Double Bottom Forms with Bearish Threat as XRP Holds Above $3 Support

XRP shows signs of a double -bottomed pattern, a potential optimistic signal, but the downward pressure remains. According to our analysis, the level of support of $ 3 is essential, because XRP continues to hold above despite the uncertainty of the market. However, the weakening of chain measures could put pressure on buyers, which allowed them to lose momentum and increase the risk of sale.

XRP records its best month

July was the strongest month for XRP so far, the price by seeing major gains after several market updates. Coinmarketcap data show that XRP has jumped out of 41% in the last 30 days, holding stable above the important level of support at $ 3.

According to CorciLass, XRP has faced a wave of liquidation in the past 24 hours. The total value of these liquidations was more than $ 17.5 million, with almost $ 13 million from long positions, while buyers came out following a rejection around the bar of $ 3.2, leading to a sale.

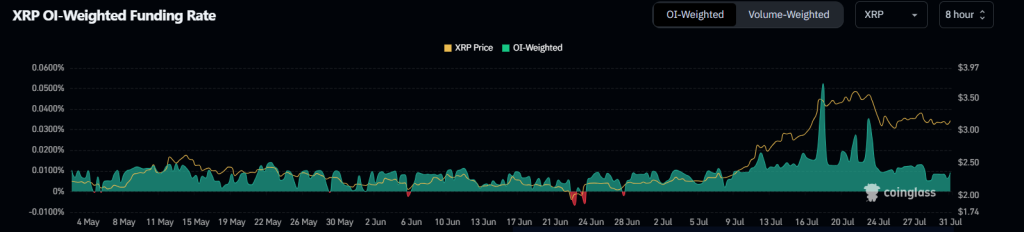

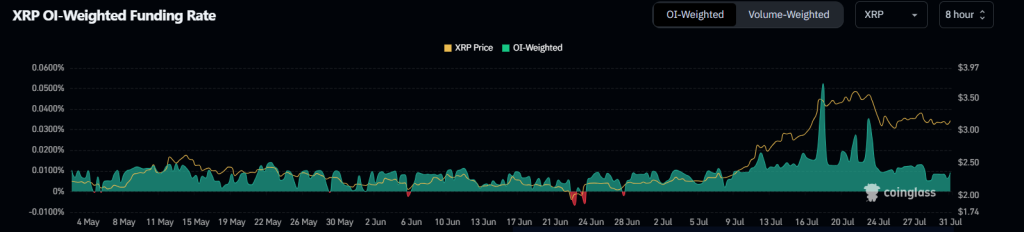

An open interest in XRP fell slightly, down 0.16%, now to 8.46 billion dollars. Despite this small decline, the funding rate remains positive at 0.0092%, which suggests that traders are still leaning towards an upward perspective even if the downward pressure increases.

Read also: Solana, sui could 20x as soon as the analyst says “it’s time Altcoin now”

During last week, monthly XRP contracts regularly negotiated at a bonus of 6% to 8%, which shows that the market feeling was stable during the $ 3 price. Even when XRP has briefly exceeded $ 3.6, there was no significant increase in the demand for long leverages.

Part of the recent purchase request around XRP also comes from speculation on an ETF Spot approved by the United States. If it is approved, it could also have a positive impact on other altcoins, including Litecoin, Solana.

What is the next step for the XRP price?

XRP is currently faced with strong competition between buyers and sellers around the simple 20 -day mobile average (SMA) at $ 3.1. During the editorial staff, the XRP price is negotiated at $ 3.08, down more than 1.5% in the last 24 hours.

Looking at the XRP price table, Bears failed to establish a foot below $ 3, the Fibonacci retracement of 38.2%. Price action, when viewed on the hourly graph, suggests a double -back training at $ 3, with the resistance to the neck at $ 3.334 (July 28).

If the price drops below the level of support of $ 3.05, it could drop to around $ 2.95. Buyers are likely to strongly defend this level, as a break below could lead to a deeper drop by $ 2.8.

On the other hand, if XRP rebounds by $ 3, this would show a strong purchase interest at lower levels. While the 20-day SMA can act as a resistance during recovery, if the bulls manage to pass, the XRP / USDT pair could reach $ 3.33 and perhaps even reach $ 3.7.

The RSI level has rebounded strongly, currently negotiating at level 46. Although it holds below the midline, buyers are confident enough to send the price to $ 3.3 of Retest.