Solana Outflows Spike, Potentially Dragging the Price Below $140, While The $250 Target Remains Active

Solana is falling back into the main levels of support, because the sales volume means that the price is going to the crucial support nearly $ 140. The ground price action shows a correction after a rejected summit and can now approach the basis of the previous request. The support of less than $ 151, which is responsible for space, has led to a drop below $ 150, which could lead to a deeper retirement to the area from $ 141 to $ 145.

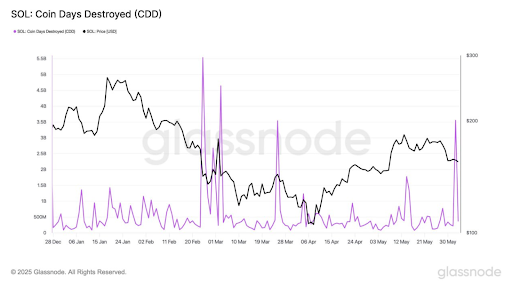

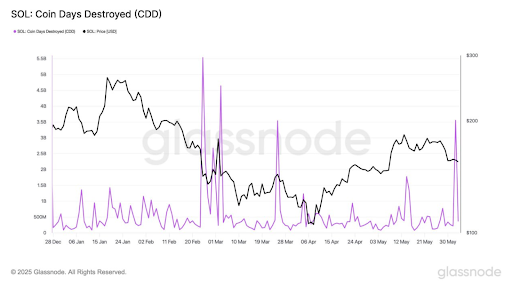

The feeling of the market around Solana moves while the large sleeping pieces are in motion. According to Glassnode data, the platform saw its 3rd largest CDD or CDD coins, which is a metric which follows the movement of the parts according to the duration of their sleep. A massive increase of almost 3.55b CDD, which suggests taking profits or repositioning.

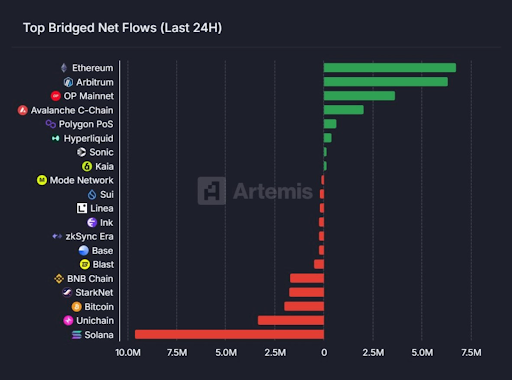

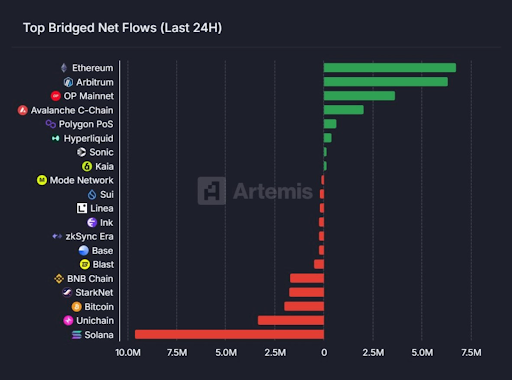

Second, another chain data point suggests a massive efflux is the inputs and outputs of the bridged cryptos. It is the cryptos that are transferred from one blockchain to another, and therefore the data suggest that investors leave Solana. According to Artemis data, Solana is the upper chain that has been faced with huge outings.

The graph above shows a huge outing of Solana’s blockchain, while Ethereum is experiencing a massive influx of almost $ 7.5 million, against more than $ 10 million outings. This suggests a probable liquidity flow between these two superior blockchains, while the race for supremacy has attracted enormous attention lately.

What is the next step for the Solana price (ground)-will it drop below $ 140 or rebound at $ 160?

Since the ground price has marked the summits close to $ 300, it has been negotiated in a strong downward trend. The rebound in annual stockings indicated an increase above the lower influence, but the current action of prices suggests that a deeper correction may be possible. The price has marked enormous losses since the beginning of the month, which could lead to levels close to pivot support levels, probably below $ 140.

The weekly graphic of the Sol price suggests that the token is recovered, but it is stuck in a cup and handle motif. The token goes to the crucial support at $ 141, and as the weekly RSI plunges into the lower support of the descending parallel canal, the price can also drop to the handle support. However, levels can bounce and increase along the model support and reach $ 160 in the coming days.