Solana (SOL) Crashes 11%—Is More Pain Ahead?

Solana (soil) is under high pressure, with its price down more than 10% in the last 24 hours, because the lower time is intensifying through key indicators. The Ichimoku Cloud, the Bbtrend structure and the prices all indicate a continuous risk, a soil now oscillating dangerously near the critical support levels.

The technical signals show that sellers control firmly, while the widening difference in resistance zones makes it increasingly difficult short -term recovery.

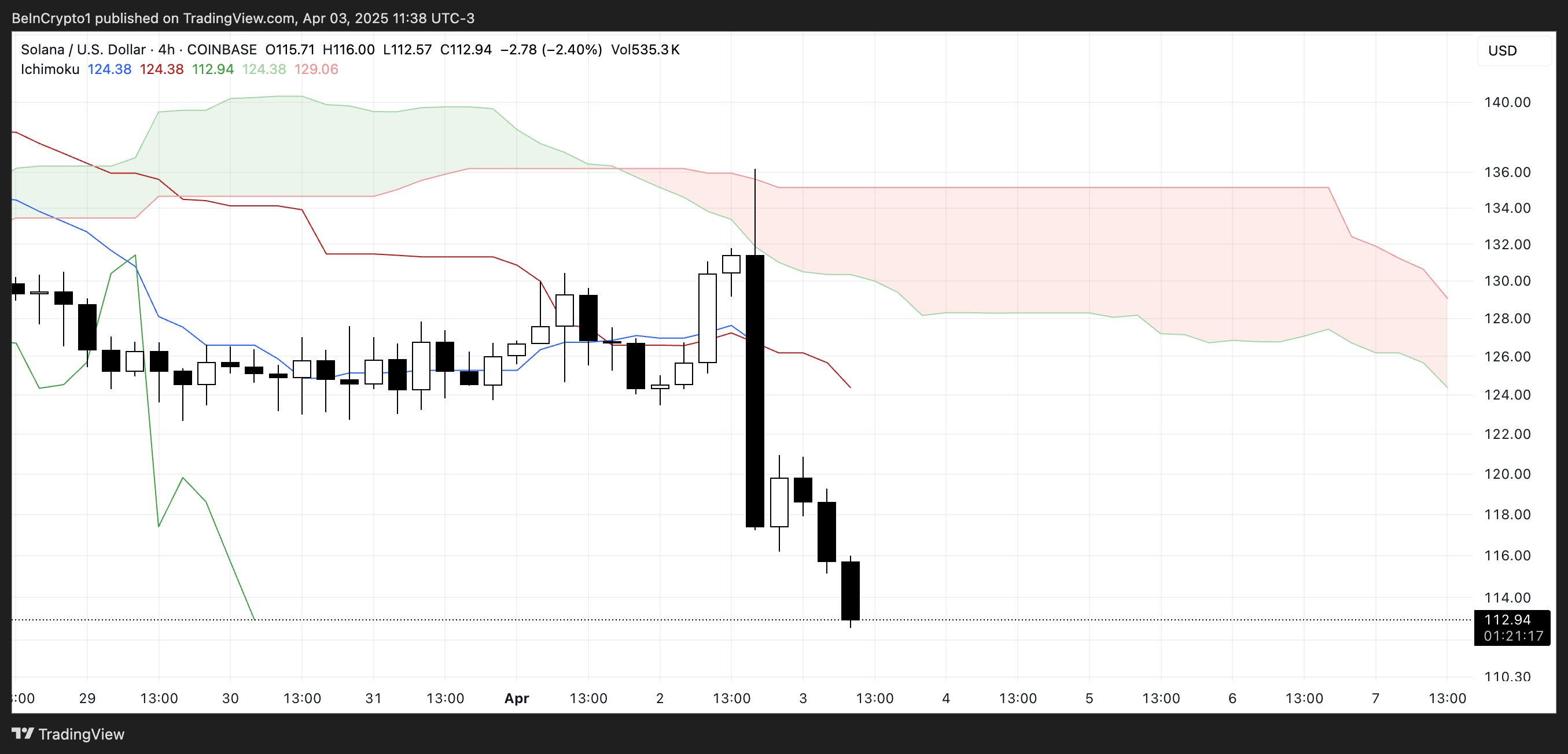

The Ichimoku cloud painting in Solana is currently flashes with strong lowering signals. The price has broken highly below Tenkan-Sen (blue line) and Kijun-Sen (red line), confirming a clear rejection of short-term support levels.

These two lines are now tilted downwards, strengthening the view according to which the bearish momentum is gaining strength.

The clear distance between the last candles and the cloud also suggests that any recovery would face a significant resistance to come.

Looking at the kumo (cloud) itself, the red cloud projected forward is thick and sloping downwards, indicating that the down pressure should persist in the coming sessions.

The price is much lower than the cloud, which generally means that the asset is in a high downward trend.

For Solana to reverse this trend, it should recover Tenkan-Sen and Kijun-sen and push in a decisive way through the entire structure of the clouds-a result which seems unlikely in the short term, given the current momentum and the formation of clouds.

Solana’s Bbtrend signals

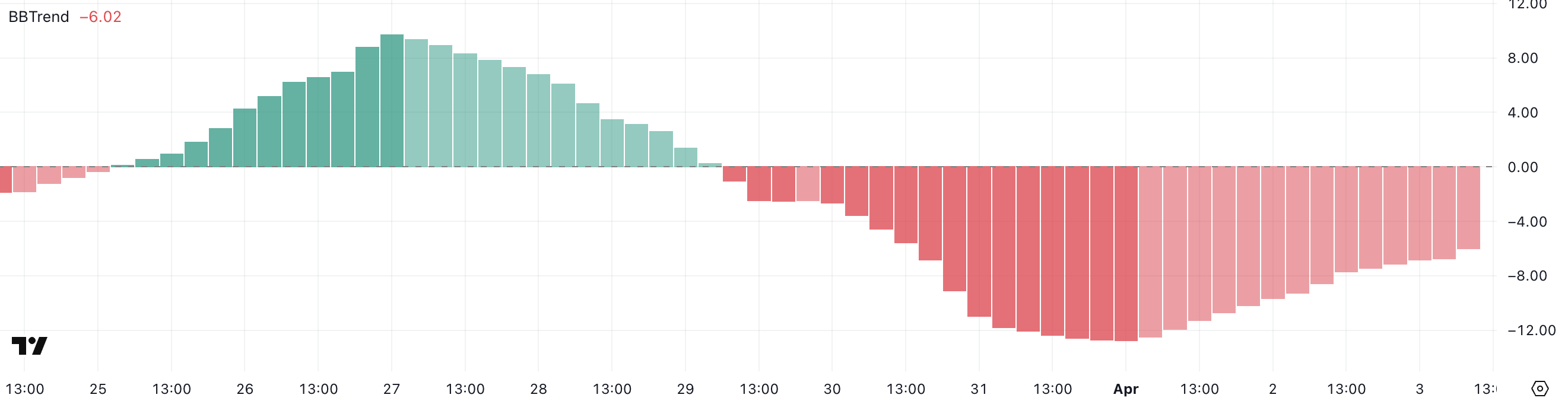

The Bbtrend indicator of Solana is currently at -6, having stayed in negative territory for more than five consecutive days. Barely two days ago, he reached a downstream peak of -12,72, showing the strength of the recent downward trend.

Although it has been slightly recovered from this bottom, the negative reading sustained indicates that the sales pressure remains firmly in control and that the bearish momentum has not yet been reversed.

The Bbtrend (Bollinger Band Trend) measures the strength and the direction of a trend using Bollinger strips. The positive values suggest upward conditions and ascending momentum, while the negative values indicate the lower trends.

Generally, values beyond 5 are considered to be strong trend signals. With Bbtrend de Solana still well below -5, this implies that the downward risk remains high.

Unless a lively change in dynamics occurs, this persistent downward reading can continue to weigh on the short -term soil price.

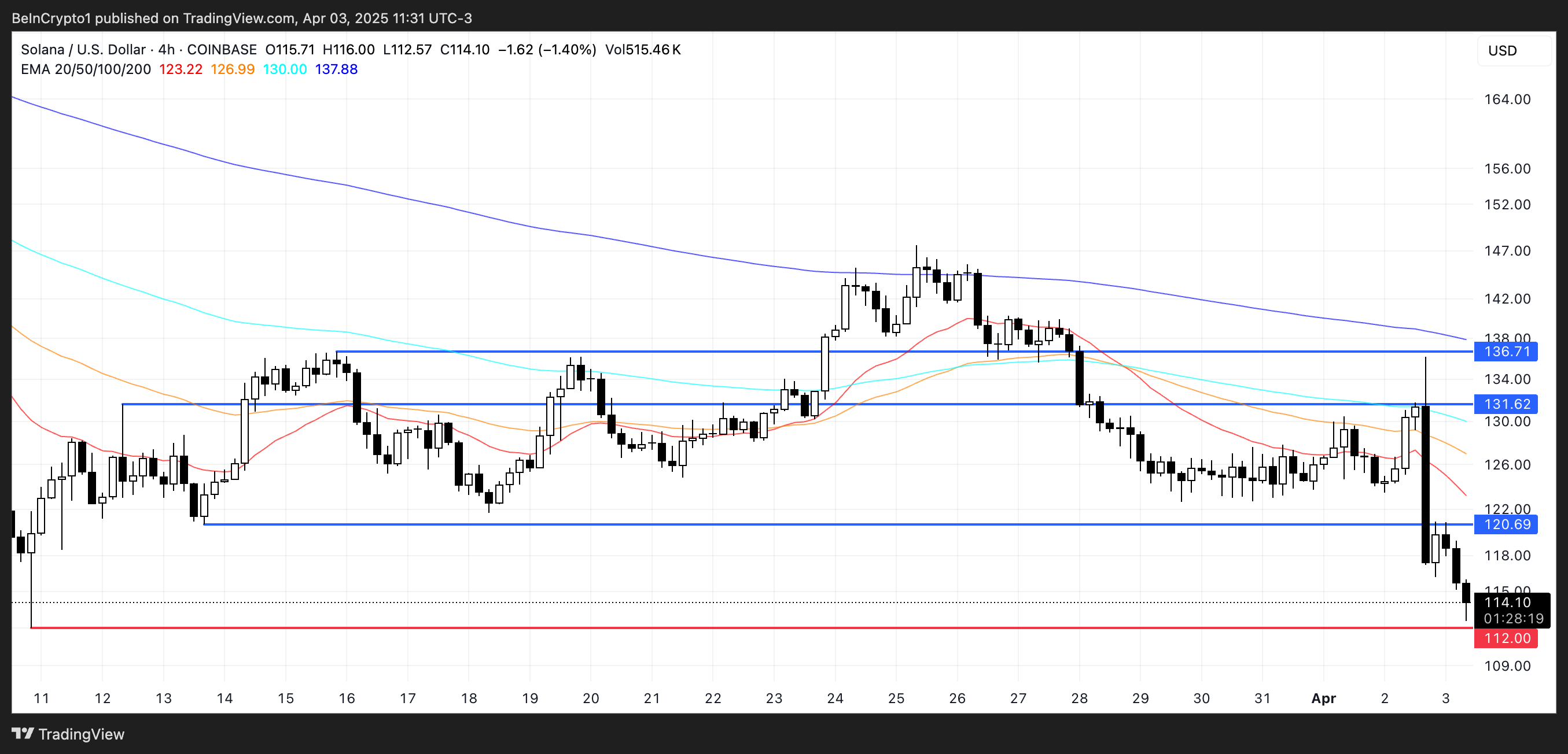

Solana Eyes $ 112 Support as Bears Test of the Bas of February

Solana’s price has broken below the key level of $ 115, and the next major support is around $ 112. A confirmed movement below this threshold could trigger the drop more. This could potentially increase the price of less than $ 110 for the first time since February 2024.

The recent impetus and the strong lower indicators suggest that the sellers remain in control, increasing the probability of testing these levels of short -term support.

However, if Solana manages to stabilize and reverse its current trajectory, a rebound towards the level of resistance of $ 120 could follow.

The rupture above would be the first sign of recovery, and if the Haussier momentum accelerates, the soil price could target higher targets at $ 131 and $ 136.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.