Solana Staking Cap Surpasses Ethereum, But Is This Sustainable?

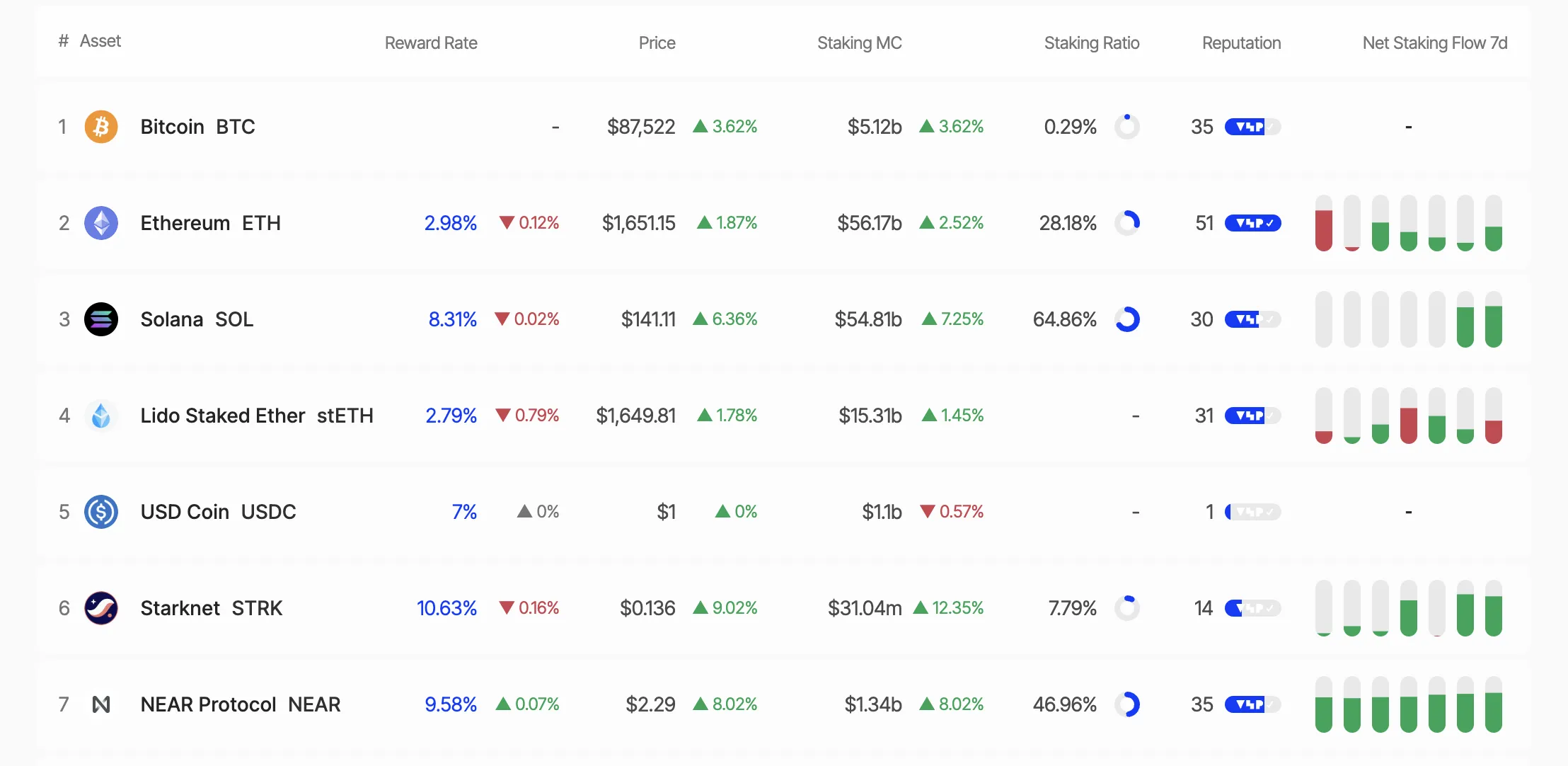

According to Stakrewards data, Solana (Sol) exceeded Ethereum (ETH) in the establishment of market capitalization, reaching $ 53.15 billion compared to $ 53.72 billion from Ethereum.

This step has triggered animated discussions on the X social media platform, raising the question: is it a turning point for Solana, or simply a short wave?

Solana goes beyond Ethereum as high yields are attractive

Recent data reveal that 64.86% of Solana’s total supply is currently jacquée, offering an impressive annual percentage (APY) of 8.31%. On the other hand, Ethereum has only 28.18% of its attached diet, with an APY of 2.98%.

This disparity highlights Solana’s growing attraction for investors looking for passive income thanks to jalitude. The capitalization capitalization is calculated by multiplying the total number of tokens marked by their current price. With soil at a price of $ 138.91 at the time of writing this article, Solana officially exceeded Ethereum in this metric.

However, the high implementation rate of Solana has aroused some controversy. Critics, such as Dankrad Feist on X, argue that the lack of Solana strike mechanism (or penalties for the Validators’ violations) undermines the economic security of its model of jealking. With its striking mechanism, Ethereum offers greater security, despite its lower strings ratio.

“It is very ironic to call him” markup “when there is no shot. What is at stake? Solana has almost zero economic security at the moment,” said Dankrad Feist.

Increase in whale activity signals CAUTION

Meanwhile, recent “whales” movements (large investors) have further fueled the interest in Solana. On April 20, 2025, an overflowing whale of 37,803 soil (worth $ 5.26 million). Likewise, Galaxy Digital withdrew 606,000 exchanges soil over four days (April 15-19, 2025), ending with 462,000 soil.

In additionOn April 17, 2025, a newly created portfolio withdrew around $ 5.15 million in the Binance Exchange soil. In the same tone, the binance terminals removed more than 370,000 ground tokens Valued at $ 52.78 million.

While some whales have removed their soil operations, other major holders have accumulated. Janover, a listed company in the United States, increased its Solana holdings to 163,651.7 soil (worth $ 21.2 million) and joined Kraken Exchange to have marked on April 16, 2025.

These actions indicate divergent games of institutional investors and whales, because the price of Solana fluctuates around key levels.

Solid price analysis: opportunities and challenges

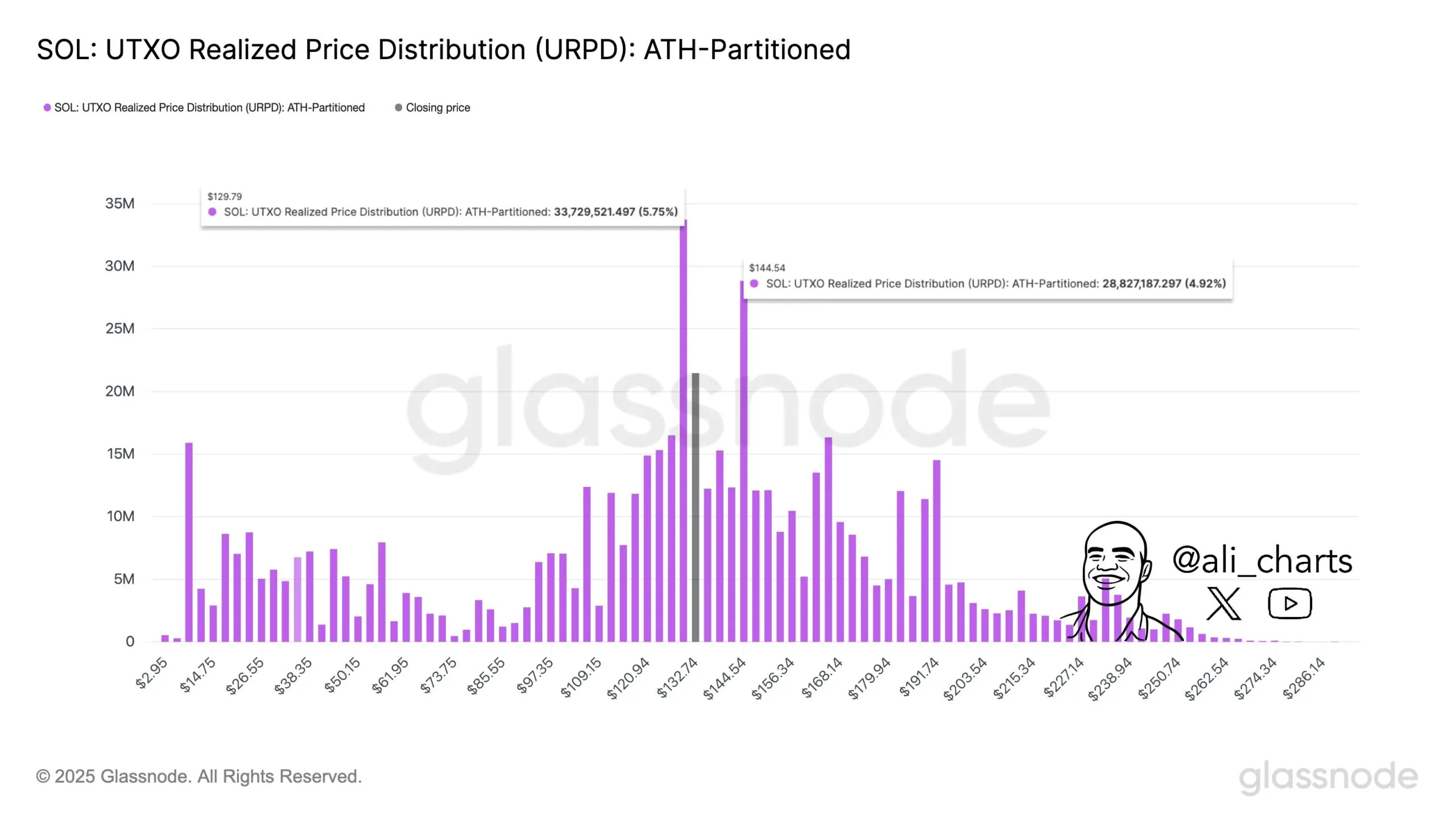

To date, Sol was negotiated at $ 140.49, up 3.53% in the last 24 hours. Analysts highlight $ 129 as a crucial support for Solana’s price, with $ 144 presenting the key roadblock to overcome before Solana’s upward potential can be carried out. The rupture above the aforementioned road dam could propel soil to new heights.

Conversely, falling below the $ 129 support level could trigger increased sales pressure. Nevertheless, Sol has shown a remarkable recovery, with an increase of 14.34% in last week.

Another factor to consider is the continuous development of Solana’s ecosystem. The main innovations include the data transfer protocol Quic, the combination of proof of history (POH) and proof of bet (POS), and the diversification of validators.

With these, Solana continues to improve its performance and decentralization. In addition, the launch of the Solang compiler, compatible with the solidity of Ethereum, attracted developers of the Ethereum ecosystem.

Beincryptto also reported on the next Solana community conference, otherwise called Solana Breakpoint. The key announcements of this event could provide other rear winds for the floor price.

However, despite the overcoming of Ethereum in the implementation of market capitalization, Solana is faced with significant challenges. Ethereum benefits from a more mature challenge ecosystem, greater institutional confidence and improved security thanks to its typing mechanism.

For some, the lower thread ratio of Ethereum (28%) can be a deliberate strategy to reduce network pressure and guarantee the liquidity of DEFI applications.

On the other hand, the high level of solara upgrade (65%) could limit liquidity in its DEFI ecosystem. This raises the question of whether Solana can find a balance between the milestone and the growth of its decentralized applications.

While Solana continues to question the domination of Ethereum, the cryptographic community remains divided. Is Solana’s climb a lasting breakthrough, or just another wave of media threw?

Non-liability clause

In membership of the Trust project guidelines, Beincrypto has embarked on transparent impartial reports. This press article aims to provide precise and timely information. However, readers are invited to check the facts independently and consult a professional before making decisions according to this content. Please note that our terms and conditions, our privacy policy and our non-responsibility clauses have been updated.