Solana (SOL) Jumps 20% as DEX Volume and Fees Soar

Solana (soil) has increased by 20% in the last seven days, supported by solid technical indicators and increasing activity on the chain. Its Ichimoku Cloud and Bbtrend graphics both point to bullish momentum, with resistance to trend and increased volatility.

At the same time, Solana resumes first place in the volume DEX and dominates the classifications of protocol costs on the main DEFI applications. With a recent golden cross on the EMA lines, Sol seems now set to test the levels of resistance of the keys if the momentum is maintained.

Solara The indicators paint an increased image

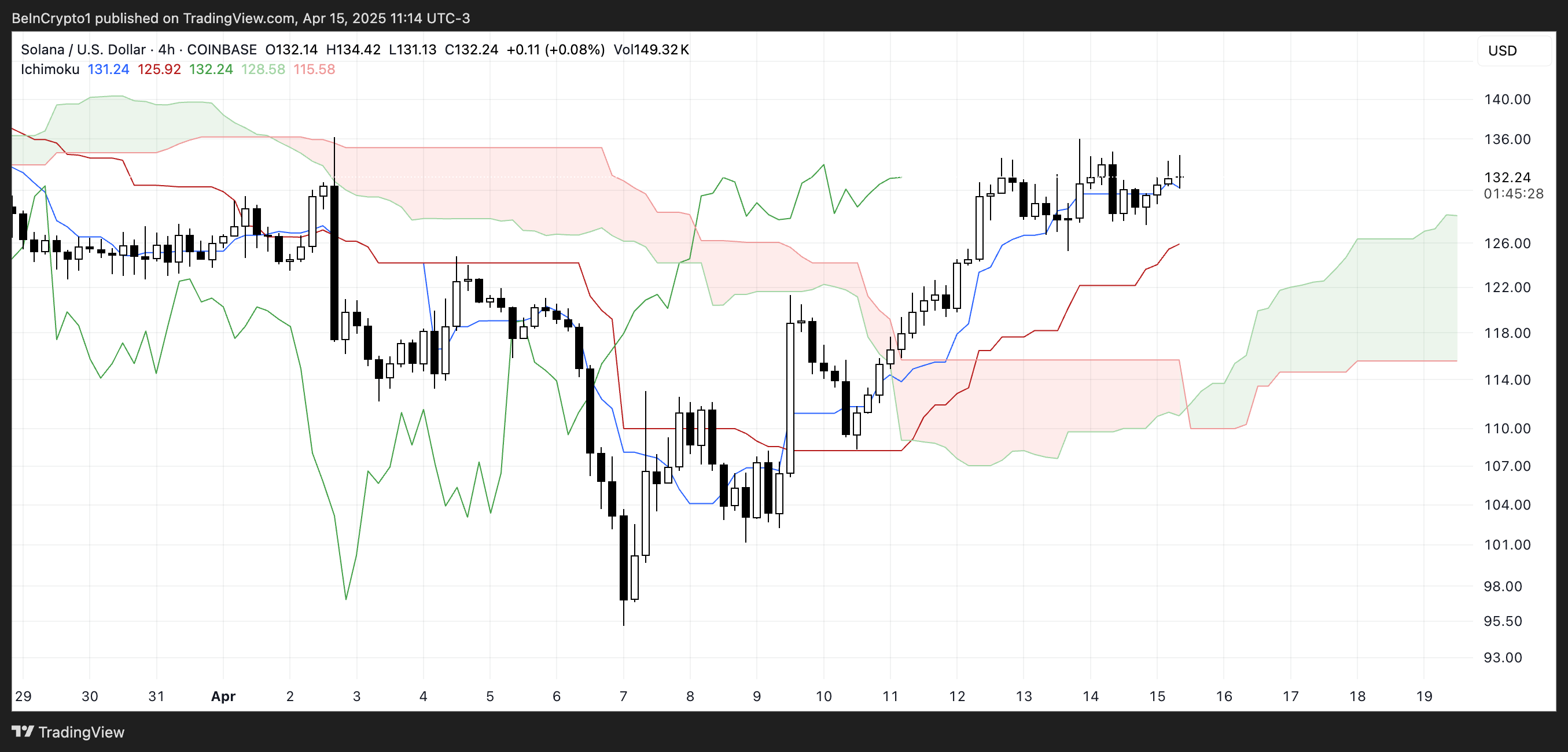

The Cloud Solana Ichimoku graphic shows a clear bullish structure, with traditional prices above Tenkan-Sen and Kijun-Sen. This alignment indicates a strong dynamic in the short and medium term, buyers keeping control.

The Kumo Ahead is green and in constant expansion, which supports the continuation of the current trend. The distance between the price and the cloud also gives the trend a certain place before any potential weakness.

The Span Chikou is positioned above the Cloud and candles, confirming the bullish confirmation of the action of previous prices. As long as Solana remains above the Kijun-Sen and the cloud remains favorable, the trend bias remains upwards.

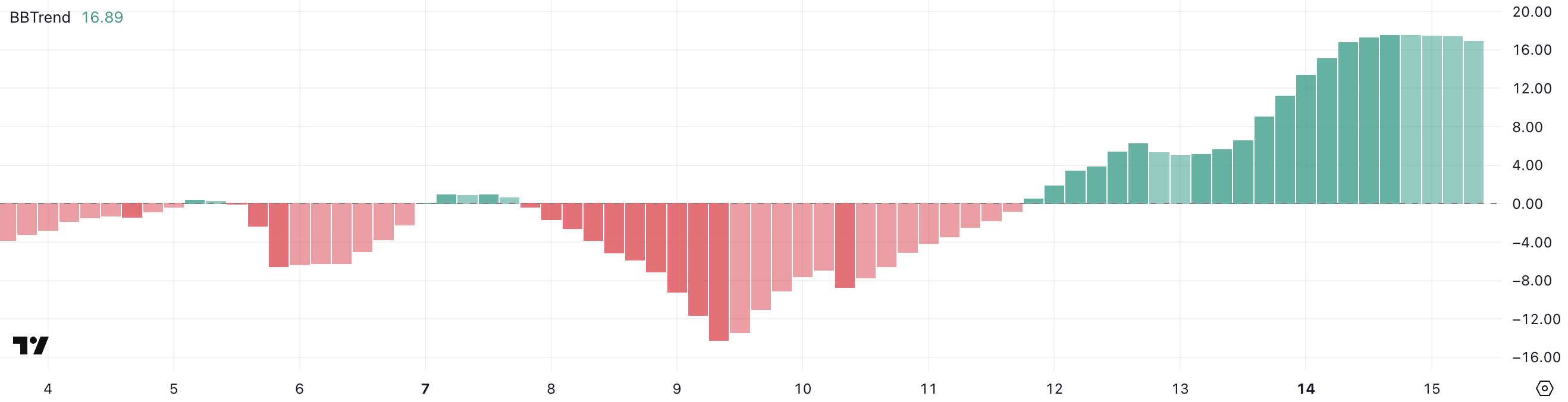

Bbtrend de Solana is currently at 16.89, showing a sharp increase compared to 1.88 two days ago, but slightly downwards compared to 17.54 yesterday. This strong increase indicates that volatility and strength of trends have recently developed significantly.

The trend indicator of the Bbtrend band, or Bollinger, measures the strength of a trend according to the distance from the price of its average range. Readings above 10 generally point out a strong moving trend, while the lower values reflect a market linked to the beach or low.

With floor bbtrend holding high levels, he suggests that assets are still in a strong trend phase. If it remains high or increases again, it could further support movement up, but a constant drop could refer to a trend or consolidation of upcoming slowdown.

Volumes and soil applications are increasing

Solana firmly restores her domination in the space of decentralized exchanges (DEX), precipitating on Ethereum and BNB in daily volume.

In the past 24 hours, Solana recorded $ 2.5 billion in Dex activity, marking a 14% increase in the last seven days. This growth exceeds 10%of the base and contrasts strongly with the decreases observed on Ethereum (-3%) and BNB (-9%).

More impressive, the volume of seven days of Solana exceeded the combined basic volume, BNB and arbitrum.

Beyond the commercial volume, Solana is also in the lead in the generation of protocol income. Among the eight main non -registered protocols classified by the costs, five are directly built on Solana: pump, axiom, jupiter, jito and meteora.

Pump stands out in particular, generating $ 2.73 million in fees in the last 24 hours and 15 million dollars in last week.

Can Solara About above $ 150 in the coming weeks?

Solana’s EMA lines have recently formed a golden cross, a bullish signal that often marks the start of a new upward trend.

This crossover suggests that the momentum moves in favor of buyers, with Solana’s price potential to soon test the keys to resistance levels.

If the current trend is held, Solana could challenge resistance around the $ 136 area. A break can open the way to higher levels such as $ 147, $ 160 and even $ 180 if the bullish pressure is intensifying.

However, if the momentum fades, Solana can face a withdrawal to the $ 124 support area. A break below which could trigger deeper decline movements, potentially revisiting $ 112 or even $ 95 if the sales pressure is accelerating.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.