Solana Futures Market Turn Bearish as SOL Might Dip Below $130

The Solana Prize was faced with significant volatility during last week due to recent market problems. This has led to a sharp decline in its feeling of the term market when leverages seem reluctant to take upward positions.

This lack of confidence increases the risk of a new price drop, with a bay below the level of $ 130 in the short term.

Solana struggles while merchants come out

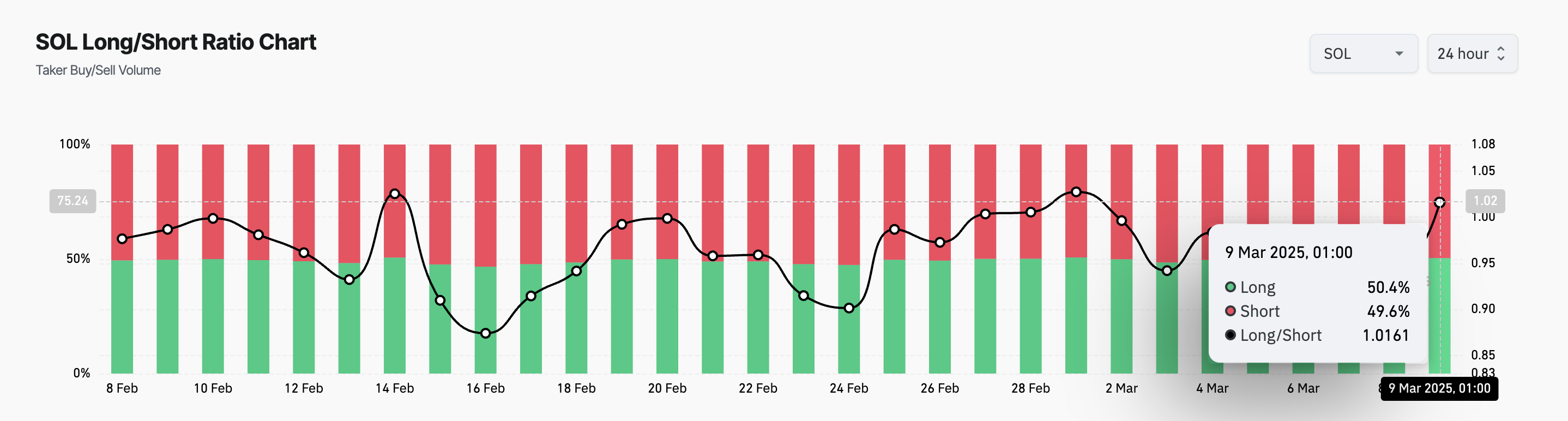

The negative soil financing rate is an indicator of the decreasing biases among its traders in the long term.

According to Coinglass data, Sol Perpetual Futures has maintained a negative financing rate in the last three days, indicating that the open sellers pay to occupy their positions. At the time of the press, this rises at -0.0060%.

The financing rate is a periodic cost exchanged between long and short traders in perpetual term contracts to maintain the price of the contract aligned on the cash market.

As with soil, when this rate is negative, it means that the sellers discovered (those who bet on a drop in prices) pay fees to long traders, indicating a lowering feeling on the market.

Consequently, more traders are positioned for a drop in price, strengthening the downward pressure on the price of the room.

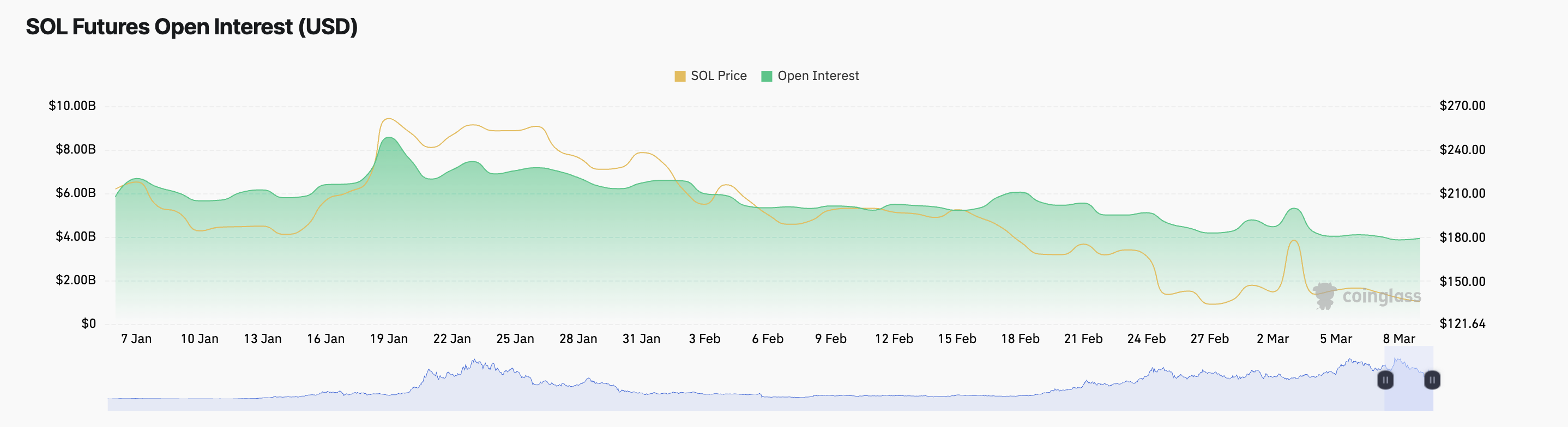

In addition, the lack of confidence among soil -term merchants is reflected in its open interest. At the time of the press, this is $ 3.94 billion, down 19% since early March.

The open interest of an asset follows the total number of active term contracts which have not been settled.

When this falls, in particular during a period of drop in prices, it suggests that traders take up positions without opening new ones. This confirms the reduction of the conviction in a short -term resumption of soil prices among its merchants in the long term.

So Solana Bulls weakens – can they prevent a drop of less than $ 130?

At the time of the press, soil is negotiated at $ 137.70, resting just above the support floor of $ 136.62. While the bullish feeling shrinks, this level may have returned to a resistance area.

If this happens, the soil price could go below $ 130 to exchange hands at $ 120.72.

On the other hand, if the bullish momentum returns to the ground market, this downward projection will be invalidated. In this scenario, a new request could generate the price of the play to $ 182.31.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.