Solana (SOL) Plunges 38% In a Month

Solana (soil) has been faced with an intense sales pressure, recently down below $ 120 – its lowest level since February 2024. It has decreased by more than 38% in the last 30 days, reinforcing its lower momentum.

With sellers firmly in control, Sol is now faced with a critical test of support levels, while any potential recovery should pierce key resistance areas to report a change of momentum.

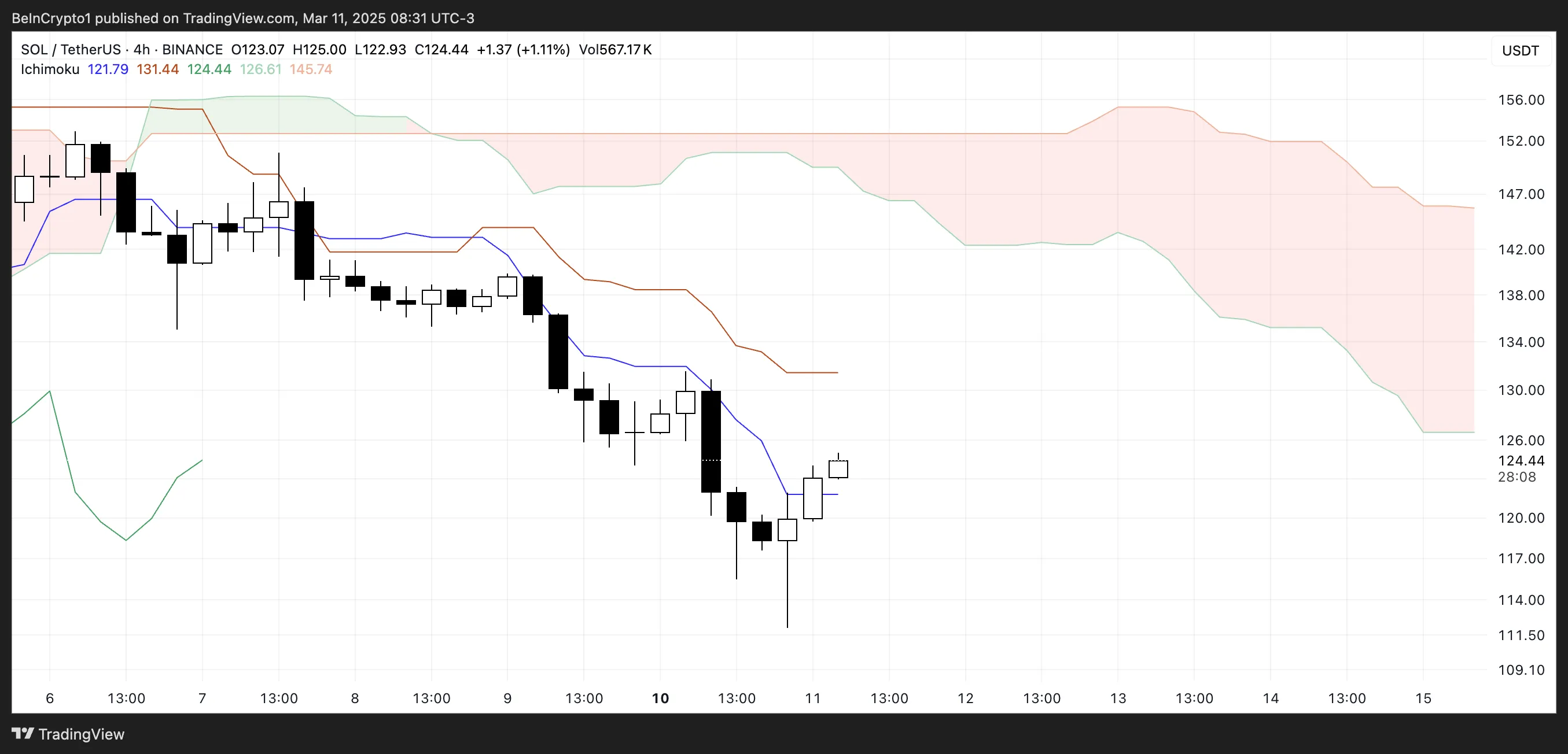

The Solana Ichimoku cloud shows a strong lower configuration

The Cloud Solana Ichimoku shows that the price is currently negotiated below the Blue Tenkan-Sen (conversion line) and the Red Kijun-Sen (basic line), indicating that the short-term trend remains down.

The price has recently rebounded from a local hollow but has not yet recovered these key resistance levels. In addition, the cloud of Ichimoku (Kumo) to come is red, reflecting the lowering feeling on the market.

The cloud itself is positioned well above the current price, which suggests that even if Sol is experiencing a short-term recovery, it will probably be faced with strong resistance near the region from $ 130 to $ 135.

The positioning of Tenkan-Sen under Kijun-Sen also supports the downward perspective, because this crossover generally signals the momentum down.

For any sign of a trend reversal, Sol should break above these two lines and ideally enter the cloud, which would indicate a potential transition to a neutral phase.

Until then, the downstream cloud and the current low price structure suggest that any gathering can be temporary before the wider drop trend resumes.

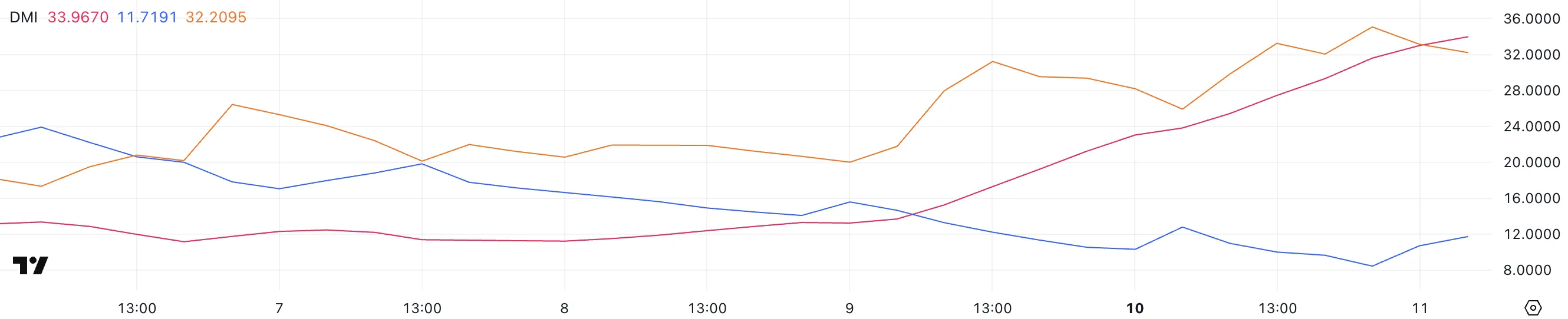

Sol DMI shows that sellers are still in control

The graph of the Solana Directional Movement Index (DMI) reveals that its average directional index (ADX) is currently 33.96, a significant increase compared to 13.2 only two days ago.

ADX measures resistance to trend and reading greater than 25 generally indicates a strong trend, while values below 20 suggest a low or non -existent trend. Given this sharp increase, this confirms that the downstream ground trend is gaining strength.

The + DI (positive directional index) fell to 11.71 from 15.5 two days ago, but slightly rebounded at 8.43 yesterday. On the other hand, the -Di (negative directional index) is 32.2, against 25.9 two days ago, but slightly down compared to 35 a few hours ago.

The relative positioning of the lines + DI and -DI suggests that sellers are still in control, because the -Di remains significantly higher than the + DI.

The recent decrease in -from 35 to 32.2 could indicate a certain short -term relief, but with Adx climbing quickly, it strengthens that the prevailing trend remains intact.

The slight rebound in + DI suggests a minor purchase pressure, but it is not enough to change the momentum in favor of the bulls. Until + di rises above -DI or ADX begins to decrease, the downward soil trend is likely to persist, sellers dominating the action of short -term prices.

Will Solana fall below $ 110?

The exponential mobile average lines of Solana (EMA) continue to represent a downward trend, the short -term EMA positioned below the long -term EMA.

This alignment suggests that the downward momentum remains dominant, even if the price currently tries a recovery. If this rebound is gaining strength, Solana’s price could face resistance at $ 130 and $ 135, key levels that must be eliminated for any potential trend reversal.

A successful rupture above these resistances could push soil around $ 152.9, a significant level which, if it was violated with high purchase pressure, could open the way to a rally around $ 179.85 – the price level seen on March 2 for the last time, when Sol was added to the strategic reserve of American cryptography.

However, if the downstream structure remains intact and the sales pressure resumes, Solana could retain the support levels of $ 115 and $ 112, which have both acted as key floors.

A non-compliance with these supports could open the door to a deeper drop, perhaps pushing the soil below $ 110 for the first time since February 2024.

Given the current positioning of EMAS, the downward trend remains in control unless Solana takes up the key resistance levels and establishes a bullish crossing, signaling a change of feeling of the market.

Non-liability clause

In accordance with the Trust project guidelines, this price analysis article is for information purposes only and should not be considered as financial or investment advice. Beincrypto is committed to exact and impartial reports, but market conditions are likely to change without notice. Always carry out your own research and consult a professional before making financial decisions. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.