level in the last 14 days. This rise in stock market sales suggests that more investors are preparing to unload their assets on the ground in the middle of a cooling cryptography market.

The peak of exchange sales comes in the middle of the wider market retirement which has weighed heavily on the feeling of investors. The market is struggling to maintain the momentum, Sol is about to extend its drop in prices.

Floor investors are preparing to sell

In recent days, digital assets have struggled to maintain an upward momentum. This reduced the interest of investors and sparked an increase in the balance of the soil exchange. It is now at 31 million soil, its higher in two weeks.

When the exchange balance of an asset increases, more of its token parts are deposited in centralized exchanges. This is considered a lower signal, because traders generally move tokens to exchanges when they intend to sell.

Solana Exchange balances climbing at a 14 -day summit confirms that his investors are preparing to leave their positions in the middle of weakening of the feeling of the market.

In addition, the soil term financing rate has become negative for the first time in more than a week, confirming the resurgence of down pressure. According to CorciLass, this is currently at -0,0006%.

The funding rate is a periodic fee paid by traders perpetual term contracts to maintain the price of the contract aligned with the cash price of the underlying assets. A negative financing rate indicates that short positions are more requested than long.

This trend highlights the grounding sales pressure on soil and refers to a possible continuation of its drop in prices.

Setting pressure supports on ground

Inputs of exchange up soil and negative financing rates paint a table of caution for its short -term performance. If the lower pressure gains, the soil price could violate support at $ 142.59 and fall around $ 123.49.

However, if the Bulls resume domination, they could lead to a rebound at $ 171.88.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.