Solana (SOL) Drops 4% as Selling Pressure Intensifies

Solana (soil) recovered more than 12% today after Trump announced a 90 -day break on prices. Despite significant recovery, the technical indicators continue to flash down lowered warnings. Key indicators such as RSI lines, Bbtrend and Ema all indicate a weakening of the momentum and a lack of conviction of the buyer. While the surveillance conditions have started to stabilize, the wider structure is still leaning slightly in favor of the sellers.

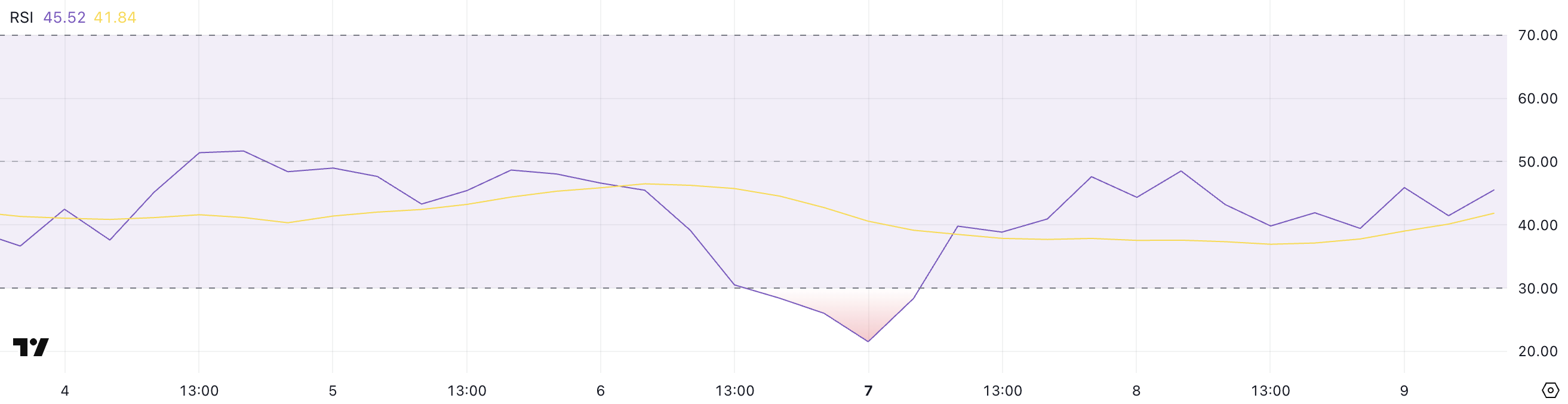

Solana RSI shows the lack of conviction among buyers

The Relative force index of Solana (RSI) is currently at 45.52, oscillating in neutral territory but remaining below the midline of 50 for almost two days.

This occurs after the RSI briefly plunged at a level of occurrence of 21.53 two days ago, indicating that the sellers had briefly dominated before the request begins to stabilize.

The slow rise of the RSI to the neutral suggests only if an extreme sale pressure has released, the bullish momentum has not yet taken control.

The RSI is a Momentum oscillator which measures the speed and extent of recent price movements. It generally varies from 0 to 100.

Readings greater than 70 are generally interpreted as a surrahat, signaling the potential of a decline, while readings less than 30 suggest occurring conditions and rebound potential.

The Solana RSI at 45.52 indicates that the asset is in the recovery phase but lacks conviction. If the RSI does not cross more than 50 soon, it could involve continuous hesitation among buyers and the potential of a side price action or even another leg lower.

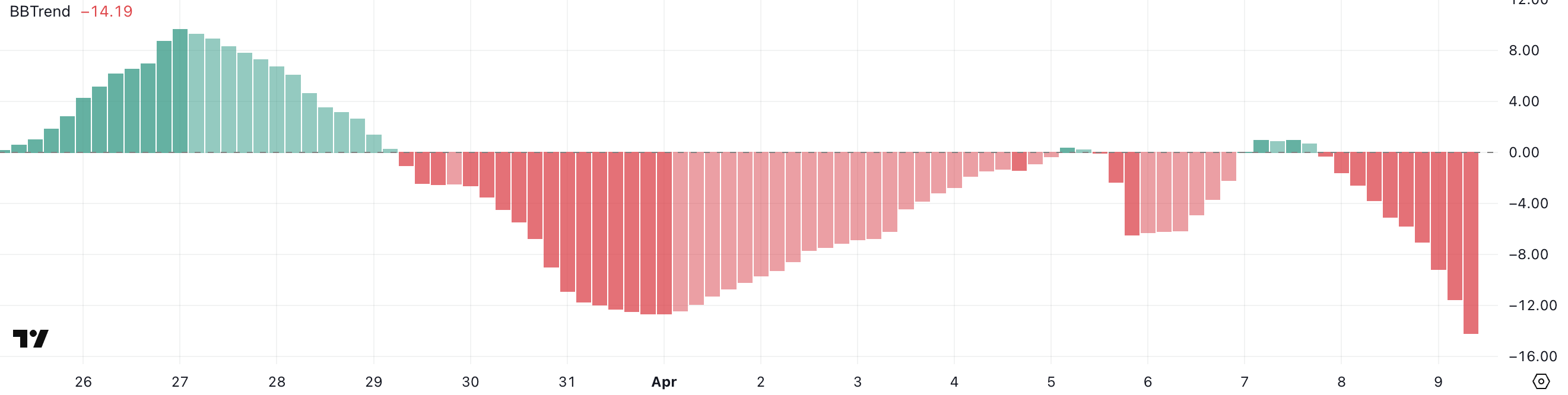

Bbtrend soil has reached its lowest levels in almost a month

The Bbtrend indicator of Solana is currently at -14,19, having become negative since yesterday, and has been at its lowest level since March 13 – a month ago.

This transition to deeper negative territory suggests that the lowering momentum is built again after a period of relative stability.

Return to these levels can indicate increasing pressure, especially if the follow -up is continuing in the short term.

The BBTREND (Bollinger Band Trend) is an indicator based on volatility which measures the strength and direction of a price trend using the distance between the price and the Bollinger strips.

Bbtrend’s positive values generally reflect the bullish momentum, while negative values signal a downward momentum. The greater the reading on a negative territory, the more strong the downward pressure is.

Bbtrend de Solana is now at -14,19, which implies an intensive lower phase, which could mean that other prices decrease unless the feeling or volume quickly changes in favor of buyers.

Will Solana again go below $ 100 in April?

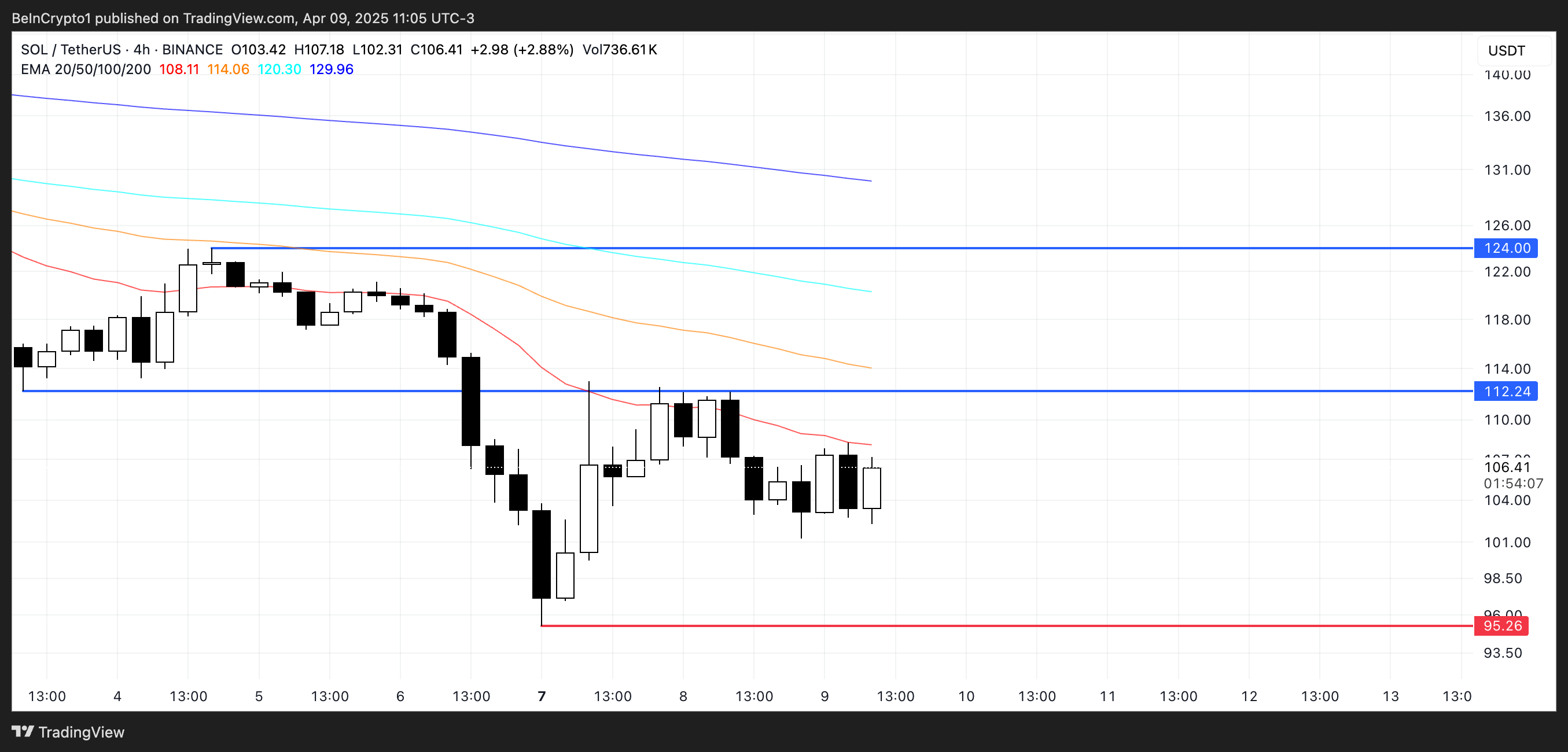

The EMA configuration of Solana continues to reflect a strong lower structure, with short -term mobile averages remaining below those in the long term.

This alignment confirms that the momentum is still in control, keeping the sellers in a dominant position.

However, if Solana Price manages to maintain the current force and purchasing interests, it could test resistance at $ 120. A break above this level can open the way to the next target at $ 134.

Upon decrease, if the current downward trend persists, Solana could revisit support nearly $ 95, a level that previously acted as a short -term floor.

Losing this level would be technically significant, which can push soil below $ 90 – the territory not seen since January 2024.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.