Solana Slides 11% This Week Amid Bearish Pressure

Solana (soil) is down more than 11% in the last seven days, as several technical indicators indicate a weakening of the momentum and an increasingly lower pressure. The relative force index (RSI) has dropped sharply, signaling a change towards a more prudent market position.

At the same time, the Ichimoku Cloud and EMA structures have lowered configurations, with key resistance levels holding firm areas and now risk support. Unless a clear reversal takes shape, Sol can continue to cope with a low -term pressure.

Solana RSI falls below 45 while the momentum fades

The Relative Force index of Solana (RSI) fell to 40.77, a notable drop of 64.25 only two days ago.

This net change reflects a weakening of the bullish momentum and suggests that the recent sales pressure has exceeded the interest of purchases.

The low descent indicates a potential transition of neutral or bullish conditions in an area of more prudent or downward feeling, while traders begin to reassess the short -term perspectives of Solana.

The RSI is a widely used momentum indicator which measures the speed and extent of recent price changes. It varies from 0 to 100, with readings greater than 70 generally indicating over -rascal conditions – often withdrawal of previous price – while the values less than 30 suggest conditions of occurrence, potentially signaling price rebounds.

Reading nearly 40.77 Place Solana in a neutral area in Fowe, suggesting that the asset loses momentum upwards but has not yet reached the territory occurring.

If RSI continues to decrease, this could indicate an additional risk, while stabilization greater than 40 could suggest consolidation before the next movement.

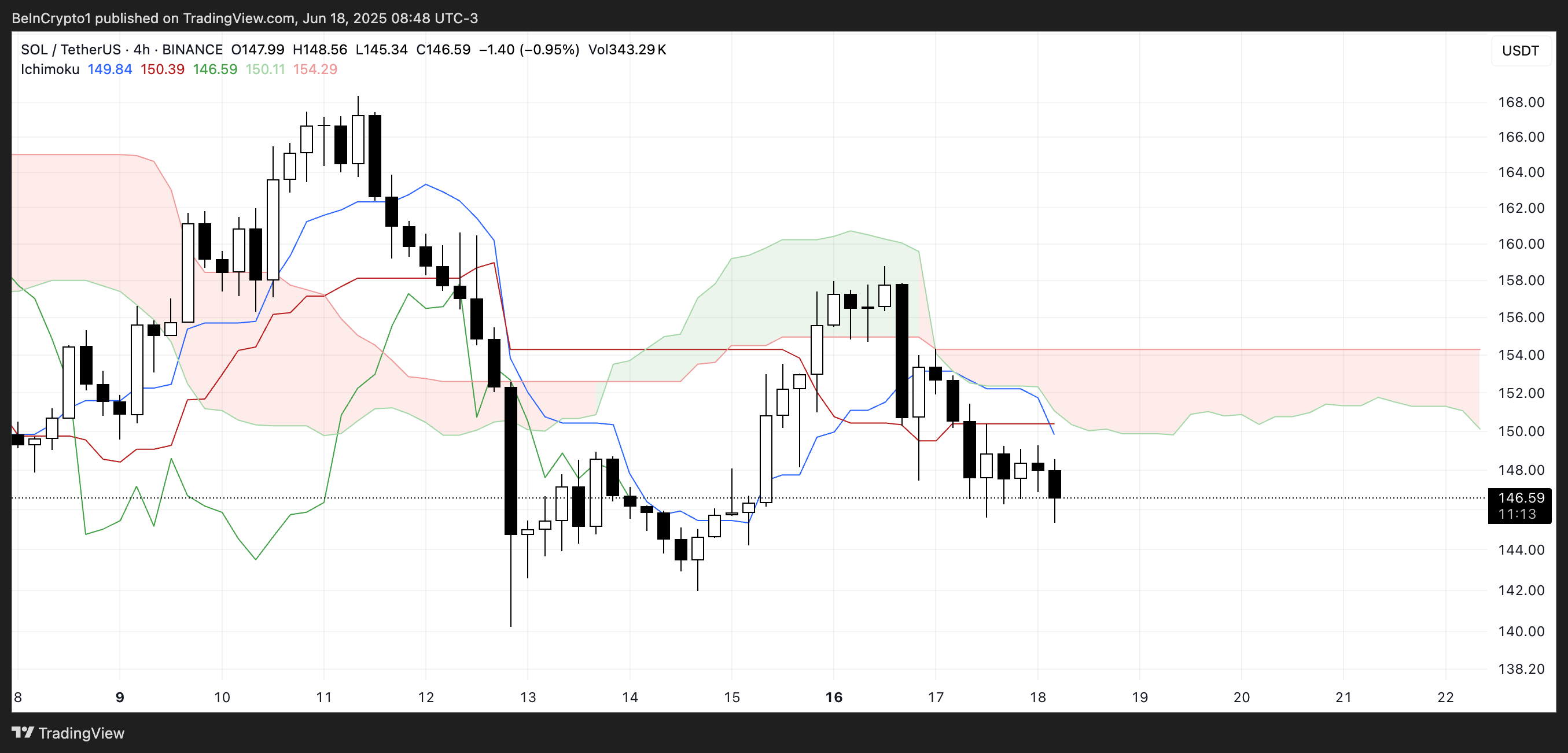

The structure of Ichimoku downwards keeps ground under pressure

The Ichimoku cloud painting from Solana reveals a downward configuration. Price Action is currently negotiated below the Kumo (Cloud), which is shaded red.

This red cloud indicates a dominant decrease dynamic and acts as a dynamic resistance. The head range A (green line forming the upper edge of the cloud) remains below the head range B (red line forming the lower edge), strengthening the lower structure.

The future cloud remains also red and relatively thick, suggesting strong resistance to general costs and making a bullish reversal more difficult unless the amount of significant movement.

Tenkan-Sen (Blue Line) is currently below the Kijun-Sen (red line), another classic lowering signal. These two lines have also flattened, signaling consolidation rather than any strong directional movement.

With candles that fight to break above Tenkan-Sen, short-term momentum seems weak.

Unless a bullish crossover occurs or the price of prices enters the cloud, Solana remains under down pressure from Ichimoku’s point of view.

The Solana EMA structure remains down despite a recent rebound attempt

The EMA structure of Solana remains down, with short -term mobile averages positioned below those in the longer term – the signaling continued to lower the momentum downwards.

This configuration appeared after an attempted increase failed two days ago, where Sol tried to reverse the trend but was faced with rejection. If the lowering alignment holds, the asset could test its immediate level of support at $ 141.53.

A ventilation below which could open the door down, potentially pushing the soil below $ 140 for the first time since April 21.

On the other hand, if the trend is reversed and the EMA in the short term begin to bend, Solana could retest the resistance zone around $ 150.59.

A clear break above this level would be the first sign of a change in potential trend. If the purchase of Momentum is strengthened beyond this, higher resistance objectives are at $ 163.64 and $ 168.36.

In the case of an extended rally, Sol could even aim for $ 179.41 as the next level up.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.